| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516320520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5408310510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5407910520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516330520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516330520 | Doc | 80.0% | CN | US | 2025-05-12 |

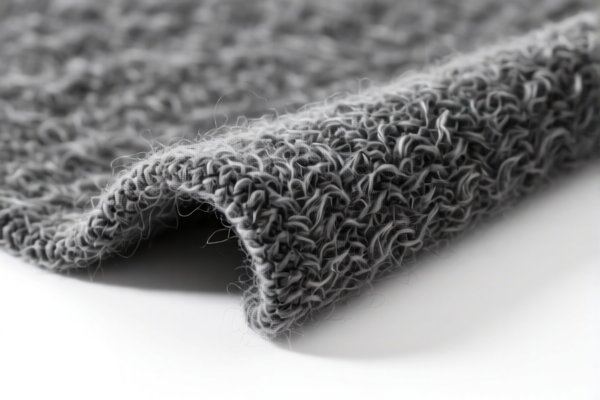

Product Name: Combed Wool Blended Antibacterial Fabric

Classification HS Codes and Tax Details:

- HS CODE: 5516.32.05.20

- Description: Wool blended combed fabric (antibacterial)

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5408.31.05.10

- Description: Wool blended antibacterial fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5407.91.05.20

- Description: Combed wool blended antibacterial treated fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5516.33.05.20

- Description: Combed wool blended fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5516.33.05.20 (Duplicate)

- Description: Wool blended combed fabric

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025, increasing the total tax rate from 80.0% to 110.0% (25% base + 25% additional + 30% special). -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. -

Certifications Required:

Verify if antibacterial treatment requires specific certifications (e.g., ISO, OEKO-TEX, etc.) for import compliance. -

Material Verification:

Confirm the exact composition of the fabric (e.g., wool percentage, type of antibacterial treatment) to ensure correct HS code classification. -

Unit Price Check:

Ensure the unit price is consistent with the declared HS code and tariff category to avoid customs disputes.

✅ Proactive Advice:

- Double-check the fabric composition and treatment process to ensure the correct HS code is used.

- Keep documentation on the antibacterial treatment and any certifications.

- Monitor the April 11, 2025 deadline to avoid unexpected tax increases.

-

Consult a customs broker for final confirmation, especially if the product is being imported in large quantities. Product Name: Combed Wool Blended Antibacterial Fabric

Classification HS Codes and Tax Details: -

HS CODE: 5516.32.05.20

- Description: Wool blended combed fabric (antibacterial)

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5408.31.05.10

- Description: Wool blended antibacterial fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5407.91.05.20

- Description: Combed wool blended antibacterial treated fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5516.33.05.20

- Description: Combed wool blended fabric

- Total Tax Rate: 80.0%

-

Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE: 5516.33.05.20 (Duplicate)

- Description: Wool blended combed fabric

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025, increasing the total tax rate from 80.0% to 110.0% (25% base + 25% additional + 30% special). -

Anti-dumping duties:

No specific anti-dumping duties are mentioned for this product category in the provided data. -

Certifications Required:

Verify if antibacterial treatment requires specific certifications (e.g., ISO, OEKO-TEX, etc.) for import compliance. -

Material Verification:

Confirm the exact composition of the fabric (e.g., wool percentage, type of antibacterial treatment) to ensure correct HS code classification. -

Unit Price Check:

Ensure the unit price is consistent with the declared HS code and tariff category to avoid customs disputes.

✅ Proactive Advice:

- Double-check the fabric composition and treatment process to ensure the correct HS code is used.

- Keep documentation on the antibacterial treatment and any certifications.

- Monitor the April 11, 2025 deadline to avoid unexpected tax increases.

- Consult a customs broker for final confirmation, especially if the product is being imported in large quantities.

Customer Reviews

No reviews yet.