| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 8441100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8440900000 | Doc | 37.5% | CN | US | 2025-05-12 |

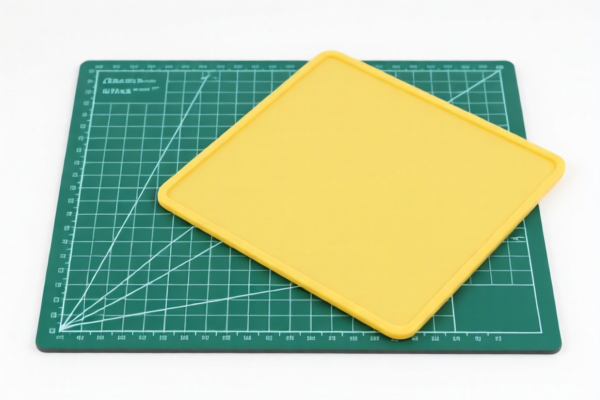

Okay, let's break down the HS codes and tax implications for your "CUTTING MAT FOR CRICUT" declaration. Based on the information provided, you have three potential HS code classifications. Here's a detailed analysis to help you determine the most accurate one:

Understanding HS Codes – A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first two digits generally indicate the chapter, the next two the subheading, and so on. Let's look at each code you've received:

1. HS Code: 3926.90.99.89 – Other articles of plastics and articles of other materials

- 39: Plastics and articles thereof (This chapter covers a wide range of plastic products).

- 39.26: Other articles of plastics and articles of other materials of headings 3901 to 3914. This is a more specific grouping within plastics.

- 39.26.90: Other. This indicates the item doesn't fit neatly into the more defined subcategories.

- 39.26.90.99: Other. Further specifies it's a miscellaneous plastic item.

-

39.26.90.99.89: Other. The most granular level, meaning it's a very specific "other" plastic item.

Tax Details: * Basic Duty: 5.3% * Additional Duty: 7.5% * Post April 2, 2025 Additional Duty: 30% * Total Tax: 42.8%

Suitability: This code could apply if the cutting mat is primarily made of plastic and isn't considered a machine part. However, given it's for a Cricut (a cutting machine), it's likely a component of a machine.

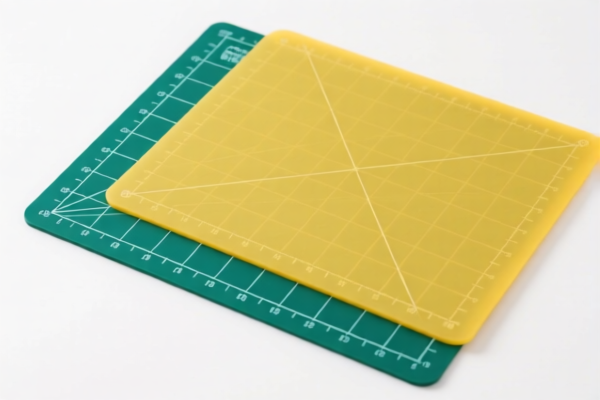

2. HS Code: 8441.10.00.00 – Machinery for making up paper pulp, paper or paperboard, including cutting machines

- 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof. (This is a broad chapter for machinery).

- 84.41: Machinery for making up paper pulp, paper or paperboard, including cutting machines.

- 84.41.10: Cutting machines.

-

84.41.10.00: Specifically cutting machines.

Tax Details: * Basic Duty: 0.0% * Additional Duty: 25.0% * Post April 2, 2025 Additional Duty: 30% * Total Tax: 55.0%

Suitability: This is the most likely code if the cutting mat is considered an integral part of a cutting machine (like the Cricut). It's specifically for cutting machines.

3. HS Code: 8440.90.00.00 – Bookbinding machinery, including book-sewing machines, and parts thereof

- 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof.

- 84.40: Bookbinding machinery, including book-sewing machines.

- 84.40.90: Parts.

-

84.40.90.00: Parts of bookbinding machinery.

Tax Details: * Basic Duty: 0.0% * Additional Duty: 7.5% * Post April 2, 2025 Additional Duty: 30% * Total Tax: 37.5%

Suitability: This code is unlikely unless the cutting mat is specifically designed and marketed as a part for bookbinding machinery. It's a very specific application.

Recommendation & Key Considerations:

I strongly recommend using HS Code 8441.10.00.00 as the most accurate classification for your "CUTTING MAT FOR CRICUT". It directly relates to cutting machines.

Important Reminders & Next Steps:

- Material Composition: Please double-check the primary material of the cutting mat. If it's overwhelmingly plastic and not essential to the function of the Cricut, 3926.90.99.89 might be considered.

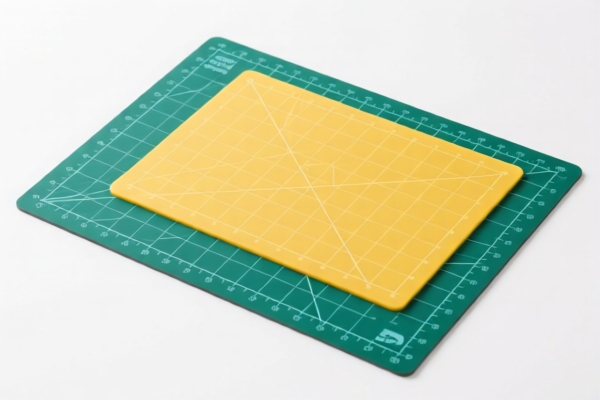

- Functionality: Is the mat considered a consumable part of the machine (needs regular replacement) or a more durable component? This will influence the classification.

- Single Invoice Value: The value of the invoice can affect the classification.

- Customs Ruling: For absolute certainty, consider obtaining a binding customs ruling from the Chinese customs authorities. This is the most reliable way to ensure correct classification.

- April 2, 2025 Changes: Be aware of the increased additional duties coming into effect on April 2, 2025.

- Certification: Depending on the final HS code, you may need to provide specific certifications (e.g., material safety data sheets).

To help me refine the recommendation further, could you tell me:

- What is the primary material of the cutting mat?

- Is it marketed as a replacement part for the Cricut?

- What is the declared value of the shipment?

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for guidance only. Always consult with a qualified customs broker or the relevant customs authorities for accurate and up-to-date regulations.

Customer Reviews

I love how the site explains the different HS codes and their implications. The 42.8% tariff for 3926.90.99.89 was clearly explained.

The information is good, but I found the classification for HS code 8440.90.00.00 a bit confusing. It doesn’t seem relevant to me.

This site is a lifesaver for exporters. The detailed breakdown of HS codes for cutting mats is exactly what I needed for my business.

The info on the 55% tariff for HS code 8441.10.00.00 was useful. I’m glad I read the note about the April 2025 changes.

The review of HS code 3926.90.99.89 was super helpful. I was confused about the plastic classification, but now I understand better.