| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4810135000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810291035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810131140 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810991060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4810921235 | Doc | 55.0% | CN | US | 2025-05-12 |

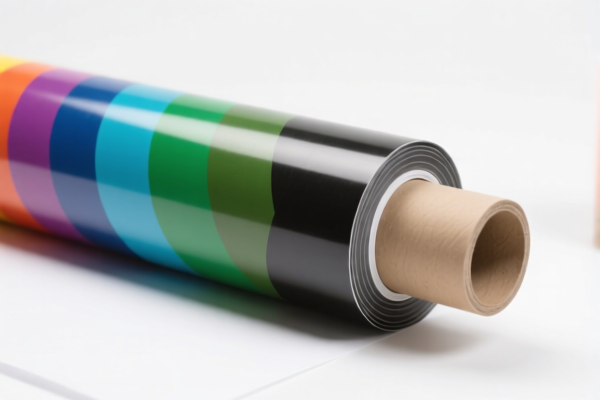

Product Classification: Coated Paper Roll for Graphic Arts

HS CODEs and Tax Information Overview:

- HS CODE: 4810135000

- Description: Paper and paperboard coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes, in rolls and processed by printing, embossing, or perforating.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810291035

- Description: Paper and paperboard coated with kaolin or other inorganic substances, typically for writing, printing, or other graphic purposes. The terms "coated" and "paper roll" match the HS definition.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810131140

- Description: Coated paper and paperboard rolls with kaolin or other inorganic substances, for writing, printing, or other graphic purposes, and without fibers obtained by mechanical or chemically mechanical methods, or with total fiber content not exceeding 10% of such fibers.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810991060

- Description: Rolls of paper coated with kaolin (Chinese clay) or other inorganic substances, in roll form.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810921235

- Description: Rolls of paper coated with kaolin or other inorganic substances, and "art coating" can be interpreted as surface coloring or decoration.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- After April 11, 2025, an additional 30.0% tariff will be applied on top of the 25.0% additional tariff. This will bring the total tax rate to 55.0% for all listed HS codes.

-

Plan accordingly for increased import costs if your product will be imported after this date.

-

Material Verification:

-

Confirm the exact composition of the paper (e.g., fiber content, coating type, and whether it contains mechanical or chemical fibers). This will determine the correct HS code and avoid misclassification.

-

Certifications and Documentation:

-

Ensure all certifications (e.g., environmental, safety, or quality standards) are in place, as customs may require documentation to confirm compliance with import regulations.

-

Unit Price and Packaging:

-

Verify the unit price and packaging details, as these may affect the classification and duty calculation.

-

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for this product category in the provided data. However, always check the latest anti-dumping duty lists for any applicable measures.

✅ Proactive Advice:

- Double-check the product description against the HS code definitions to ensure accurate classification.

- Consult a customs broker or expert if the product has unique features (e.g., special coatings, mixed materials).

-

Monitor policy updates after April 11, 2025, as the special tariff may be adjusted or extended. Product Classification: Coated Paper Roll for Graphic Arts

HS CODEs and Tax Information Overview: -

HS CODE: 4810135000

- Description: Paper and paperboard coated with kaolin or other inorganic substances, for writing, printing, or other graphic purposes, in rolls and processed by printing, embossing, or perforating.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810291035

- Description: Paper and paperboard coated with kaolin or other inorganic substances, typically for writing, printing, or other graphic purposes. The terms "coated" and "paper roll" match the HS definition.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810131140

- Description: Coated paper and paperboard rolls with kaolin or other inorganic substances, for writing, printing, or other graphic purposes, and without fibers obtained by mechanical or chemically mechanical methods, or with total fiber content not exceeding 10% of such fibers.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810991060

- Description: Rolls of paper coated with kaolin (Chinese clay) or other inorganic substances, in roll form.

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4810921235

- Description: Rolls of paper coated with kaolin or other inorganic substances, and "art coating" can be interpreted as surface coloring or decoration.

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Increase Alert:

- After April 11, 2025, an additional 30.0% tariff will be applied on top of the 25.0% additional tariff. This will bring the total tax rate to 55.0% for all listed HS codes.

-

Plan accordingly for increased import costs if your product will be imported after this date.

-

Material Verification:

-

Confirm the exact composition of the paper (e.g., fiber content, coating type, and whether it contains mechanical or chemical fibers). This will determine the correct HS code and avoid misclassification.

-

Certifications and Documentation:

-

Ensure all certifications (e.g., environmental, safety, or quality standards) are in place, as customs may require documentation to confirm compliance with import regulations.

-

Unit Price and Packaging:

-

Verify the unit price and packaging details, as these may affect the classification and duty calculation.

-

Anti-Dumping Duties:

- No specific anti-dumping duties are mentioned for this product category in the provided data. However, always check the latest anti-dumping duty lists for any applicable measures.

✅ Proactive Advice:

- Double-check the product description against the HS code definitions to ensure accurate classification.

- Consult a customs broker or expert if the product has unique features (e.g., special coatings, mixed materials).

- Monitor policy updates after April 11, 2025, as the special tariff may be adjusted or extended.

Customer Reviews

No reviews yet.