| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920730000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

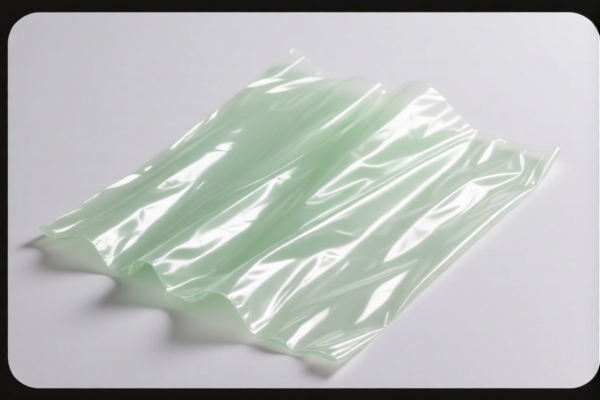

Product Name: Cellulose Acetate Sheet

HS Code: 3920730000 or 3920795000

Classification Summary:

- HS Code 3920730000: Specifically includes "cellulose or its chemical derivatives: cellulose acetate" — this is the most accurate classification for Cellulose Acetate Sheet.

- HS Code 3920795000: Applies to other cellulose derivatives, which may not be as precise for your product unless it falls under a broader category.

🔍 Tariff Overview (as of now):

HS Code 3920730000

- Base Tariff Rate: 2.9%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.9%

HS Code 3920795000

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy — ensure your import timeline is planned accordingly.

- No Anti-dumping duties are currently listed for this product category.

- No specific tariffs on iron or aluminum apply here, as the product is a cellulose derivative, not a metal.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed cellulose acetate and not a different cellulose derivative, to ensure correct HS code classification.

- Check Unit Price and Certification: Some customs authorities may require documentation such as material safety data sheets (MSDS) or certifications of origin.

- Consult with Customs Broker: For large or complex shipments, it's advisable to work with a customs broker to ensure compliance and avoid delays.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Cellulose Acetate Sheet

HS Code: 3920730000 or 3920795000

Classification Summary:

- HS Code 3920730000: Specifically includes "cellulose or its chemical derivatives: cellulose acetate" — this is the most accurate classification for Cellulose Acetate Sheet.

- HS Code 3920795000: Applies to other cellulose derivatives, which may not be as precise for your product unless it falls under a broader category.

🔍 Tariff Overview (as of now):

HS Code 3920730000

- Base Tariff Rate: 2.9%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 57.9%

HS Code 3920795000

- Base Tariff Rate: 3.7%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy — ensure your import timeline is planned accordingly.

- No Anti-dumping duties are currently listed for this product category.

- No specific tariffs on iron or aluminum apply here, as the product is a cellulose derivative, not a metal.

📌 Proactive Advice:

- Verify Material Composition: Confirm that the product is indeed cellulose acetate and not a different cellulose derivative, to ensure correct HS code classification.

- Check Unit Price and Certification: Some customs authorities may require documentation such as material safety data sheets (MSDS) or certifications of origin.

- Consult with Customs Broker: For large or complex shipments, it's advisable to work with a customs broker to ensure compliance and avoid delays.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.