| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3913901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3913902090 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3913905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3913901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3913901000 | Doc | 55.0% | CN | US | 2025-05-12 |

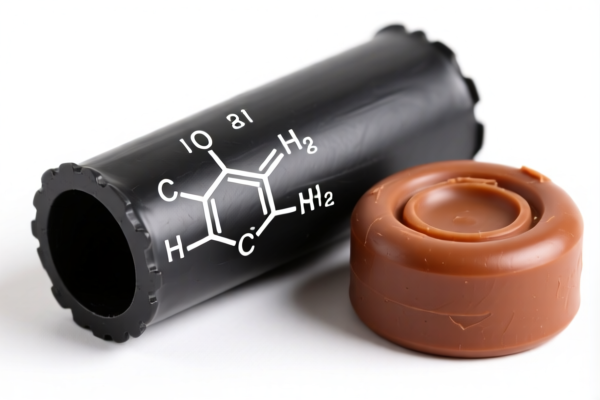

Product Classification: Chemical Derivatives of Natural Rubber

HS CODE: 3913901000, 3913902090, 3913905000

🔍 Classification Overview

- HS CODE 3913901000: Chemical derivatives of natural rubber

- HS CODE 3913902090: Natural polymers and their modified derivatives not elsewhere specified

- HS CODE 3913905000: Modified natural polymers

These codes are used to classify chemical derivatives and modified forms of natural rubber, which are commonly used in industrial and consumer products such as tires, adhesives, and coatings.

📊 Tariff Summary (as of now)

HS CODE 3913901000 – Chemical derivatives of natural rubber

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

HS CODE 3913902090 – Natural polymers and modified derivatives not elsewhere specified

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

HS CODE 3913905000 – Modified natural polymers

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all three HS codes after this date.

- Anti-dumping duties: Not currently applicable for these product categories.

- Importers should be aware that the total tax rate will increase significantly after April 11, 2025.

📌 Proactive Advice for Importers

- Verify the exact product description and chemical composition to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs.

- Confirm required certifications (e.g., REACH, RoHS, or other local compliance standards) to avoid delays in customs clearance.

- Consider adjusting procurement timelines if importing after April 11, 2025, to account for the higher tax burden.

- Consult with customs brokers or legal advisors to ensure full compliance with evolving regulations.

Let me know if you need help with HS code verification or customs documentation for your specific product.

Product Classification: Chemical Derivatives of Natural Rubber

HS CODE: 3913901000, 3913902090, 3913905000

🔍 Classification Overview

- HS CODE 3913901000: Chemical derivatives of natural rubber

- HS CODE 3913902090: Natural polymers and their modified derivatives not elsewhere specified

- HS CODE 3913905000: Modified natural polymers

These codes are used to classify chemical derivatives and modified forms of natural rubber, which are commonly used in industrial and consumer products such as tires, adhesives, and coatings.

📊 Tariff Summary (as of now)

HS CODE 3913901000 – Chemical derivatives of natural rubber

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

HS CODE 3913902090 – Natural polymers and modified derivatives not elsewhere specified

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

HS CODE 3913905000 – Modified natural polymers

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

⏰ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all three HS codes after this date.

- Anti-dumping duties: Not currently applicable for these product categories.

- Importers should be aware that the total tax rate will increase significantly after April 11, 2025.

📌 Proactive Advice for Importers

- Verify the exact product description and chemical composition to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs.

- Confirm required certifications (e.g., REACH, RoHS, or other local compliance standards) to avoid delays in customs clearance.

- Consider adjusting procurement timelines if importing after April 11, 2025, to account for the higher tax burden.

- Consult with customs brokers or legal advisors to ensure full compliance with evolving regulations.

Let me know if you need help with HS code verification or customs documentation for your specific product.

Customer Reviews

No reviews yet.