Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5515990520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5408310520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5515990510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 6003109000 | Doc | 61.6% | CN | US | 2025-05-12 |

| 6005901000 | Doc | 65.0% | CN | US | 2025-05-12 |

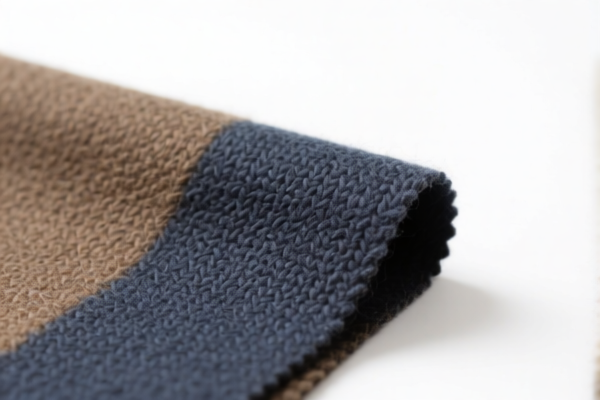

Product Name: Blended Wool Blended Upholstery Fabric

Classification Analysis:

- HS CODE: 5515990520

- Description: Woven fabrics mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is the most likely HS code for your product, assuming it is a woven fabric primarily made of wool or fine animal hair.

- HS CODE: 5408310520

- Description: Woven synthetic fiber fabrics, including those obtained from materials of Chapter 5405, mixed with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies if the fabric is a blend of synthetic fibers and wool or fine animal hair.

- HS CODE: 5515990510

- Description: Other woven fabrics of synthetic short staple fibers, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for synthetic short fiber fabrics blended with wool or fine animal hair.

- HS CODE: 6003109000

- Description: Knitted or crocheted fabrics of wool or other animal hair, not wider than 30 cm.

- Total Tax Rate: 61.6%

- Base Tariff Rate: 6.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies only if the fabric is knitted or crocheted and has a width of no more than 30 cm.

- HS CODE: 6005901000

- Description: Other fabrics of wool or fine animal hair.

- Total Tax Rate: 65.0%

- Base Tariff Rate: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for other types of wool or fine animal hair fabrics, not covered by other categories.

Key Tax Rate Changes (April 11, 2025):

- All listed HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so it is crucial to check the exact import date and plan accordingly.

Proactive Advice:

- Verify the fabric composition: Confirm whether the fabric is woven or knitted, and the exact percentage of wool or fine animal hair in the blend.

- Check the width: If the fabric is knitted or crocheted, ensure it is not wider than 30 cm to avoid misclassification.

- Review documentation: Ensure all customs documents (e.g., commercial invoice, packing list) clearly state the fabric type, composition, and intended use.

- Certifications: Some countries may require specific certifications (e.g., origin, environmental compliance) for textile imports.

- Consult a customs broker: For complex classifications, it is advisable to seek professional help to avoid delays or penalties.

Let me know if you need further clarification or assistance with customs documentation.

Product Name: Blended Wool Blended Upholstery Fabric

Classification Analysis:

- HS CODE: 5515990520

- Description: Woven fabrics mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This is the most likely HS code for your product, assuming it is a woven fabric primarily made of wool or fine animal hair.

- HS CODE: 5408310520

- Description: Woven synthetic fiber fabrics, including those obtained from materials of Chapter 5405, mixed with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies if the fabric is a blend of synthetic fibers and wool or fine animal hair.

- HS CODE: 5515990510

- Description: Other woven fabrics of synthetic short staple fibers, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for synthetic short fiber fabrics blended with wool or fine animal hair.

- HS CODE: 6003109000

- Description: Knitted or crocheted fabrics of wool or other animal hair, not wider than 30 cm.

- Total Tax Rate: 61.6%

- Base Tariff Rate: 6.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies only if the fabric is knitted or crocheted and has a width of no more than 30 cm.

- HS CODE: 6005901000

- Description: Other fabrics of wool or fine animal hair.

- Total Tax Rate: 65.0%

- Base Tariff Rate: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code is for other types of wool or fine animal hair fabrics, not covered by other categories.

Key Tax Rate Changes (April 11, 2025):

- All listed HS codes will see an increase in the additional tariff from 25.0% to 30.0% after April 11, 2025.

- This is a time-sensitive policy, so it is crucial to check the exact import date and plan accordingly.

Proactive Advice:

- Verify the fabric composition: Confirm whether the fabric is woven or knitted, and the exact percentage of wool or fine animal hair in the blend.

- Check the width: If the fabric is knitted or crocheted, ensure it is not wider than 30 cm to avoid misclassification.

- Review documentation: Ensure all customs documents (e.g., commercial invoice, packing list) clearly state the fabric type, composition, and intended use.

- Certifications: Some countries may require specific certifications (e.g., origin, environmental compliance) for textile imports.

- Consult a customs broker: For complex classifications, it is advisable to seek professional help to avoid delays or penalties.

Let me know if you need further clarification or assistance with customs documentation.

Customer Reviews

No reviews yet.