Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

- Product Name: Chlorinated Rubber Resin

- HS CODE: 3911907000

- Classification Summary: Chlorinated synthetic rubber (including chlorinated nitrile rubber)

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the existing 25.0% general additional tariff. This is a time-sensitive policy and will significantly increase the total tax burden.

- No Anti-dumping duties currently reported for this product category.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this product is a chemical resin.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed classified under HS CODE 3911907000 and not misclassified under other codes such as 3904905000 (chlorinated polyethylene resin) or 4008210000 (chlorinated rubber sheets).

- Check Unit Price and Certification: Confirm the unit price and whether any specific certifications (e.g., REACH, RoHS) are required for import.

- Plan for Tariff Increase: If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is a blend or modified version of chlorinated rubber.

📊 Comparison with Similar Products:

| HS CODE | Product Name | Total Tax Rate | Notes |

|---|---|---|---|

| 3911907000 | Chlorinated synthetic rubber | 55.0% | Includes chlorinated nitrile rubber |

| 3904905000 | Chlorinated polyethylene resin | 61.5% | Higher tax due to 6.5% base rate |

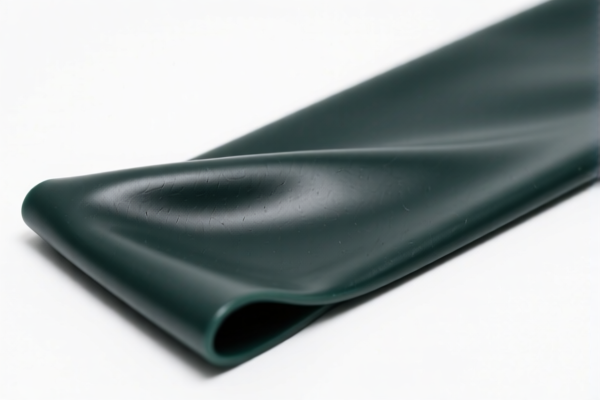

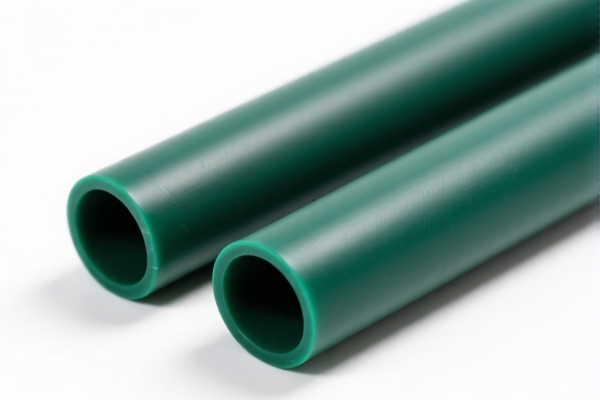

| 4008210000 | Chlorinated rubber sheets | 55.0% | Similar to 3911907000 but as sheets |

Let me know if you need help with customs documentation or classification clarification.

- Product Name: Chlorinated Rubber Resin

- HS CODE: 3911907000

- Classification Summary: Chlorinated synthetic rubber (including chlorinated nitrile rubber)

🔍 Tariff Overview (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied on top of the existing 25.0% general additional tariff. This is a time-sensitive policy and will significantly increase the total tax burden.

- No Anti-dumping duties currently reported for this product category.

- No specific anti-dumping duties on iron or aluminum are applicable here, as this product is a chemical resin.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed classified under HS CODE 3911907000 and not misclassified under other codes such as 3904905000 (chlorinated polyethylene resin) or 4008210000 (chlorinated rubber sheets).

- Check Unit Price and Certification: Confirm the unit price and whether any specific certifications (e.g., REACH, RoHS) are required for import.

- Plan for Tariff Increase: If importing after April 11, 2025, budget for the 30.0% additional tariff to avoid unexpected costs.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is a blend or modified version of chlorinated rubber.

📊 Comparison with Similar Products:

| HS CODE | Product Name | Total Tax Rate | Notes |

|---|---|---|---|

| 3911907000 | Chlorinated synthetic rubber | 55.0% | Includes chlorinated nitrile rubber |

| 3904905000 | Chlorinated polyethylene resin | 61.5% | Higher tax due to 6.5% base rate |

| 4008210000 | Chlorinated rubber sheets | 55.0% | Similar to 3911907000 but as sheets |

Let me know if you need help with customs documentation or classification clarification.

Customer Reviews

No reviews yet.