| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912900090 | Doc | 60.2% | CN | US | 2025-05-12 |

| 3912900090 | Doc | 60.2% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920791000 | Doc | 61.2% | CN | US | 2025-05-12 |

| 3920795000 | Doc | 58.7% | CN | US | 2025-05-12 |

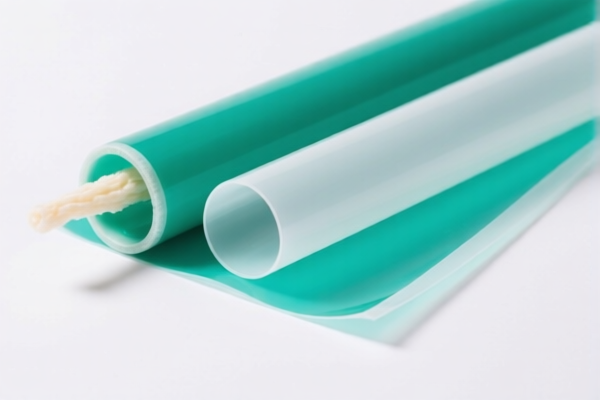

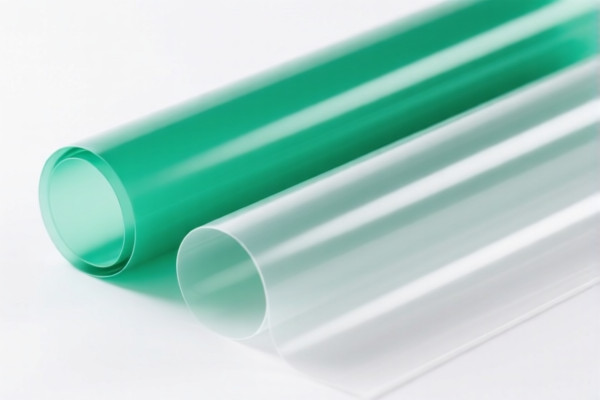

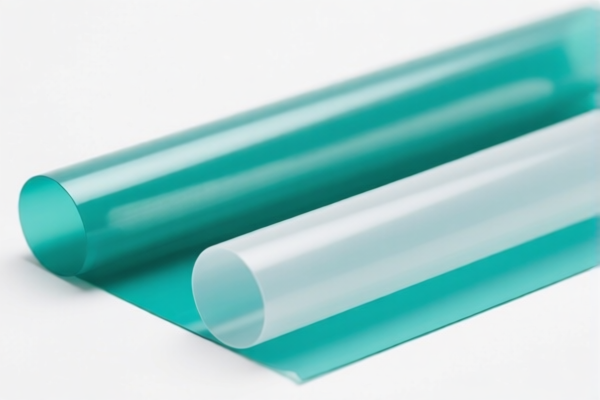

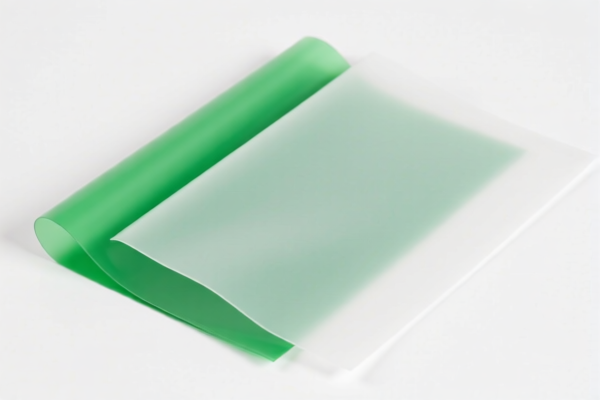

Product Name: Cellulose derivative films

Classification HS Codes and Tax Details:

- HS CODE: 3912900090

- Description: Mixture of cellulose derivatives

- Description: Aqueous solution of cellulose derivatives

- Total Tax Rate: 60.2%

-

Breakdown:

- Base Tariff: 5.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920791000

- Description: Composite cellulose ester film

- Description: Cellulose ester film

- Total Tax Rate: 61.2%

-

Breakdown:

- Base Tariff: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920795000

- Description: Cellulose ester film

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation. -

Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its chemical structure and form (e.g., film, solution, composite).

- Check Unit Price: Tariff rates may vary depending on the declared value and classification.

- Certifications Required: Confirm if any certifications (e.g., REACH, RoHS, or import permits) are needed for the product type and destination country.

-

Consult a Customs Broker: For complex or high-value shipments, professional assistance is recommended to avoid delays or penalties. Product Name: Cellulose derivative films

Classification HS Codes and Tax Details: -

HS CODE: 3912900090

- Description: Mixture of cellulose derivatives

- Description: Aqueous solution of cellulose derivatives

- Total Tax Rate: 60.2%

-

Breakdown:

- Base Tariff: 5.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920791000

- Description: Composite cellulose ester film

- Description: Cellulose ester film

- Total Tax Rate: 61.2%

-

Breakdown:

- Base Tariff: 6.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920795000

- Description: Cellulose ester film

- Total Tax Rate: 58.7%

- Breakdown:

- Base Tariff: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. However, always verify with the latest customs announcements or consult a customs broker for confirmation. -

Proactive Advice:

- Verify Material Composition: Ensure the product is correctly classified based on its chemical structure and form (e.g., film, solution, composite).

- Check Unit Price: Tariff rates may vary depending on the declared value and classification.

- Certifications Required: Confirm if any certifications (e.g., REACH, RoHS, or import permits) are needed for the product type and destination country.

- Consult a Customs Broker: For complex or high-value shipments, professional assistance is recommended to avoid delays or penalties.

Customer Reviews

No reviews yet.