Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912110000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

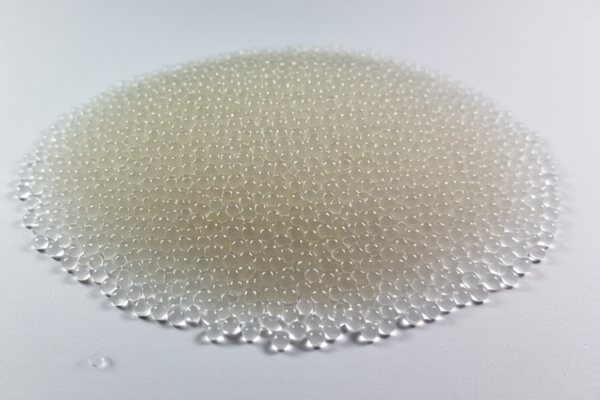

Product Name: Cellulose Acetate Granules

Classification: Based on the provided HS codes, the product falls under Chapter 3912 of the Harmonized System, which covers "Cellulose acetate."

🔍 HS Code Classification and Tax Details

Option 1: Non-Plasticized Cellulose Acetate (Granules)

- HS Code:

3912110000 - Summary: Non-plasticized cellulose acetate in granular form, considered a primary form product.

- Total Tax Rate: 60.6%

- Breakdown of Taxes:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product.

Option 2: Plasticized Cellulose Acetate

- HS Code:

3912120000 - Summary: Plasticized cellulose acetate.

- Total Tax Rate: 60.6%

- Breakdown of Taxes:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on both HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- No Anti-dumping duties: These products are not subject to anti-dumping duties on iron or aluminum, as they are chemical products, not metal-based.

- Certifications Required: Depending on the country of import, you may need to provide documentation such as:

- Material Safety Data Sheet (MSDS)

- Certificate of Origin

- Import License (if applicable)

🛠️ Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the cellulose acetate is plasticized or non-plasticized, as this determines the correct HS code.

- Check Unit Price: The tax rate is based on the declared value, so ensure the unit price is accurate and consistent with market rates.

- Review Certification Requirements: Some countries may require specific certifications or permits for chemical imports.

- Plan for Tariff Increases: If your shipment is scheduled after April 11, 2025, be prepared for a 30.0% increase in the additional tariff.

Let me know if you need help determining the correct HS code based on product specifications or if you need assistance with customs documentation.

Product Name: Cellulose Acetate Granules

Classification: Based on the provided HS codes, the product falls under Chapter 3912 of the Harmonized System, which covers "Cellulose acetate."

🔍 HS Code Classification and Tax Details

Option 1: Non-Plasticized Cellulose Acetate (Granules)

- HS Code:

3912110000 - Summary: Non-plasticized cellulose acetate in granular form, considered a primary form product.

- Total Tax Rate: 60.6%

- Breakdown of Taxes:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product.

Option 2: Plasticized Cellulose Acetate

- HS Code:

3912120000 - Summary: Plasticized cellulose acetate.

- Total Tax Rate: 60.6%

- Breakdown of Taxes:

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on both HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning.

- No Anti-dumping duties: These products are not subject to anti-dumping duties on iron or aluminum, as they are chemical products, not metal-based.

- Certifications Required: Depending on the country of import, you may need to provide documentation such as:

- Material Safety Data Sheet (MSDS)

- Certificate of Origin

- Import License (if applicable)

🛠️ Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the cellulose acetate is plasticized or non-plasticized, as this determines the correct HS code.

- Check Unit Price: The tax rate is based on the declared value, so ensure the unit price is accurate and consistent with market rates.

- Review Certification Requirements: Some countries may require specific certifications or permits for chemical imports.

- Plan for Tariff Increases: If your shipment is scheduled after April 11, 2025, be prepared for a 30.0% increase in the additional tariff.

Let me know if you need help determining the correct HS code based on product specifications or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.