| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5407432030 | Doc | 63.5% | CN | US | 2025-05-12 |

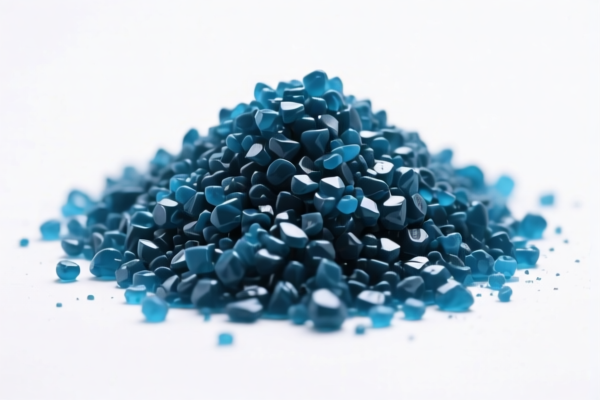

Product Name: Colored Polyamide Raw Material

Classification HS Code: 5407432030 (for colored polyamide woven fabric)

Note: If the product is in the form of raw material (e.g., pellets, powder, or sheets), it may fall under 3908902000 or 3908907000, depending on the specific form and usage. Please confirm the exact product form before classification.

🔍 HS Code Classification Overview

- HS Code 3908902000

- Product Type: Polyamide raw materials in primary form (e.g., pellets, powders, high-performance polyamide, polyamide alloys, etc.)

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Applicable for: General polyamide raw materials in primary form.

-

HS Code 3908907000

- Product Type: Other polyamide raw materials in primary form (e.g., tubes, sheets)

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Applicable for: Polyamide in non-pellet form (e.g., sheets, tubes).

-

HS Code 5407432030

- Product Type: Colored polyamide woven fabric (e.g., made from different colored yarns)

- Total Tax Rate: 63.5%

- Tax Breakdown:

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Finished woven fabric, not raw material.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all three HS codes after April 11, 2025.

-

This is a time-sensitive policy—ensure your import timeline aligns with this date.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for polyamide products in the provided data.

-

However, always verify with customs or a compliance expert for the latest anti-dumping or countervailing duty updates.

-

Certifications Required:

- Confirm if customs documentation, material specifications, or certifications (e.g., REACH, RoHS, or product compliance certificates) are required for import.

✅ Proactive Advice for Importers

- Verify the exact product form (pellets, sheets, fabric, etc.) to ensure correct HS code classification.

- Check the unit price and material composition to determine if any additional duties apply.

- Review the April 11, 2025 deadline and plan your import schedule accordingly.

- Consult with customs brokers or compliance experts for real-time updates on tariffs and documentation.

Let me know if you need help with HS code verification or customs documentation.

Product Name: Colored Polyamide Raw Material

Classification HS Code: 5407432030 (for colored polyamide woven fabric)

Note: If the product is in the form of raw material (e.g., pellets, powder, or sheets), it may fall under 3908902000 or 3908907000, depending on the specific form and usage. Please confirm the exact product form before classification.

🔍 HS Code Classification Overview

- HS Code 3908902000

- Product Type: Polyamide raw materials in primary form (e.g., pellets, powders, high-performance polyamide, polyamide alloys, etc.)

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Applicable for: General polyamide raw materials in primary form.

-

HS Code 3908907000

- Product Type: Other polyamide raw materials in primary form (e.g., tubes, sheets)

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Applicable for: Polyamide in non-pellet form (e.g., sheets, tubes).

-

HS Code 5407432030

- Product Type: Colored polyamide woven fabric (e.g., made from different colored yarns)

- Total Tax Rate: 63.5%

- Tax Breakdown:

- Base Tariff: 8.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable for: Finished woven fabric, not raw material.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all three HS codes after April 11, 2025.

-

This is a time-sensitive policy—ensure your import timeline aligns with this date.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for polyamide products in the provided data.

-

However, always verify with customs or a compliance expert for the latest anti-dumping or countervailing duty updates.

-

Certifications Required:

- Confirm if customs documentation, material specifications, or certifications (e.g., REACH, RoHS, or product compliance certificates) are required for import.

✅ Proactive Advice for Importers

- Verify the exact product form (pellets, sheets, fabric, etc.) to ensure correct HS code classification.

- Check the unit price and material composition to determine if any additional duties apply.

- Review the April 11, 2025 deadline and plan your import schedule accordingly.

- Consult with customs brokers or compliance experts for real-time updates on tariffs and documentation.

Let me know if you need help with HS code verification or customs documentation.

Customer Reviews

No reviews yet.