| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112116030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111909000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112302000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

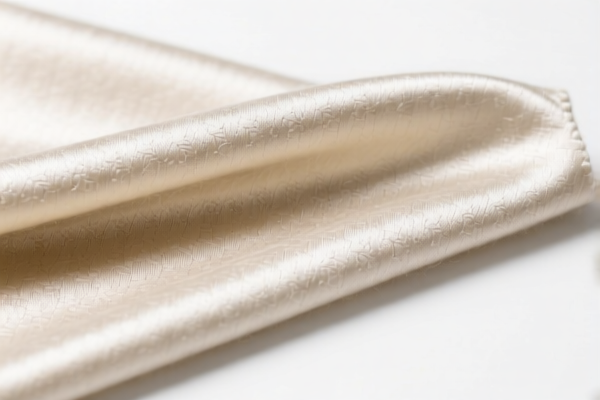

Product Name: Combed Wool Blended Satin Weave Fabric

Classification Analysis and Tax Information:

✅ HS CODE: 5112303000

Description: Mixed combed wool satin weave fabric, blended with man-made short fibers.

Total Tax Rate: 80.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5112116030

Description: Combed wool satin weave fabric, made of wool.

Total Tax Rate: 80.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5111909000

Description: Combed wool satin weave fabric, woven fabric of carded wool or carded fine animal hair.

Total Tax Rate: 80.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5112302000

Description: Combed wool blended fabric, woven with man-made short fibers, suitable for tapestry fabric.

Total Tax Rate: 62.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (wool and wool blends).

- Material Verification: Confirm the exact composition of the fabric (e.g., percentage of wool vs. man-made fibers) to ensure correct HS code classification.

- Certifications: Check if any import certifications (e.g., textile origin, environmental compliance) are required for the destination market.

📌 Proactive Advice:

- Verify the fabric composition (e.g., wool percentage, type of man-made fiber) to ensure accurate HS code selection.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs or a classification expert if the fabric is used in a specific application (e.g., apparel, home textiles) that may affect classification.

Let me know if you need help with a specific HS code or tariff calculation.

Product Name: Combed Wool Blended Satin Weave Fabric

Classification Analysis and Tax Information:

✅ HS CODE: 5112303000

Description: Mixed combed wool satin weave fabric, blended with man-made short fibers.

Total Tax Rate: 80.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5112116030

Description: Combed wool satin weave fabric, made of wool.

Total Tax Rate: 80.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5111909000

Description: Combed wool satin weave fabric, woven fabric of carded wool or carded fine animal hair.

Total Tax Rate: 80.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 5112302000

Description: Combed wool blended fabric, woven with man-made short fibers, suitable for tapestry fabric.

Total Tax Rate: 62.0%

Breakdown of Tax Rates:

- Base Tariff Rate: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not applicable for this product category (wool and wool blends).

- Material Verification: Confirm the exact composition of the fabric (e.g., percentage of wool vs. man-made fibers) to ensure correct HS code classification.

- Certifications: Check if any import certifications (e.g., textile origin, environmental compliance) are required for the destination market.

📌 Proactive Advice:

- Verify the fabric composition (e.g., wool percentage, type of man-made fiber) to ensure accurate HS code selection.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs or a classification expert if the fabric is used in a specific application (e.g., apparel, home textiles) that may affect classification.

Let me know if you need help with a specific HS code or tariff calculation.

Customer Reviews

No reviews yet.