| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926904800 | Doc | 33.4% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4823901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4823902000 | Doc | 55.0% | CN | US | 2025-05-12 |

HS Code Classification for Cutting Mats

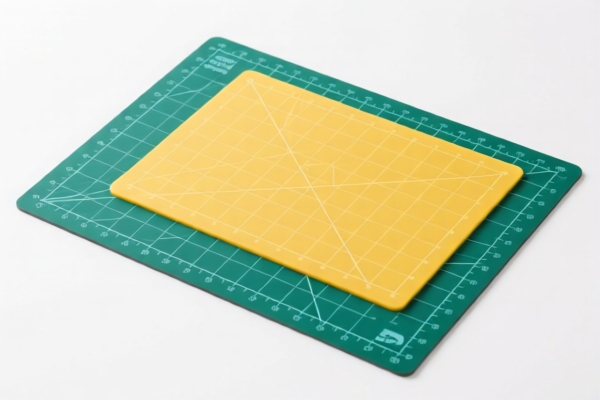

Based on the provided reference data and the product description "CUTTING MATS", here's a breakdown of potential HS code classifications. Determining the most accurate code requires more information about the mat's composition.

Here's a structured analysis:

- 3926.90 (Other articles of plastics and articles of other materials of headings 3901 to 3914): This is a broad category for articles not specifically covered elsewhere within the 3901-3914 headings. Cutting mats could fall here if made from a plastic material not specifically listed.

- 3926.90.48.00: Specifically for "Photo albums". This is unlikely to be relevant unless the cutting mat is designed to hold photos. Total Tax Rate: 33.4%.

- 3926.90.99.10: "Other Laboratory ware". If the cutting mats are used for precise cutting in a laboratory setting, this might apply. Total Tax Rate: 42.8%.

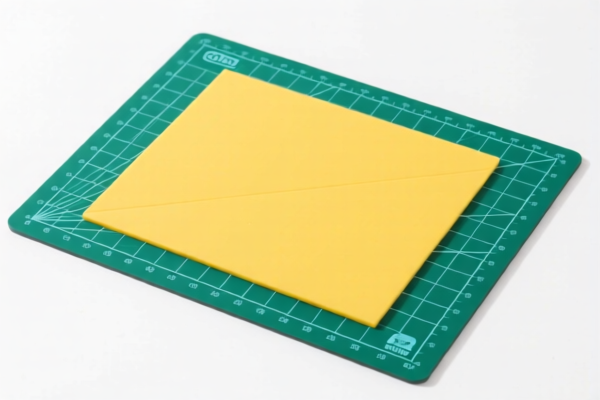

- 3920.79 (Other plates, sheets, film, foil and strip, of plastics, noncellular and not reinforced, laminated, supported or similarly combined with other materials): This is a strong possibility if the cutting mats are made of plastic sheets.

- 3920.79.50.00: "Of cellulose or its chemical derivatives: Of other cellulose derivatives: Other". If the mat is made from cellulose acetate, cellulose nitrate, etc. Total Tax Rate: 58.7%.

- 3920.99.50.00: "Of other plastics: Of other plastics: Other". This is a likely candidate if the mat is made from PVC, polypropylene, polyethylene, etc. Total Tax Rate: 60.8%.

- 4823.90 (Other paper, paperboard, cellulose wadding and webs of cellulose fibers, cut to size or shape; other articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers): If the cutting mat is primarily made of paper or cardboard, this is the relevant category.

- 4823.90.10.00: "Of paper pulp". Total Tax Rate: 55.0%.

- 4823.90.20.00: "Of papier-mâché". Total Tax Rate: 55.0%.

Key Considerations & Recommendations:

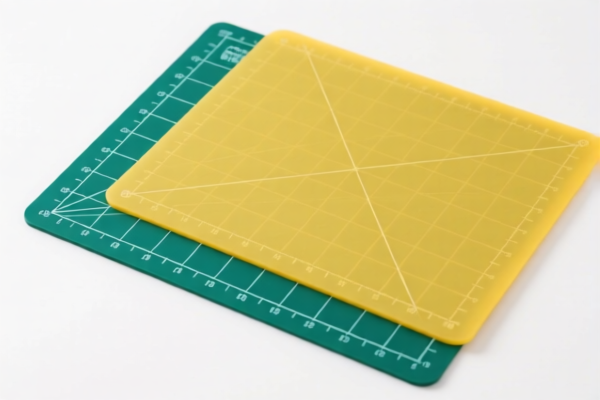

- Material Composition: The primary material of the cutting mat is crucial. Is it plastic (PVC, PP, PE), paper/cardboard, or a composite?

- Reinforcement: Is the mat reinforced with any materials (e.g., metal, fabric)?

- Thickness & Density: These factors can influence classification.

- Intended Use: While "cutting mat" is descriptive, knowing what is being cut (fabric, paper, food, etc.) can help.

- 2025.4.2 Tariff Changes: Be aware that additional tariffs will apply after April 2, 2025, for many of these codes.

Actionable Steps:

- Confirm Material: Obtain a detailed material specification from the supplier.

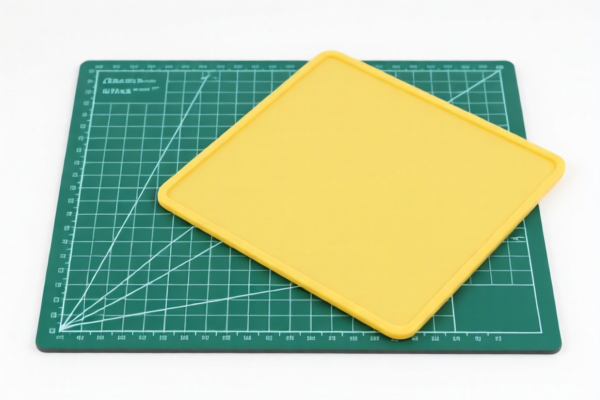

- Review Samples: If possible, a physical sample can help determine the composition and construction.

- Consult with a Licensed Customs Broker: For definitive classification, especially with composite materials, a broker's expertise is recommended.

- Prepare Documentation: Have a clear product description, material specifications, and intended use statement ready for customs.

Customer Reviews

The information on the 3920.79.50.00 code was spot-on. I was able to use it for my export documentation right away.

I really appreciated the detailed breakdown of the 3926.90.48.00 code. It made the process much easier for me.

The page provided a good overview of the different HS codes for cutting mats. It would be even better with more images.

The 4823.90.10.00 code was exactly what I needed for my paper cutting mats. The explanation was helpful.

The page explained the difference between plastic and paper cutting mats clearly. Great for someone new to HS codes.