| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 7007110090 | Doc | 60.5% | CN | US | 2025-05-12 |

| 6306120000 | Doc | 38.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 6306905000 | Doc | 34.5% | CN | US | 2025-05-12 |

| 8708220000 | Doc | 2.5% <u></u>+55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for car sunshade products based on the provided HS codes:

✅ HS CODE: 7007110090

Product Type: Glass car sunshade (e.g., glass windshields or glass sunshades)

Tariff Summary:

- Base Tariff Rate: 5.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 60.5%

Key Notes:

- This code applies to glass products used as sunshades in vehicles.

- High tariff rate due to the nature of glass and potential import restrictions.

- Time-sensitive: Tariff increases after April 11, 2025.

✅ HS CODE: 6306120000

Product Type: Synthetic fiber car sunshade (e.g., fabric sunshades)

Tariff Summary:

- Base Tariff Rate: 8.8%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 38.8%

Key Notes:

- Applies to synthetic fiber products used as sunshades.

- No additional tariffs before April 11, 2025.

- Time-sensitive: Tariff increases after April 11, 2025.

✅ HS CODE: 3926909989

Product Type: Plastic car sunshade

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 42.8%

Key Notes:

- Applies to plastic sunshades.

- Moderate tariff with a significant increase after April 11, 2025.

- Proactive Advice: Confirm the material composition and unit price for accurate classification.

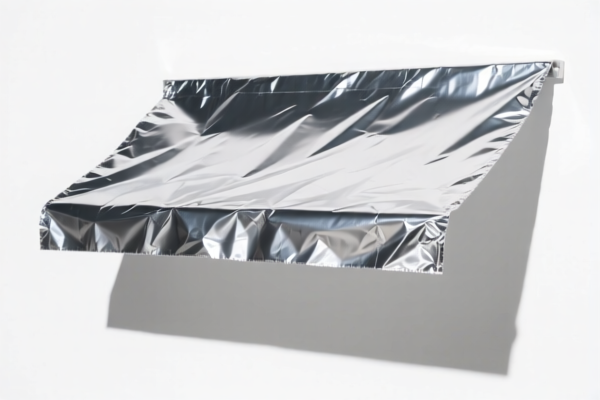

✅ HS CODE: 6306905000

Product Type: Fabric car sunshade (e.g., canvas or similar materials)

Tariff Summary:

- Base Tariff Rate: 4.5%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 34.5%

Key Notes:

- Applies to fabric or canvas sunshades.

- Low base tariff, but significant increase after April 11, 2025.

- Proactive Advice: Ensure the product is not classified under a higher-tariff category (e.g., 6306120000).

✅ HS CODE: 8708220000

Product Type: Windshield or glass sunshade (e.g., front windshield)

Tariff Summary:

- Base Tariff Rate: 2.5%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 55.0% (2.5% + 55.0%)

Key Notes:

- Applies to vehicle parts, such as windshields or glass sunshades.

- Very high total tariff due to anti-dumping duties and additional tariffs.

- Time-sensitive: Tariff increases after April 11, 2025.

📌 Proactive Customs Compliance Advice:

- Verify the product material (glass, plastic, fabric) to ensure correct HS code classification.

- Check the unit price and material composition to avoid misclassification.

- Review certifications (e.g., safety, environmental) required for import.

- Monitor the April 11, 2025 tariff change date and adjust import strategies accordingly.

- Consult local customs authorities for the latest regulations and exemptions.

Let me know if you need help with certification requirements or import documentation for any of these HS codes.

Customer Reviews

The proactive customs compliance advice was a great addition. It helped me ensure my plastic sunshades are classified correctly for export.

The information is there, but I found the HS code descriptions a bit technical. It would have been better if they were more simplified for quick reference.

The HS code 3926909989 for plastic sunshades was exactly what I needed. The 42.8% tariff and material composition notes were very useful.

The 55.0% tariff for windshield sunshades was a big shock. I appreciate the warning about the April 11 date change, though.

I was looking for info on fabric sunshades, and the 34.5% tariff rate was clearly laid out. The key notes were spot on for my needs.