| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7323997000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 4205008000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 9617006000 | Doc | 37.2% | CN | US | 2025-05-12 |

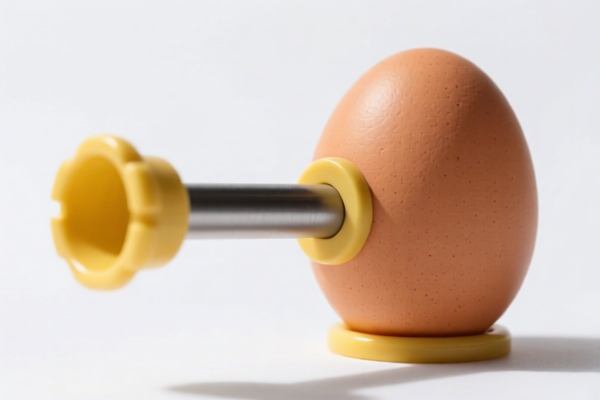

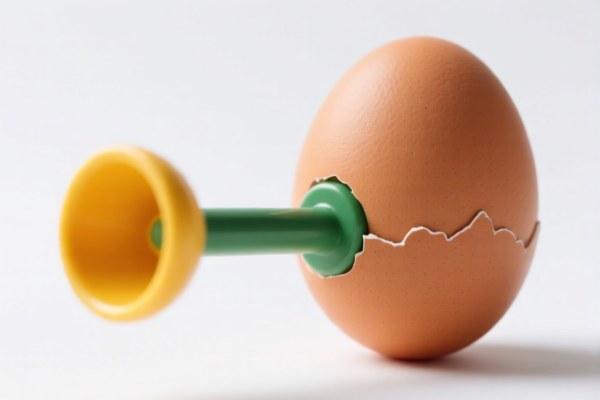

Okay, let's break down the HS codes and tax implications for your "CAMPING EGG HOLDER" declaration. Here's a detailed analysis, presented in a structured format to help you understand the classification and potential costs.

Important Note: Determining the correct HS code is crucial. Misclassification can lead to delays, penalties, and unexpected costs. This analysis is based on the descriptions provided; the final determination rests with customs officials.

HS Code Breakdown & Analysis

Here's a look at each HS code you've received, with explanations and potential considerations:

1. 7323.99.70.00 – Table, kitchen or other household articles and parts thereof, of iron or steel

- Chapter 73: Iron or steel articles. This broadly covers products made primarily of iron or steel.

- 7323: Table, kitchen or other household articles and parts thereof. This narrows it down to items used in the kitchen or household.

- 7323.99: Other. This is a residual subheading for items not specifically classified elsewhere within 7323.

- 7323.99.70.00: Other: Not coated or plated with precious metal. This further specifies items that haven't undergone precious metal coating.

- Tax Implications:

- Basic Duty: 5.3%

- Additional Duty: 0.0% currently.

- Post April 2nd, 2025: Additional Duty will increase to 30% for steel and aluminum products.

- Total Tax: 60.3%

- Considerations: If your egg holder is coated with any precious metal (even a thin layer), this HS code is incorrect. Also, the 30% additional duty post-April 2025 is significant.

2. 3923.90.00.80 – Articles for the conveyance or packing of goods, of plastics

- Chapter 39: Plastics and articles thereof. This covers products made from various types of plastics.

- 3923: Articles for the conveyance or packing of goods, of plastics. This includes items like containers, boxes, and packaging materials.

- 3923.90.00: Other. This is a residual subheading for items not specifically classified elsewhere within 3923.

- 3923.90.00.80: Other. This further specifies items not classified elsewhere.

- Tax Implications:

- Basic Duty: 3.0%

- Additional Duty: 25.0% currently.

- Post April 2nd, 2025: Additional Duty will increase to 30%.

- Total Tax: 58.0%

- Considerations: This code is suitable if the egg holder is primarily made of plastic and functions as a container or packaging item.

3. 4205.00.80.00 – Other articles of leather or of composition leather

- Chapter 42: Articles of leather; saddlery and harness equipment. This covers products made from leather or imitation leather.

- 4205: Other articles of leather or of composition leather. This includes a wide range of leather goods not specifically classified elsewhere.

- 4205.00: Other. This is a residual subheading for items not specifically classified elsewhere within 4205.

- 4205.00.80.00: Other. This further specifies items not classified elsewhere.

- Tax Implications:

- Basic Duty: 0.0%

- Additional Duty: 25.0% currently.

- Post April 2nd, 2025: Additional Duty will increase to 30%.

- Total Tax: 55.0%

- Considerations: This code is appropriate only if the egg holder is made of genuine leather or a composition leather material.

4. 9617.00.60.00 – Vacuum flasks and other vacuum vessels, complete; parts thereof other than glass inners

- Chapter 96: Miscellaneous manufactured articles. This covers a diverse range of products not classified elsewhere.

- 9617: Vacuum flasks and other vacuum vessels, complete; parts thereof other than glass inners. This includes items like thermoses and vacuum containers.

- 9617.00: Other. This is a residual subheading for items not specifically classified elsewhere within 9617.

- 9617.00.60.00: Parts. This specifically refers to components of vacuum flasks and vessels.

- Tax Implications:

- Basic Duty: 7.2%

- Additional Duty: 0.0% currently.

- Post April 2nd, 2025: Additional Duty will increase to 30%.

- Total Tax: 37.2%

- Considerations: This code is suitable if the egg holder is a component of a larger vacuum vessel or thermos system. If it's a complete, standalone item, this code is likely incorrect.

Recommendations & Next Steps:

- Material Verification: Crucially, confirm the primary material of your egg holder. This will dictate the correct HS code.

- Functionality: Determine the primary function of the egg holder. Is it a container, a household item, a component, or something else?

- Detailed Description: Provide a more detailed description of the egg holder to customs officials. Include information about its size, weight, and any specific features.

- Consider the April 2025 Duty Changes: Be prepared for potential increases in additional duties for steel, aluminum, and other materials.

- Certification: Depending on the material and intended use, you may need to provide certifications (e.g., material safety data sheets, compliance certificates).

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. Always consult with a qualified customs broker or customs official for accurate and up-to-date information.

Customer Reviews

The detailed breakdown of the HS code 7323.99.70.00 was exactly what I needed. I now understand the tax implications for my steel egg holder.

The post-April 2025 duty increase note was really useful. I didn't know that the additional duty would go up for some materials.

The analysis of HS code 9617.00.60.00 was spot on. I now know that this isn't the right code for my egg holder, which saved me from a mistake.

The info on HS code 4205.00.80.00 was a bit confusing. I wasn't sure if my product qualifies as leather, but it was a good start.

I really appreciated the detailed tax implications for each HS code. The 58.0% tariff for 3923.90.00.80 was exactly what I needed for my export planning.