Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Name: Chlorinated Rubber Powder

HS CODE: 3911907000

🔍 Classification Summary:

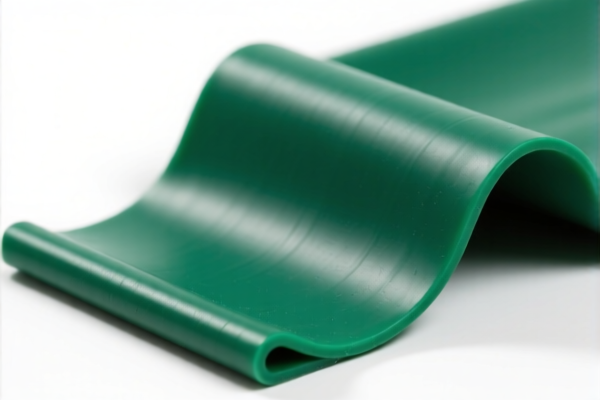

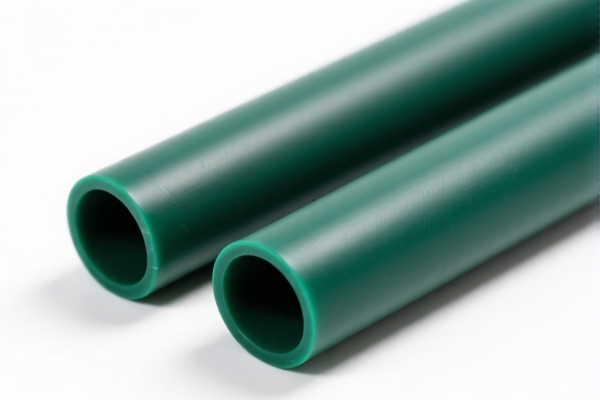

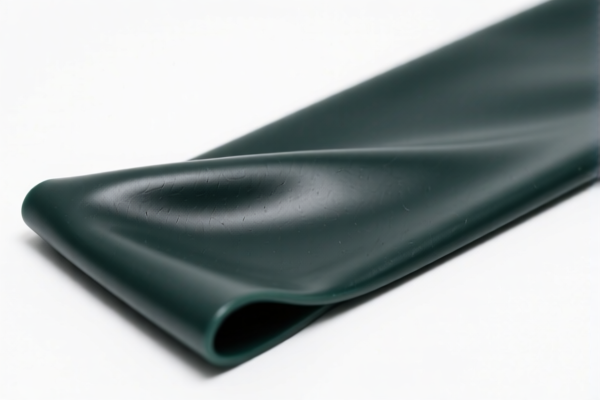

- The product "Chlorinated Rubber Powder" is classified under HS CODE 3911907000, which corresponds to chlorinated synthetic rubber in primary form.

- This classification applies to various forms of chlorinated rubber, including powder, granules, and sheet-like raw materials.

📊 Tariff Overview:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the existing 25.0% general additional tariff.

- This means that after April 11, 2025, the total tariff will increase to 55.0%.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in its primary form (not processed or compounded) to maintain correct classification under HS CODE 3911907000.

- Check Unit Price and Packaging: Tariff calculations may depend on the unit price and packaging method, especially if the product is classified differently based on form.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., Material Safety Data Sheet, product composition analysis) are required for customs clearance.

- Monitor Policy Updates: Stay informed about tariff changes and trade policy updates, especially around the April 11, 2025 deadline.

📌 Additional Notes:

- No Anti-Dumping Duties Listed: As of now, there are no specific anti-dumping duties reported for this product.

- No Special Tariffs on Iron/Aluminum: This product is not related to iron or aluminum, so no additional duties apply in that context.

If you have further details about the product (e.g., exact composition, end-use, or country of origin), I can provide more tailored guidance.

Product Name: Chlorinated Rubber Powder

HS CODE: 3911907000

🔍 Classification Summary:

- The product "Chlorinated Rubber Powder" is classified under HS CODE 3911907000, which corresponds to chlorinated synthetic rubber in primary form.

- This classification applies to various forms of chlorinated rubber, including powder, granules, and sheet-like raw materials.

📊 Tariff Overview:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the existing 25.0% general additional tariff.

- This means that after April 11, 2025, the total tariff will increase to 55.0%.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in its primary form (not processed or compounded) to maintain correct classification under HS CODE 3911907000.

- Check Unit Price and Packaging: Tariff calculations may depend on the unit price and packaging method, especially if the product is classified differently based on form.

- Certifications Required: Confirm if any customs documentation or certifications (e.g., Material Safety Data Sheet, product composition analysis) are required for customs clearance.

- Monitor Policy Updates: Stay informed about tariff changes and trade policy updates, especially around the April 11, 2025 deadline.

📌 Additional Notes:

- No Anti-Dumping Duties Listed: As of now, there are no specific anti-dumping duties reported for this product.

- No Special Tariffs on Iron/Aluminum: This product is not related to iron or aluminum, so no additional duties apply in that context.

If you have further details about the product (e.g., exact composition, end-use, or country of origin), I can provide more tailored guidance.

Customer Reviews

No reviews yet.