| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3912120000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 3916905000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3912900090 | Doc | 60.2% | CN | US | 2025-05-12 |

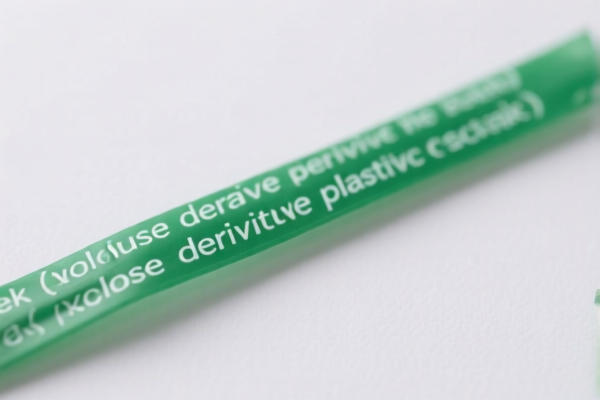

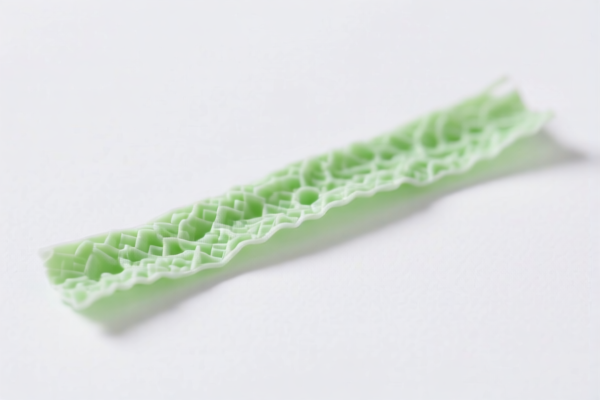

Here is the classification and tariff information for "Cellulose derivative plastic strip" based on the provided HS codes and tax details:

✅ HS CODE: 3912120000

Product Description: Cellulose derivative plastic strip (e.g., acetate)

Total Tax Rate: 60.6%

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for acetate-based cellulose derivatives.

✅ HS CODE: 3916905000

Product Description: Polystyrene fiber strip (not acetate-based)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polystyrene fiber strips, not cellulose derivatives.

✅ HS CODE: 3920690000

Product Description: Polyester plastic strip (general category)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general polyester category, not specifically for cellulose derivatives.

✅ HS CODE: 3920632000

Product Description: Polyester plastic strip (specific category)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific polyester category, not cellulose-based.

✅ HS CODE: 3912900090

Product Description: Mixture of cellulose derivatives

Total Tax Rate: 60.2%

- Base Tariff Rate: 5.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for mixed cellulose derivatives, not a single type like acetate.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the plastic strip (e.g., acetate, polyester, or mixed cellulose derivatives) to ensure correct HS code classification.

- Certifications: Check if any customs certifications or origin documentation are required for your product.

- Unit Price: Be aware that tariff rates are based on the declared value, so ensure the unit price is accurately reported.

If you have more details about the material composition or intended use, I can help further refine the classification and tax implications. Here is the classification and tariff information for "Cellulose derivative plastic strip" based on the provided HS codes and tax details:

✅ HS CODE: 3912120000

Product Description: Cellulose derivative plastic strip (e.g., acetate)

Total Tax Rate: 60.6%

- Base Tariff Rate: 5.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for acetate-based cellulose derivatives.

✅ HS CODE: 3916905000

Product Description: Polystyrene fiber strip (not acetate-based)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for polystyrene fiber strips, not cellulose derivatives.

✅ HS CODE: 3920690000

Product Description: Polyester plastic strip (general category)

Total Tax Rate: 59.2%

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general polyester category, not specifically for cellulose derivatives.

✅ HS CODE: 3920632000

Product Description: Polyester plastic strip (specific category)

Total Tax Rate: 60.8%

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a more specific polyester category, not cellulose-based.

✅ HS CODE: 3912900090

Product Description: Mixture of cellulose derivatives

Total Tax Rate: 60.2%

- Base Tariff Rate: 5.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for mixed cellulose derivatives, not a single type like acetate.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the plastic strip (e.g., acetate, polyester, or mixed cellulose derivatives) to ensure correct HS code classification.

- Certifications: Check if any customs certifications or origin documentation are required for your product.

- Unit Price: Be aware that tariff rates are based on the declared value, so ensure the unit price is accurately reported.

If you have more details about the material composition or intended use, I can help further refine the classification and tax implications.

Customer Reviews

No reviews yet.