| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5203000500 | Doc | 60.0% | CN | US | 2025-05-12 |

| 5203001000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 5205142000 | Doc | 63.7% | CN | US | 2025-05-12 |

| 5205350000 | Doc | 67.0% | CN | US | 2025-05-12 |

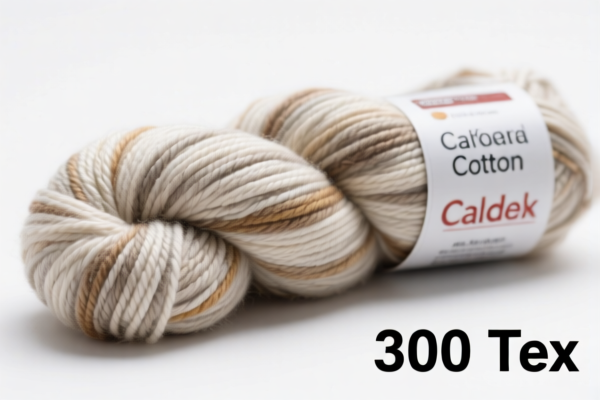

Customs Compliance Analysis for Carded Cotton Yarn (300 Tex)

Based on the provided HS codes and tariff details, here is a structured breakdown of the classification and applicable tariffs for carded cotton yarn (300 Tex):

1. HS Code: 5203000500

Description:

- Cotton, carded or combed: Fibers of cotton processed but not spun

- Described in general note 15 of the tariff schedule

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.0%

Key Notes: - This code applies to processed cotton fibers that are not yet spun. - Ensure the product is not classified as yarn (i.e., not spun into thread). - This is not applicable to cotton yarn (spun product).

2. HS Code: 5203001000

Description:

- Cotton, carded or combed: Fibers of cotton processed but not spun

- Described in additional U.S. note 10 to this chapter

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.0%

Key Notes: - This code is similar to 5203000500 but governed by U.S. note 10. - Again, this is for processed cotton fibers, not spun yarn. - Confirm the processing stage of the product to avoid misclassification.

3. HS Code: 5205142000

Description:

- Cotton yarn (other than sewing thread), containing 85% or more by weight of cotton

- Not put up for retail sale

- Single yarn, of uncombed fibers

- Exceeding 52 nm but not exceeding 80 nm

- Other (300)

Tariff Breakdown:

- Base Tariff Rate: 8.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 63.7%

Key Notes: - This is the correct classification for carded cotton yarn with 300 Tex (300 nm). - The yarn is single, uncombed, and not for retail sale. - Ensure the cotton content is at least 85% by weight. - Confirm the count (Tex) is within the specified range (52–80 nm).

4. HS Code: 5205350000

Description:

- Cotton yarn (other than sewing thread), containing 85% or more by weight of cotton

- Not put up for retail sale

- Multiple (folded) or cabled yarn, of uncombed fibers

- Exceeding 80 nm per single yarn (300)

Tariff Breakdown:

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 67.0%

Key Notes: - This code applies to cabled or folded cotton yarn. - It is not applicable to single yarn (e.g., 300 Tex carded cotton yarn). - Ensure the product is not single and is cabled or folded.

Proactive Advice for Importers:

- Verify the product form: Is it processed cotton fiber (not spun) or cotton yarn (spun)?

- Confirm the count (Tex): Ensure it is 300 Tex and falls under the correct nm range.

- Check cotton content: Must be at least 85% by weight.

- Review documentation: Ensure the product is not for retail sale (e.g., bulk or industrial use).

- Check for certifications: Some products may require certifications (e.g., origin, cotton content).

- Monitor tariff changes: The special tariff after April 11, 2025 is 30.0%, which is higher than the additional tariff of 25.0%.

- Consult a customs broker: For accurate classification and compliance, especially with complex textile classifications.

Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 5203000500 | Processed cotton fibers (not spun) | 5.0% | 25.0% | 30.0% | 60.0% |

| 5203001000 | Processed cotton fibers (not spun) | 5.0% | 25.0% | 30.0% | 60.0% |

| 5205142000 | Single carded cotton yarn (300 Tex) | 8.7% | 25.0% | 30.0% | 63.7% |

| 5205350000 | Cabled/folded cotton yarn (300 Tex) | 12.0% | 25.0% | 30.0% | 67.0% |

If you have the product specifications, certifications, and intended use, I can help you further confirm the correct HS code and tariff implications.

Customs Compliance Analysis for Carded Cotton Yarn (300 Tex)

Based on the provided HS codes and tariff details, here is a structured breakdown of the classification and applicable tariffs for carded cotton yarn (300 Tex):

1. HS Code: 5203000500

Description:

- Cotton, carded or combed: Fibers of cotton processed but not spun

- Described in general note 15 of the tariff schedule

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.0%

Key Notes: - This code applies to processed cotton fibers that are not yet spun. - Ensure the product is not classified as yarn (i.e., not spun into thread). - This is not applicable to cotton yarn (spun product).

2. HS Code: 5203001000

Description:

- Cotton, carded or combed: Fibers of cotton processed but not spun

- Described in additional U.S. note 10 to this chapter

Tariff Breakdown:

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.0%

Key Notes: - This code is similar to 5203000500 but governed by U.S. note 10. - Again, this is for processed cotton fibers, not spun yarn. - Confirm the processing stage of the product to avoid misclassification.

3. HS Code: 5205142000

Description:

- Cotton yarn (other than sewing thread), containing 85% or more by weight of cotton

- Not put up for retail sale

- Single yarn, of uncombed fibers

- Exceeding 52 nm but not exceeding 80 nm

- Other (300)

Tariff Breakdown:

- Base Tariff Rate: 8.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 63.7%

Key Notes: - This is the correct classification for carded cotton yarn with 300 Tex (300 nm). - The yarn is single, uncombed, and not for retail sale. - Ensure the cotton content is at least 85% by weight. - Confirm the count (Tex) is within the specified range (52–80 nm).

4. HS Code: 5205350000

Description:

- Cotton yarn (other than sewing thread), containing 85% or more by weight of cotton

- Not put up for retail sale

- Multiple (folded) or cabled yarn, of uncombed fibers

- Exceeding 80 nm per single yarn (300)

Tariff Breakdown:

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 67.0%

Key Notes: - This code applies to cabled or folded cotton yarn. - It is not applicable to single yarn (e.g., 300 Tex carded cotton yarn). - Ensure the product is not single and is cabled or folded.

Proactive Advice for Importers:

- Verify the product form: Is it processed cotton fiber (not spun) or cotton yarn (spun)?

- Confirm the count (Tex): Ensure it is 300 Tex and falls under the correct nm range.

- Check cotton content: Must be at least 85% by weight.

- Review documentation: Ensure the product is not for retail sale (e.g., bulk or industrial use).

- Check for certifications: Some products may require certifications (e.g., origin, cotton content).

- Monitor tariff changes: The special tariff after April 11, 2025 is 30.0%, which is higher than the additional tariff of 25.0%.

- Consult a customs broker: For accurate classification and compliance, especially with complex textile classifications.

Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tariff |

|---|---|---|---|---|---|

| 5203000500 | Processed cotton fibers (not spun) | 5.0% | 25.0% | 30.0% | 60.0% |

| 5203001000 | Processed cotton fibers (not spun) | 5.0% | 25.0% | 30.0% | 60.0% |

| 5205142000 | Single carded cotton yarn (300 Tex) | 8.7% | 25.0% | 30.0% | 63.7% |

| 5205350000 | Cabled/folded cotton yarn (300 Tex) | 12.0% | 25.0% | 30.0% | 67.0% |

If you have the product specifications, certifications, and intended use, I can help you further confirm the correct HS code and tariff implications.

Customer Reviews

No reviews yet.