| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8442501000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8442509000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 8487900080 | Doc | 83.9% | CN | US | 2025-05-12 |

| 8487900040 | Doc | 58.9% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

| 7310100005 | Doc | 80.0% | CN | US | 2025-05-12 |

| 7310290055 | Doc | 80.0% | CN | US | 2025-05-12 |

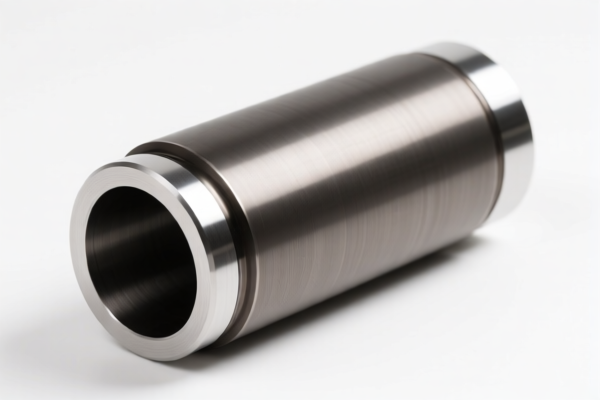

HS Code Classification for "CYLINDER"

Based on the provided reference data, classifying "CYLINDER" requires considering the specific application and material. Here's a breakdown of potential HS codes, categorized by likely scenarios:

1. Printing Components (Most Likely if related to printing industry)

-

8442501000: Plates, cylinders and other printing components; plates, cylinders and lithographic stones, prepared for printing purposes (for example, planed, grained or polished): Plates, cylinders and other printing components; plates, cylinders and lithographic stones, prepared for printing purposes (for example, planed, grained or polished): Plates.

- 84: Machinery and mechanical appliances.

- 42: Machinery and apparatus for preparing or making plates, cylinders or other printing components.

- 50: Plates, cylinders and other printing components.

- 10: Plates.

- Tax Rate: Base Tariff: 0.0%, Additional Tariff: 25.0%, Post 2025.4.2 Additional Tariff: 30%, Total: 55.0%. Applicable if the cylinder is specifically manufactured for printing processes.

-

8442509000: Plates, cylinders and other printing components; plates, cylinders and lithographic stones, prepared for printing purposes (for example, planed, grained or polished): Plates, cylinders and other printing components; plates, cylinders and lithographic stones, prepared for printing purposes (for example, planed, grained or polished): Other.

- 84: Machinery and mechanical appliances.

- 42: Machinery and apparatus for preparing or making plates, cylinders or other printing components.

- 50: Plates, cylinders and other printing components.

- 90: Other.

- Tax Rate: Base Tariff: 0.0%, Additional Tariff: 7.5%, Post 2025.4.2 Additional Tariff: 30%, Total: 37.5%. Applicable if the cylinder is a printing component but doesn't fall under the more specific 'Plates' category.

2. Machinery Parts (If used as a component in a larger machine)

- 8487900080: Machinery parts, not containing electrical connectors, insulators, coils, contacts or other electrical features, and not specified or included elsewhere in this chapter: Other Other.

- 84: Machinery and mechanical appliances.

- 87: Parts of machinery, not containing electrical connectors, insulators, coils, contacts or other electrical features.

- 90: Other.

- 80: Other.

- Tax Rate: Base Tariff: 3.9%, Additional Tariff: 25.0%, Post 2025.4.2 Additional Tariff: 30%, Additional Tariff for steel/aluminum: 25%, Total: 83.9%. Applicable if the cylinder is a non-electrical part of a larger machine.

3. Iron or Steel Articles (If made of iron or steel and not specifically a machine part)

- 7326908688: Other articles of iron or steel: Other: Other: Other: Other Other.

- 73: Articles of iron or steel.

- 26: Other articles of iron or steel.

- 90: Other.

- 86: Other.

- 88: Other.

- Tax Rate: Base Tariff: 2.9%, Additional Tariff: 25.0%, Post 2025.4.2 Additional Tariff: 30%, Additional Tariff for steel/aluminum: 25%, Total: 82.9%. Applicable if the cylinder is a general iron or steel article.

4. Tanks, Casks, Drums, and Similar Containers (If used for storage/transport)

- 7310100005: Tanks, casks, drums, cans, boxes and similar containers, for any material (other than compressed or liquefied gas), of iron or steel, of a capacity not exceeding

300 liters , whether or not lined or heat insulated, but not fitted with mechanical or thermal equipment: Of a capacity of50 liters or more Refillable stainless steel kegs, whether or not pressurized, of a kind described in statistical note 1 to this chapter.- 73: Articles of iron or steel.

- 10: Tanks, casks, drums, etc.

- 10: Of a capacity of 50 liters or more.

- 05: Refillable stainless steel kegs.

- Tax Rate: Base Tariff: 0.0%, Additional Tariff: 25.0%, Post 2025.4.2 Additional Tariff: 30%, Additional Tariff for steel/aluminum: 25%, Total: 80.0%.

Important Considerations & Recommendations:

- Material: The material composition (e.g., stainless steel, carbon steel, aluminum) is crucial for determining the correct tariff.

- Function: What is the cylinder used for? This will help narrow down the appropriate HS code.

- Capacity (if applicable): If the cylinder is a container, its capacity is a key factor.

- Detailed Specification: Provide a detailed product specification sheet, including dimensions, material grade, and intended use.

- Certification: Depending on the application, specific certifications (e.g., pressure vessel certification) may be required.

- 2025.4.2 Tariff Changes: Be aware of the upcoming tariff changes on April 2, 2025, which will significantly impact the total tax rate for many products.

- Consult a Customs Broker: For accurate classification and to ensure compliance, it is highly recommended to consult with a licensed customs broker. They can provide expert guidance based on your specific product and import requirements.

Customer Reviews

The section on tariff changes after April 2, 2025, was really useful. It gave me a clear warning about the impact on the total tax rate for my product.

The information is thorough, but I found it a bit overwhelming. More visual aids or a summary table would have helped me grasp the HS code classifications faster.

The detailed breakdown of the 8442509000 code was great. The 37.5% tariff rate and its relevance to non-plate printing components made it easy to understand.

The explanation of HS Code 7310100005 for containers was clear, but I wish there were more examples of how capacity affects classification.

The section on iron or steel cylinders with HS Code 7326908688 was exactly what I needed. The 82.9% tariff rate and the material-based classification were very helpful.