| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

| 5503110000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916905000 | Doc | 60.8% | CN | US | 2025-05-12 |

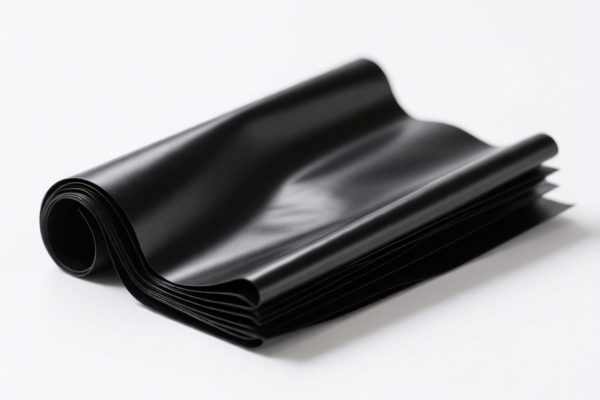

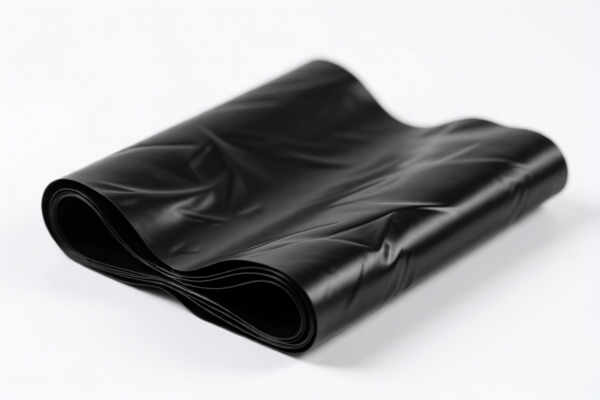

Product Name: Black Polyamide Raw Material

Classification: Based on the provided HS codes, the product falls under the category of polyamide (nylon) raw materials or finished products, depending on the specific form (e.g., granules, fibers, or molded parts).

🔍 HS Code Classification and Tax Details

1. HS Code: 3908902000 - Polyamide Granules (Raw Material)

- Description: Polyamide particles used as raw material for manufacturing.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a raw material form, suitable for further processing.

- No anti-dumping duties are typically applied to raw materials unless specified.

2. HS Code: 5402510000 - Polyamide Fiber Raw Material

- Description: Raw material for polyamide fiber production.

- Total Tax Rate: 63.8%

- Base Tariff: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a fiber raw material, used in textile manufacturing.

- Higher base tariff compared to granules.

3. HS Code: 5503110000 - Polyamide Short Fiber Raw Material

- Description: Short polyamide fibers used in industrial or textile applications.

- Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a finished fiber product, not a raw material.

- Lower base tariff than 5402510000, but still subject to additional tariffs.

4. HS Code: 3908907000 - Black Polyamide Plastic

- Description: Finished black polyamide plastic products.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a finished product, not a raw material.

- Higher base tariff than granules but lower than fiber products.

5. HS Code: 3916905000 - Black Polyamide Fiber Type Material

- Description: Black polyamide fiber-based molded or shaped products.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a semi-finished or molded product.

- Slightly lower tax rate than 3908907000.

⚠️ Important Alerts and Recommendations

-

April 11, 2025 Special Tariff:

All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning. -

Anti-Dumping Duties:

Not applicable to polyamide raw materials or finished products unless specifically imposed by the importing country (e.g., China). -

Certifications Required:

- Verify if customs documentation (e.g., commercial invoice, packing list, certificate of origin) is complete.

-

Confirm if product specifications (e.g., material composition, color, form) match the HS code classification.

-

Proactive Actions:

- Verify the exact product form (granules, fibers, molded parts) to ensure correct HS code.

- Check the unit price to determine if it falls under preferential tariff rates or not.

- Consult with customs brokers or trade compliance experts for accurate classification and duty calculation.

✅ Summary Table

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|---|

| 3908902000 | Polyamide Granules | 55.0% | 0.0% | 25.0% | 30.0% |

| 5402510000 | Polyamide Fiber Raw Material | 63.8% | 8.8% | 25.0% | 30.0% |

| 5503110000 | Polyamide Short Fiber | 59.3% | 4.3% | 25.0% | 30.0% |

| 3908907000 | Black Polyamide Plastic | 61.5% | 6.5% | 25.0% | 30.0% |

| 3916905000 | Black Polyamide Fiber Type | 60.8% | 5.8% | 25.0% | 30.0% |

If you need help determining the correct HS code for your specific product, feel free to provide more details (e.g., product form, color, intended use).

Product Name: Black Polyamide Raw Material

Classification: Based on the provided HS codes, the product falls under the category of polyamide (nylon) raw materials or finished products, depending on the specific form (e.g., granules, fibers, or molded parts).

🔍 HS Code Classification and Tax Details

1. HS Code: 3908902000 - Polyamide Granules (Raw Material)

- Description: Polyamide particles used as raw material for manufacturing.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a raw material form, suitable for further processing.

- No anti-dumping duties are typically applied to raw materials unless specified.

2. HS Code: 5402510000 - Polyamide Fiber Raw Material

- Description: Raw material for polyamide fiber production.

- Total Tax Rate: 63.8%

- Base Tariff: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a fiber raw material, used in textile manufacturing.

- Higher base tariff compared to granules.

3. HS Code: 5503110000 - Polyamide Short Fiber Raw Material

- Description: Short polyamide fibers used in industrial or textile applications.

- Total Tax Rate: 59.3%

- Base Tariff: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a finished fiber product, not a raw material.

- Lower base tariff than 5402510000, but still subject to additional tariffs.

4. HS Code: 3908907000 - Black Polyamide Plastic

- Description: Finished black polyamide plastic products.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a finished product, not a raw material.

- Higher base tariff than granules but lower than fiber products.

5. HS Code: 3916905000 - Black Polyamide Fiber Type Material

- Description: Black polyamide fiber-based molded or shaped products.

- Total Tax Rate: 60.8%

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This is a semi-finished or molded product.

- Slightly lower tax rate than 3908907000.

⚠️ Important Alerts and Recommendations

-

April 11, 2025 Special Tariff:

All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning. -

Anti-Dumping Duties:

Not applicable to polyamide raw materials or finished products unless specifically imposed by the importing country (e.g., China). -

Certifications Required:

- Verify if customs documentation (e.g., commercial invoice, packing list, certificate of origin) is complete.

-

Confirm if product specifications (e.g., material composition, color, form) match the HS code classification.

-

Proactive Actions:

- Verify the exact product form (granules, fibers, molded parts) to ensure correct HS code.

- Check the unit price to determine if it falls under preferential tariff rates or not.

- Consult with customs brokers or trade compliance experts for accurate classification and duty calculation.

✅ Summary Table

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|---|

| 3908902000 | Polyamide Granules | 55.0% | 0.0% | 25.0% | 30.0% |

| 5402510000 | Polyamide Fiber Raw Material | 63.8% | 8.8% | 25.0% | 30.0% |

| 5503110000 | Polyamide Short Fiber | 59.3% | 4.3% | 25.0% | 30.0% |

| 3908907000 | Black Polyamide Plastic | 61.5% | 6.5% | 25.0% | 30.0% |

| 3916905000 | Black Polyamide Fiber Type | 60.8% | 5.8% | 25.0% | 30.0% |

If you need help determining the correct HS code for your specific product, feel free to provide more details (e.g., product form, color, intended use).

Customer Reviews

No reviews yet.