| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912110000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 3920730000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

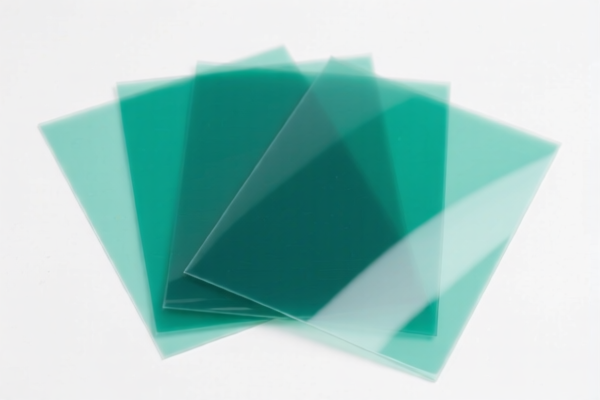

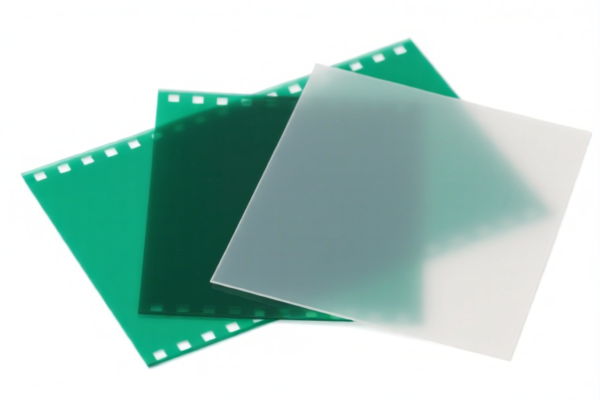

Product Name: Cellulose Acetate Films

Classification: HS Codes related to cellulose acetate films

Below is the detailed classification and tariff information for cellulose acetate films based on the provided HS codes:

🔍 HS Code: 3912110000

Description: Cellulose acetate films classified as primary forms of cellulose and its chemical derivatives.

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.6%

- Note: This code is for primary forms of cellulose acetate, not finished products.

🔍 HS Code: 3920791000

Description: Cellulose acetate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose or its chemical derivatives.

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.2%

- Note: This code applies to finished or semi-finished cellulose acetate films.

🔍 HS Code: 3920795000

Description: Cellulose acetate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose or its chemical derivatives.

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.7%

- Note: This code may apply to specific types of cellulose acetate films, possibly with different specifications or uses.

🔍 HS Code: 3920730000

Description: Cellulose acetate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose acetate.

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.9%

- Note: This code is specific to cellulose acetate, not other cellulose derivatives.

🔍 HS Code: 3920791000 (Alternative Use)

Description: Cellulose propionate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose or its chemical derivatives.

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.2%

- Note: This code may also apply to cellulose propionate films, which are a different chemical derivative of cellulose.

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert: A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition (e.g., cellulose acetate vs. cellulose propionate) and finished product status to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Unit Price: Verify the unit price and product specifications to ensure compliance with customs valuation rules.

✅ Proactive Advice:

- Double-check the product's chemical structure and finished state to avoid misclassification.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep updated records of product specifications and documentation to support customs declarations.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Product Name: Cellulose Acetate Films

Classification: HS Codes related to cellulose acetate films

Below is the detailed classification and tariff information for cellulose acetate films based on the provided HS codes:

🔍 HS Code: 3912110000

Description: Cellulose acetate films classified as primary forms of cellulose and its chemical derivatives.

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.6%

- Note: This code is for primary forms of cellulose acetate, not finished products.

🔍 HS Code: 3920791000

Description: Cellulose acetate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose or its chemical derivatives.

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.2%

- Note: This code applies to finished or semi-finished cellulose acetate films.

🔍 HS Code: 3920795000

Description: Cellulose acetate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose or its chemical derivatives.

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.7%

- Note: This code may apply to specific types of cellulose acetate films, possibly with different specifications or uses.

🔍 HS Code: 3920730000

Description: Cellulose acetate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose acetate.

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.9%

- Note: This code is specific to cellulose acetate, not other cellulose derivatives.

🔍 HS Code: 3920791000 (Alternative Use)

Description: Cellulose propionate films classified as non-cellular plastics and un-reinforced plastic sheets, films, foils, and strips made from cellulose or its chemical derivatives.

- Base Tariff Rate: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.2%

- Note: This code may also apply to cellulose propionate films, which are a different chemical derivative of cellulose.

⚠️ Important Notes and Recommendations:

- Tariff Increase Alert: A special tariff of 30.0% will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact chemical composition (e.g., cellulose acetate vs. cellulose propionate) and finished product status to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Unit Price: Verify the unit price and product specifications to ensure compliance with customs valuation rules.

✅ Proactive Advice:

- Double-check the product's chemical structure and finished state to avoid misclassification.

- Consult with customs brokers or classification experts if the product is borderline between multiple HS codes.

- Keep updated records of product specifications and documentation to support customs declarations.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Customer Reviews

No reviews yet.