| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111201000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5210492000 | Doc | 65.0% | CN | US | 2025-05-12 |

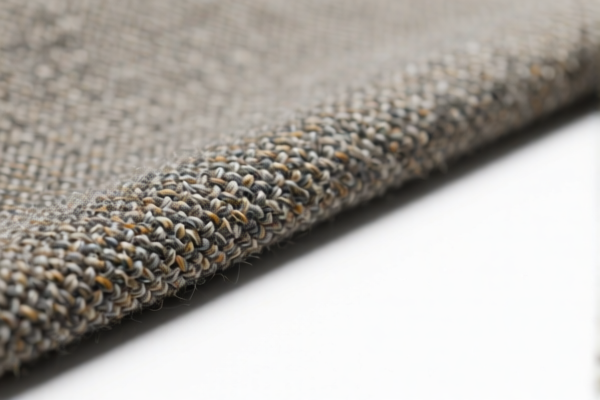

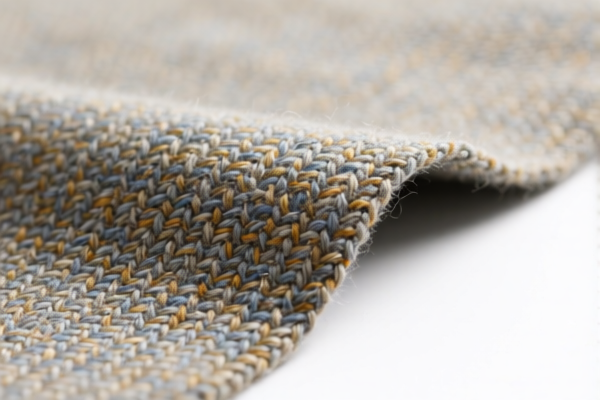

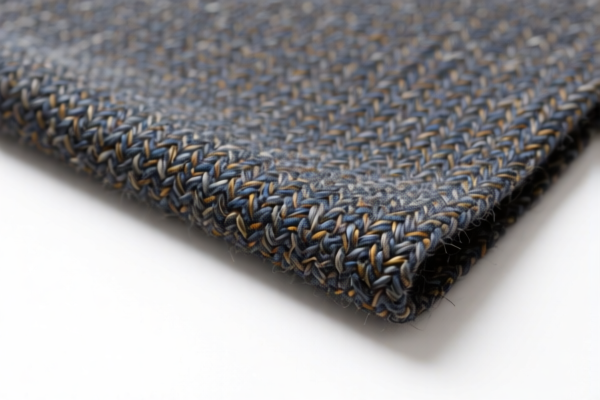

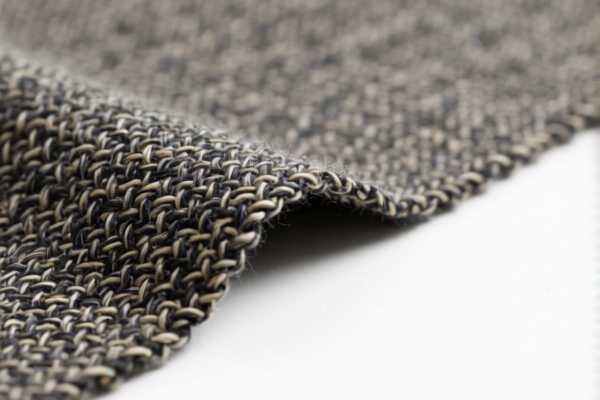

Product Name: Combed Wool Blended Twill Weave Fabric

Classification HS Code: 5112303000, 5112909010, 5111201000, 5210492000 (depending on specific composition and finish)

🔍 HS Code Classification Overview

Below is a structured breakdown of the HS codes and associated tariffs for the Combed Wool Blended Twill Weave Fabric:

✅ HS Code: 5112303000

Description: Mixed combed wool twill weave fabric

Total Tax Rate: 80.0%

Tariff Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to mixed combed wool twill weave fabric, including dyed or colored versions.

✅ HS Code: 5112909010

Description: Combed wool and cotton twill weave fabric

Total Tax Rate: 80.0%

Tariff Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to combed wool and cotton twill weave fabric.

✅ HS Code: 5111201000

Description: Combed wool blended twill weave fabric

Total Tax Rate: 62.0%

Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to combed wool blended twill weave fabric, typically with a higher wool content.

✅ HS Code: 5210492000

Description: Mixed twill weave fabric (not wool)

Total Tax Rate: 65.0%

Tariff Breakdown:

- Base Tariff: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to non-wool mixed twill weave fabric, such as cotton and polyester blends.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not applicable for wool or textile products in this category.

- Material Verification: Confirm the exact composition (e.g., wool percentage, fiber types, and finishing) to ensure correct HS code classification.

- Certifications: Check if any import certifications (e.g., textile labels, origin documentation) are required for compliance.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric is accurately described (e.g., wool percentage, blend type, and finishing).

- Check Unit Price: Tariff rates can vary based on the value per unit or weight, so confirm the valuation method.

- Review Documentation: Prepare commercial invoice, packing list, and certificate of origin to avoid delays at customs.

- Consult Tariff Updates: Stay informed about tariff changes and trade agreements that may affect your product.

Let me know if you need help determining the correct HS code based on your fabric’s specific composition or if you need assistance with customs documentation.

Product Name: Combed Wool Blended Twill Weave Fabric

Classification HS Code: 5112303000, 5112909010, 5111201000, 5210492000 (depending on specific composition and finish)

🔍 HS Code Classification Overview

Below is a structured breakdown of the HS codes and associated tariffs for the Combed Wool Blended Twill Weave Fabric:

✅ HS Code: 5112303000

Description: Mixed combed wool twill weave fabric

Total Tax Rate: 80.0%

Tariff Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to mixed combed wool twill weave fabric, including dyed or colored versions.

✅ HS Code: 5112909010

Description: Combed wool and cotton twill weave fabric

Total Tax Rate: 80.0%

Tariff Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to combed wool and cotton twill weave fabric.

✅ HS Code: 5111201000

Description: Combed wool blended twill weave fabric

Total Tax Rate: 62.0%

Tariff Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to combed wool blended twill weave fabric, typically with a higher wool content.

✅ HS Code: 5210492000

Description: Mixed twill weave fabric (not wool)

Total Tax Rate: 65.0%

Tariff Breakdown:

- Base Tariff: 10.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code applies to non-wool mixed twill weave fabric, such as cotton and polyester blends.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning.

- Anti-dumping duties: Not applicable for wool or textile products in this category.

- Material Verification: Confirm the exact composition (e.g., wool percentage, fiber types, and finishing) to ensure correct HS code classification.

- Certifications: Check if any import certifications (e.g., textile labels, origin documentation) are required for compliance.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric is accurately described (e.g., wool percentage, blend type, and finishing).

- Check Unit Price: Tariff rates can vary based on the value per unit or weight, so confirm the valuation method.

- Review Documentation: Prepare commercial invoice, packing list, and certificate of origin to avoid delays at customs.

- Consult Tariff Updates: Stay informed about tariff changes and trade agreements that may affect your product.

Let me know if you need help determining the correct HS code based on your fabric’s specific composition or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.