| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912110000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3920730000 | Doc | 57.9% | CN | US | 2025-05-12 |

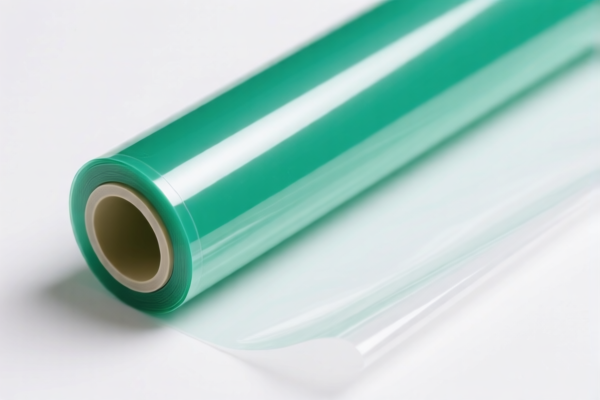

Product Name: Cellulose Acetate Film

Classification: Fiber and its chemical derivatives, specifically cellulose acetate film

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for cellulose acetate film, with a focus on tariff changes effective after April 2, 2025:

🔢 1. HS CODE: 3912110000

Description:

- Applicable to cellulose acetate film classified under fiber and its chemical derivatives, unlisted or not included in other headings, in primary form (non-plasticized cellulose acetate).

Tariff Breakdown:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.6%

🔢 2. HS CODE: 3920791000

Description:

- Applicable to cellulose acetate film classified under non-cellular plastics and non-reinforced plastic sheets, plates, films, foils, and strips made from cellulose or its chemical derivatives.

Tariff Breakdown:

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.2%

🔢 3. HS CODE: 3920795000

Description:

- Applicable to cellulose acetate film classified under non-cellular plastics and non-reinforced plastic sheets, plates, films, foils, and strips made from cellulose or its chemical derivatives.

Tariff Breakdown:

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 58.7%

🔢 4. HS CODE: 3920730000

Description:

- Applicable to cellulose acetate film classified under non-cellular plastics and non-reinforced plastic sheets, plates, films, foils, and strips made from cellulose acetate.

Tariff Breakdown:

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 57.9%

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all four HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin and product specifications.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is pure cellulose acetate film and not mixed with other materials, as this can affect classification. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product. -

Consult with Customs Broker:

For accurate classification and tariff calculation, it is recommended to consult a customs broker or a qualified customs compliance expert, especially if the product is close to the boundary of multiple HS codes. -

Monitor Policy Updates:

Stay updated on tariff changes and trade agreements that may affect the classification and duty rates of cellulose acetate film.

Let me know if you need help with customs documentation, classification confirmation, or duty calculation for your specific shipment.

Product Name: Cellulose Acetate Film

Classification: Fiber and its chemical derivatives, specifically cellulose acetate film

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for cellulose acetate film, with a focus on tariff changes effective after April 2, 2025:

🔢 1. HS CODE: 3912110000

Description:

- Applicable to cellulose acetate film classified under fiber and its chemical derivatives, unlisted or not included in other headings, in primary form (non-plasticized cellulose acetate).

Tariff Breakdown:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.6%

🔢 2. HS CODE: 3920791000

Description:

- Applicable to cellulose acetate film classified under non-cellular plastics and non-reinforced plastic sheets, plates, films, foils, and strips made from cellulose or its chemical derivatives.

Tariff Breakdown:

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.2%

🔢 3. HS CODE: 3920795000

Description:

- Applicable to cellulose acetate film classified under non-cellular plastics and non-reinforced plastic sheets, plates, films, foils, and strips made from cellulose or its chemical derivatives.

Tariff Breakdown:

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 58.7%

🔢 4. HS CODE: 3920730000

Description:

- Applicable to cellulose acetate film classified under non-cellular plastics and non-reinforced plastic sheets, plates, films, foils, and strips made from cellulose acetate.

Tariff Breakdown:

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 57.9%

⚠️ Important Notes and Alerts

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all four HS codes after April 2, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product in the provided data. However, it is advisable to check for any anti-dumping or countervailing duties that may apply depending on the country of origin and product specifications.

📌 Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is pure cellulose acetate film and not mixed with other materials, as this can affect classification. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product. -

Consult with Customs Broker:

For accurate classification and tariff calculation, it is recommended to consult a customs broker or a qualified customs compliance expert, especially if the product is close to the boundary of multiple HS codes. -

Monitor Policy Updates:

Stay updated on tariff changes and trade agreements that may affect the classification and duty rates of cellulose acetate film.

Let me know if you need help with customs documentation, classification confirmation, or duty calculation for your specific shipment.

Customer Reviews

No reviews yet.