Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

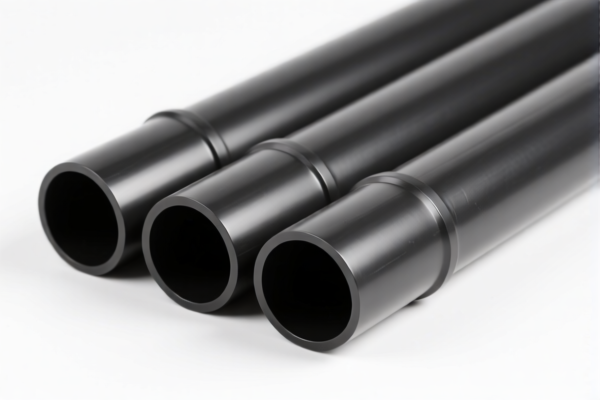

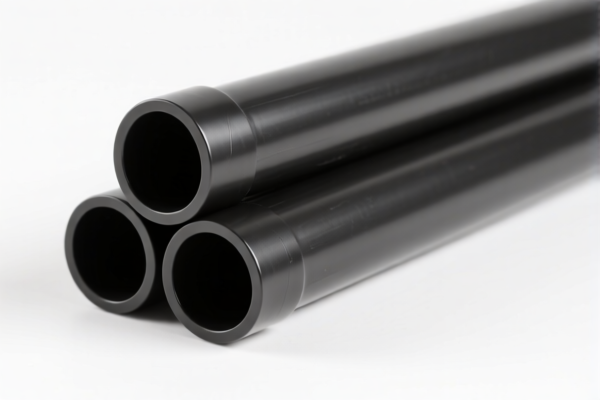

Product Classification: Carbon Steel Reinforced Plastic Tubes

HS CODE: 3917390010

🔍 Classification Summary

- Product Description: Carbon steel reinforced plastic tubes fall under the category of "metal-reinforced plastic tubes" (HS CODE: 3917390010).

- Applicable Tax Rate: 33.1% (as of now).

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- This is a significant increase and will apply to all imports classified under this HS code after the specified date.

⚠️ Important Notes

- Anti-Dumping Duties: Not applicable for this product category (no specific anti-dumping duties on carbon steel-reinforced plastic tubes are currently in effect).

- April 11, 2025, Policy Alert: Be prepared for a 30% additional tariff after this date. This could significantly increase the total import cost.

- Material Verification: Confirm that the product is indeed made of carbon steel and not another type of metal (e.g., stainless steel or copper), as this may affect classification.

- Certifications Required: Ensure compliance with any required import certifications (e.g., material safety, environmental standards, or product specifications).

📌 Proactive Advice

- Check Material Composition: Verify the exact type of metal used for reinforcement (carbon steel, stainless steel, etc.) to ensure correct HS code classification.

- Review Unit Price: The 30% additional tariff after April 11, 2025, may impact cost structures—consider this in pricing and sourcing strategies.

- Consult Customs Authority: For complex or high-value shipments, seek confirmation from local customs or a customs broker to avoid classification errors.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Classification: Carbon Steel Reinforced Plastic Tubes

HS CODE: 3917390010

🔍 Classification Summary

- Product Description: Carbon steel reinforced plastic tubes fall under the category of "metal-reinforced plastic tubes" (HS CODE: 3917390010).

- Applicable Tax Rate: 33.1% (as of now).

📊 Tariff Breakdown

- Base Tariff Rate: 3.1%

- Additional Tariff (Currently): 0.0%

- Special Tariff Imposed After April 11, 2025: 30.0%

- This is a significant increase and will apply to all imports classified under this HS code after the specified date.

⚠️ Important Notes

- Anti-Dumping Duties: Not applicable for this product category (no specific anti-dumping duties on carbon steel-reinforced plastic tubes are currently in effect).

- April 11, 2025, Policy Alert: Be prepared for a 30% additional tariff after this date. This could significantly increase the total import cost.

- Material Verification: Confirm that the product is indeed made of carbon steel and not another type of metal (e.g., stainless steel or copper), as this may affect classification.

- Certifications Required: Ensure compliance with any required import certifications (e.g., material safety, environmental standards, or product specifications).

📌 Proactive Advice

- Check Material Composition: Verify the exact type of metal used for reinforcement (carbon steel, stainless steel, etc.) to ensure correct HS code classification.

- Review Unit Price: The 30% additional tariff after April 11, 2025, may impact cost structures—consider this in pricing and sourcing strategies.

- Consult Customs Authority: For complex or high-value shipments, seek confirmation from local customs or a customs broker to avoid classification errors.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.