| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4823906000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8484100000 | Doc | 57.5% | CN | US | 2025-05-12 |

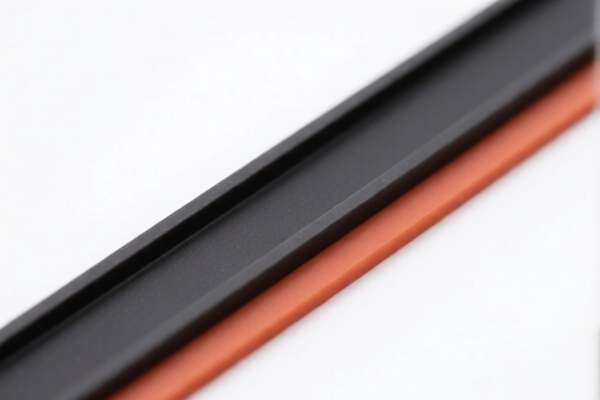

HS Code Classification & Duty Analysis: CAULK TAPE SEALANT STRIP

Based on the provided information, your "CAULK TAPE SEALANT STRIP" appears to fall under multiple HS code possibilities depending on its composition and construction. Here's a detailed breakdown of each potential classification, along with duty implications:

1. HS Code: 3919.10.20.55 – Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics

- Chapter 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 3919: Self-adhesive plates, sheets, film, foil, tape, strip and other flat shapes, of plastics. This specifically targets plastic-based adhesive products.

- 3919.10: In rolls of a width not exceeding 20 cm. This narrows down the classification to plastic tapes/strips that are rolled and relatively narrow.

- 3919.10.20: Other. This is a further sub-division within the narrow roll category.

-

3919.10.20.55: Other. This is the most specific classification, indicating a plastic tape/strip that doesn't fit into more defined categories within 3919.10.20.

-

Duty:

- Basic Duty: 5.8%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30.0%

- Total Duty: 60.8%

-

Important Considerations: This classification is suitable if the primary material is plastic. Please verify the exact plastic composition (e.g., PVC, PE, PP) as this can influence specific import regulations.

-

2. HS Code: 4823.90.60.00 – Other paper, paperboard, cellulose wadding and webs of cellulose fibers

- Chapter 48: Paper and paperboard; articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers.

- 4823: Other paper, paperboard, cellulose wadding and webs of cellulose fibers, cut to size or shape; other articles of paper pulp, paper, paper, paperboard, cellulose wadding or webs of cellulose fibers.

- 4823.90: Other. This covers paper-based products not specifically classified elsewhere.

- 4823.90.60: Of coated paper or paperboard: Gaskets, washers and other seals. This specifically targets coated paper/paperboard used for sealing applications.

-

4823.90.60.00: Other. This is the most specific classification within the coated paper/paperboard sealing category.

-

Duty:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30.0%

- Total Duty: 55.0%

-

Important Considerations: This classification is appropriate if the primary material is paper or paperboard, especially if it has a coating. Confirm the coating material and its purpose.

-

3. HS Code: 8484.10.00.00 – Gaskets and similar joints of metal sheeting combined with other material or of two or more layers of metal

- Chapter 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof.

- 8484: Gaskets and similar joints of metal sheeting combined with other material or of two or more layers of metal; sets or assortments of gaskets and similar joints, dissimilar in composition, put up in pouches, envelopes or similar packings; mechanical seals.

- 8484.10: Gaskets and similar joints of metal sheeting combined with other material or of two or more layers of metal. This targets gaskets that incorporate metal.

- 8484.10.00: Other. This is the most specific classification within the metal-containing gasket category.

-

8484.10.00.00: Other. This is the most specific classification within the metal-containing gasket category.

-

Duty:

- Basic Duty: 2.5%

- Additional Duty: 25.0%

- Post April 2, 2025 Additional Duty: 30.0%

- Total Duty: 57.5%

-

Important Considerations: This classification is suitable if the product contains metal sheeting as a significant component. Verify the type of metal and its function.

-

Recommendations & Next Steps:

- Material Composition: The most crucial step is to definitively determine the primary material(s) of your "CAULK TAPE SEALANT STRIP". Is it primarily plastic, paper, or metal?

- Layered Construction: If the product has multiple layers, identify each layer's material and its function.

- Single Invoice: Ensure the single invoice clearly states the material composition.

- Certification: Depending on the final HS code, you may need specific certifications (e.g., REACH compliance for plastics, material safety data sheets).

- Pricing: Double-check the declared unit price as customs may scrutinize prices for valuation purposes.

- Post April 2, 2025: Be aware of the upcoming duty changes on April 2, 2025, and factor them into your import costs.

Disclaimer: This analysis is based on the information provided and is for general guidance only. The final HS code determination rests with customs authorities. It is highly recommended to consult with a licensed customs broker or import specialist for accurate classification and compliance.

Customer Reviews

I appreciate the clear explanation of the different HS codes and their corresponding duties. This will be a valuable resource for my business.

The section on material composition was very helpful. I now know to double-check the primary material of my product before finalizing the HS code.

The detailed classification of the three HS codes for caulk tape sealant strips was exactly what I needed. This saved me a lot of time researching on my own.

I found the duty breakdowns useful, especially the note about the upcoming changes after April 2, 2025. It helped me plan my import costs better.

The explanation of HS Code 8484100000 for metal-containing gaskets was clear. I now understand how to identify if my product fits this category.