| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 4016990500 | Doc | 40.9% | CN | US | 2025-05-12 |

Okay, let's break down the classification and potential duties for your declared items, "CORNER GUARDS," based on the provided HS codes and descriptions. I'll present this in a structured format to help you understand the implications.

Important Disclaimer: HS code classification is complex and ultimately determined by customs officials. This analysis is based on the information you provided and should be used as a starting point for your own due diligence. I strongly recommend confirming the final classification with your customs broker or local customs authority.

Analysis of Declared Items: CORNER GUARDS

Here's a breakdown of each item, its HS code, and associated duties. I'll explain the HS code structure as we go.

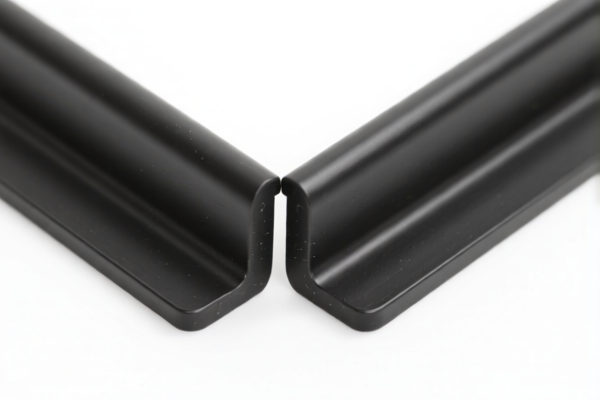

1. Item 1: "Other articles of iron or steel: Other: Other: Other Other"

- HS Code: (Currently Blank - This is a significant issue - see notes below)

- Description Breakdown: This description is extremely vague. "Other articles of iron or steel" is a broad category. The repeated "Other" indicates a lack of specific classification.

- HS Code Structure (General):

- First 2 Digits (Chapter): Indicates the broad category of the product (e.g., 73 for iron or steel).

- Next 2 Digits (Subheading): Narrows down the category (e.g., 7326 for iron or steel angles, shapes, and sections).

- Next 4 Digits: Further specifies the product.

- Next 6 Digits: Provides even more detail.

- Potential Issues & Recommendations:

- Missing HS Code: You must determine the correct HS code for this item. Without it, customs will assign one, which may not be the most favorable.

- Material is Key: Is it carbon steel, stainless steel, galvanized steel? The specific type of iron or steel significantly impacts the HS code.

- Function is Key: What is the primary function of the corner guard? Is it structural, protective, decorative?

- Example: If it's carbon steel corner guards used for protecting cargo, it might fall under 7326.90.00.00 (Other iron or steel angles, shapes and sections).

- Duty Rates: Duty rates for iron and steel vary widely depending on the specific HS code. Expect rates ranging from 0% to 10% or higher, plus potential anti-dumping duties.

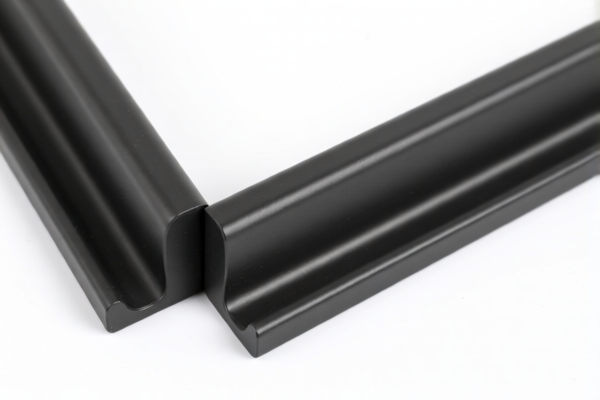

2. Item 2: "Builders' ware of plastics, not elsewhere specified or included: Other"

- HS Code: 3925.90.00.00

- Description Breakdown: This code covers builders' ware (items used in construction) made of plastics that aren't specifically classified elsewhere.

- HS Code Structure:

- 39: Plastics and articles thereof.

- 25: Plastics in primary forms.

- 90: Other.

- 00.00: Further specifies "Other" within the category.

- Tax Details:

- 基础关税 (Basic Tariff): 5.3%

- 加征关税 (Additional Tariff): 25.0% (Currently) / 30% (After April 2, 2025)

- 总税率 (Total Tariff): 60.3%

- Recommendations:

- Plastic Type: Confirm the specific type of plastic (PVC, PP, PE, etc.). While 3925.90.00.00 is broad, knowing the plastic type is helpful for customs.

- Certification: Depending on the application (e.g., building safety), you may need certifications like RoHS or REACH.

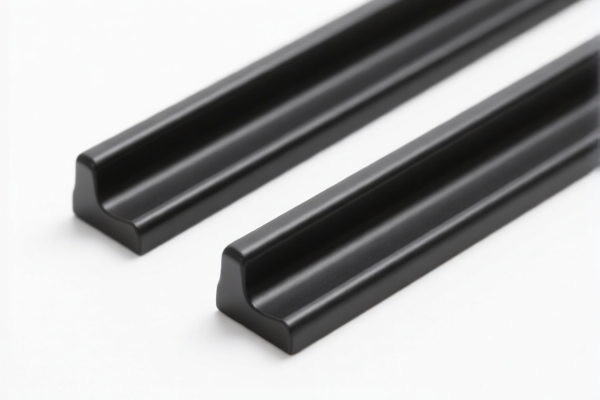

3. Item 3: "Other articles of vulcanized rubber other than hard rubber: Other: Other: Household articles not elsewhere specified or included"

- HS Code: 4016.99.05.00

- Description Breakdown: This code covers articles made of vulcanized rubber (rubber that has been chemically treated to improve its strength and elasticity) that aren't specifically classified elsewhere, specifically household articles.

- HS Code Structure:

- 40: Rubber and articles thereof.

- 16: Articles of vulcanized rubber, not elsewhere specified or included.

- 99: Other.

- 05.00: Further specifies "Other" within the category.

- Tax Details:

- 基础关税 (Basic Tariff): 3.4%

- 加征关税 (Additional Tariff): 7.5% (Currently) / 30% (After April 2, 2025)

- 总税率 (Total Tariff): 40.9%

- Recommendations:

- Rubber Composition: Confirm the specific rubber composition (natural rubber, synthetic rubber, etc.).

- Household Use: Ensure the item is genuinely considered a "household article" for this classification.

- Material Safety: Depending on the application, you may need certifications like RoHS or REACH.

Important Reminders:

- April 2, 2025 Tariff Changes: Be aware of the upcoming changes to the additional tariffs.

- Accurate Valuation: Ensure the declared value of your goods is accurate. Customs will scrutinize valuations.

- Country of Origin: The country of origin is crucial for determining applicable tariffs and trade agreements.

- Consult a Broker: I strongly recommend working with a licensed customs broker. They can provide expert guidance and ensure compliance with all regulations.

I hope this detailed breakdown is helpful. Please let me know if you have any further questions or would like me to elaborate on any specific point.

Customer Reviews

The review of the HS code for rubber corner guards was extremely helpful. The tax details and recommendations gave me confidence in the classification.

The analysis of the HS code structure was well-explained. I appreciate the detailed explanation of the 3925.90.00.00 classification for plastic corner guards.

The information on the 40.9% tariff for the rubber corner guards was exactly what I needed. I'm glad I found this resource before shipping.

The breakdown of the HS code 3925.90.00.00 was helpful, but I wish there were more examples of plastic types that fall under this category.

I found the explanation of the 60.3% tariff rate for the plastic corner guards very clear. The links to the official documentation are a huge plus.