Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 9405920000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 7004205000 | Doc | 62.2% | CN | US | 2025-05-12 |

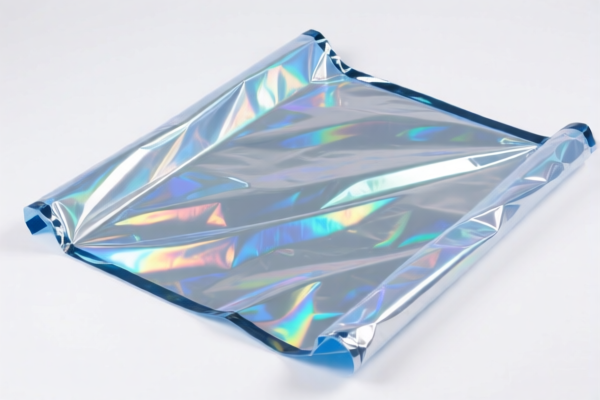

Here is the structured classification and tariff information for "Building Reflectorized Plastic Sheet" based on the provided HS codes and tax details:

🔍 Product Classification Overview

Product Name: Building Reflectorized Plastic Sheet

Possible HS Codes and Tax Rates:

📦 1. HS Code: 3919905010 - 反光塑料片 (Reflectorized Plastic Sheet)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is for general-purpose reflectorized plastic sheets, not specifically for traffic or construction use.

📦 2. HS Code: 3920995000 - 塑料反光板 (Plastic Reflectorized Board)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is for plastic reflectorized boards, possibly used in signage or safety applications.

📦 3. HS Code: 9405920000 - 塑料反光板 (Plastic Reflectorized Board)

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.7%

- Notes: This code is for plastic reflectorized boards used in furniture or decorative items. May not be suitable for construction or traffic applications.

📦 4. HS Code: 3919101050 - 交通反光塑料板 (Traffic Reflectorized Plastic Board)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is specifically for traffic-related reflectorized plastic boards, such as road signs or safety markers.

📦 5. HS Code: 7004205000 - 反光玻璃板 (Reflectorized Glass Board)

- Base Tariff Rate: 7.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.2%

- Notes: This is for glass-based reflectorized boards, not plastic. May not be applicable for your product unless it's a hybrid material.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm whether your product is made of plastic or glass, and whether it is used for traffic, construction, or general purposes. This will determine the correct HS code.

- Certifications: Check if any certifications (e.g., safety, environmental, or technical standards) are required for import into the destination country.

- Unit Price and Classification: Verify the material composition and unit price to ensure the correct HS code is applied and to avoid misclassification penalties.

✅ Proactive Advice:

- Double-check the product description to match the most accurate HS code.

- Consult a customs broker or classification expert if the product is a composite or hybrid material.

- Keep records of product specifications, material composition, and intended use for customs compliance.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for "Building Reflectorized Plastic Sheet" based on the provided HS codes and tax details:

🔍 Product Classification Overview

Product Name: Building Reflectorized Plastic Sheet

Possible HS Codes and Tax Rates:

📦 1. HS Code: 3919905010 - 反光塑料片 (Reflectorized Plastic Sheet)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is for general-purpose reflectorized plastic sheets, not specifically for traffic or construction use.

📦 2. HS Code: 3920995000 - 塑料反光板 (Plastic Reflectorized Board)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is for plastic reflectorized boards, possibly used in signage or safety applications.

📦 3. HS Code: 9405920000 - 塑料反光板 (Plastic Reflectorized Board)

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.7%

- Notes: This code is for plastic reflectorized boards used in furniture or decorative items. May not be suitable for construction or traffic applications.

📦 4. HS Code: 3919101050 - 交通反光塑料板 (Traffic Reflectorized Plastic Board)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is specifically for traffic-related reflectorized plastic boards, such as road signs or safety markers.

📦 5. HS Code: 7004205000 - 反光玻璃板 (Reflectorized Glass Board)

- Base Tariff Rate: 7.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 62.2%

- Notes: This is for glass-based reflectorized boards, not plastic. May not be applicable for your product unless it's a hybrid material.

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All listed codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm whether your product is made of plastic or glass, and whether it is used for traffic, construction, or general purposes. This will determine the correct HS code.

- Certifications: Check if any certifications (e.g., safety, environmental, or technical standards) are required for import into the destination country.

- Unit Price and Classification: Verify the material composition and unit price to ensure the correct HS code is applied and to avoid misclassification penalties.

✅ Proactive Advice:

- Double-check the product description to match the most accurate HS code.

- Consult a customs broker or classification expert if the product is a composite or hybrid material.

- Keep records of product specifications, material composition, and intended use for customs compliance.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.