Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911907000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3824821000 | Doc | 61.5% | CN | US | 2025-05-12 |

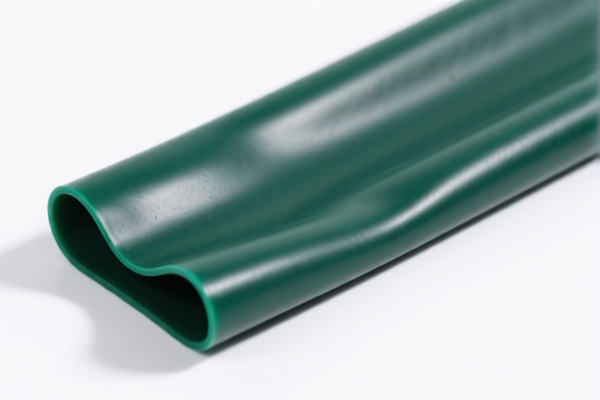

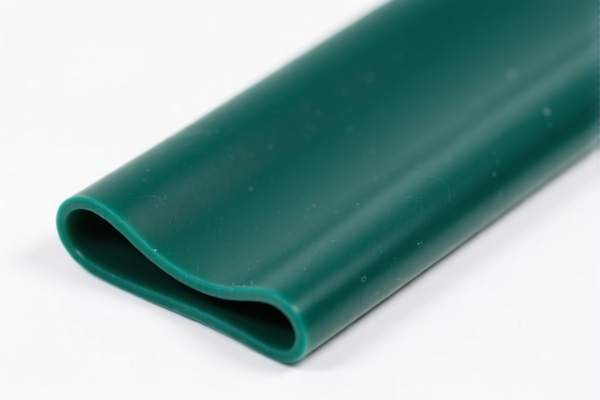

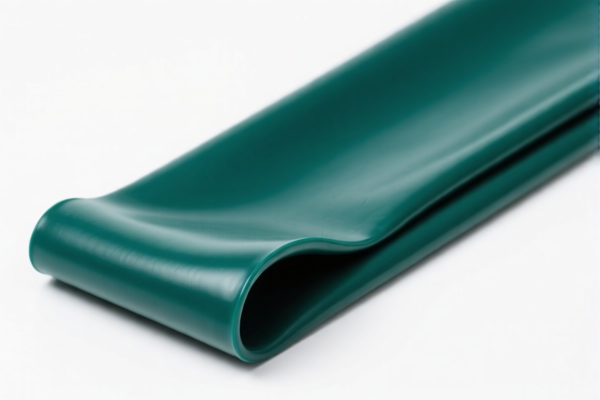

Product Name: Chlorinated Rubber Sheet

Classification Analysis and Tax Information:

- HS CODE: 3911907000

- Description: Chlorinated synthetic rubber sheets, chlorinated synthetic rubber sheet raw materials, chlorinated synthetic rubber gaskets, chlorinated synthetic rubber granules, and chlorinated synthetic rubber base sheets are classified under this code. It represents the primary form of chlorinated synthetic rubber.

-

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4008210000

- Description: Chlorinated rubber sheets are classified under this code, which covers vulcanized rubber sheets, plates, and strips.

-

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3824821000

- Description: Chlorinated rubber adhesive is classified under this code, which includes adhesives used in the preparation of casting molds or cores, and chemical products and preparations used in chemical industries or related industries.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: A special additional tariff of 30.0% will be applied to all three classifications. This is a time-sensitive policy and should be considered in cost planning.

- Anti-Dumping Duties: No specific anti-dumping duties for iron or aluminum are mentioned in the current data, but it is advisable to check for any recent updates or specific product-related duties.

- Material Verification: Confirm the exact composition and form of the product (e.g., whether it is a sheet, adhesive, or raw material) to ensure correct classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or customs compliance documents) are required for import into the target market.

- Unit Price and Packaging: Ensure that the unit price and packaging method are consistent with the declared HS code to avoid classification disputes.

If you have more details about the product (e.g., specific use, composition, or country of origin), I can provide more tailored guidance.

Product Name: Chlorinated Rubber Sheet

Classification Analysis and Tax Information:

- HS CODE: 3911907000

- Description: Chlorinated synthetic rubber sheets, chlorinated synthetic rubber sheet raw materials, chlorinated synthetic rubber gaskets, chlorinated synthetic rubber granules, and chlorinated synthetic rubber base sheets are classified under this code. It represents the primary form of chlorinated synthetic rubber.

-

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4008210000

- Description: Chlorinated rubber sheets are classified under this code, which covers vulcanized rubber sheets, plates, and strips.

-

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3824821000

- Description: Chlorinated rubber adhesive is classified under this code, which includes adhesives used in the preparation of casting molds or cores, and chemical products and preparations used in chemical industries or related industries.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes and Recommendations:

- Tariff Changes After April 11, 2025: A special additional tariff of 30.0% will be applied to all three classifications. This is a time-sensitive policy and should be considered in cost planning.

- Anti-Dumping Duties: No specific anti-dumping duties for iron or aluminum are mentioned in the current data, but it is advisable to check for any recent updates or specific product-related duties.

- Material Verification: Confirm the exact composition and form of the product (e.g., whether it is a sheet, adhesive, or raw material) to ensure correct classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or customs compliance documents) are required for import into the target market.

- Unit Price and Packaging: Ensure that the unit price and packaging method are consistent with the declared HS code to avoid classification disputes.

If you have more details about the product (e.g., specific use, composition, or country of origin), I can provide more tailored guidance.

Customer Reviews

No reviews yet.