Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

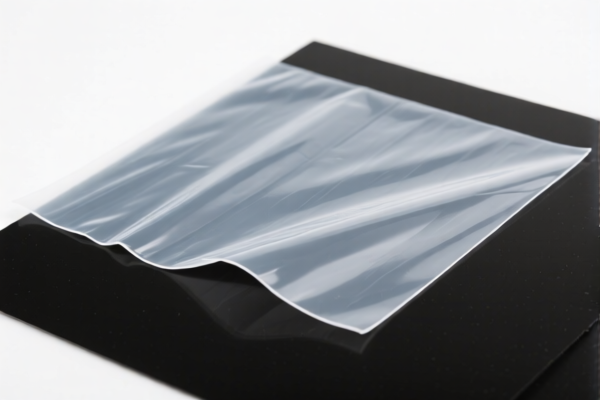

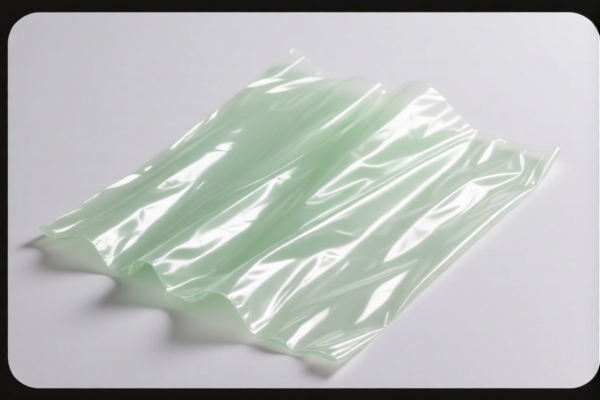

Product Name: Cellulose Acetate Combined Sheets

HS CODE: 3912120000

🔍 Product Classification Summary

- Product Type: Cellulose Acetate Combined Sheets

- HS CODE: 3912120000

- Classification Basis: This product is classified under 3912.12.00.00 as a plasticized cellulose acetate sheet, which is a type of synthetic resin sheet.

📊 Tariff Overview

- Total Tax Rate: 60.6%

- Breakdown of Taxes:

- Base Tariff Rate: 5.6%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

⏰ Time-Sensitive Policy Alert

- April 2, 2025 Special Tariff:

- Starting April 2, 2025, an additional 30.0% tariff will be applied to this product.

- This is a significant increase from the current 25.0% additional tariff.

- Action Required: If your import schedule includes this product after April 2, 2025, you must reassess your cost structure and compliance strategy.

📌 Other Considerations

- Anti-Dumping Duties:

- No specific anti-dumping duties are currently listed for this product.

- Certifications Required:

- Confirm if customs documentation (e.g., commercial invoice, packing list, certificate of origin) is required.

- Verify if material specifications (e.g., plasticizer content, thickness, etc.) affect classification or tax rates.

- Unit Price Verification:

- Ensure the unit price is correctly declared to avoid discrepancies during customs inspection.

✅ Proactive Advice

- Check Material Composition: Confirm that the product is indeed plasticized cellulose acetate and not a different type of composite or modified material.

- Monitor Tariff Updates: Keep track of any new trade policies or tariff adjustments that may affect this product.

- Consult Customs Broker: For large-volume imports, consider engaging a customs broker to ensure compliance and optimize tax planning.

Let me know if you need help with customs documentation templates or tariff comparison tools.

Product Name: Cellulose Acetate Combined Sheets

HS CODE: 3912120000

🔍 Product Classification Summary

- Product Type: Cellulose Acetate Combined Sheets

- HS CODE: 3912120000

- Classification Basis: This product is classified under 3912.12.00.00 as a plasticized cellulose acetate sheet, which is a type of synthetic resin sheet.

📊 Tariff Overview

- Total Tax Rate: 60.6%

- Breakdown of Taxes:

- Base Tariff Rate: 5.6%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 2, 2025): 30.0%

⏰ Time-Sensitive Policy Alert

- April 2, 2025 Special Tariff:

- Starting April 2, 2025, an additional 30.0% tariff will be applied to this product.

- This is a significant increase from the current 25.0% additional tariff.

- Action Required: If your import schedule includes this product after April 2, 2025, you must reassess your cost structure and compliance strategy.

📌 Other Considerations

- Anti-Dumping Duties:

- No specific anti-dumping duties are currently listed for this product.

- Certifications Required:

- Confirm if customs documentation (e.g., commercial invoice, packing list, certificate of origin) is required.

- Verify if material specifications (e.g., plasticizer content, thickness, etc.) affect classification or tax rates.

- Unit Price Verification:

- Ensure the unit price is correctly declared to avoid discrepancies during customs inspection.

✅ Proactive Advice

- Check Material Composition: Confirm that the product is indeed plasticized cellulose acetate and not a different type of composite or modified material.

- Monitor Tariff Updates: Keep track of any new trade policies or tariff adjustments that may affect this product.

- Consult Customs Broker: For large-volume imports, consider engaging a customs broker to ensure compliance and optimize tax planning.

Let me know if you need help with customs documentation templates or tariff comparison tools.

Customer Reviews

No reviews yet.