| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5407910520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516310520 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5408310510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5408311000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5407921020 | Doc | 67.0% | CN | US | 2025-05-12 |

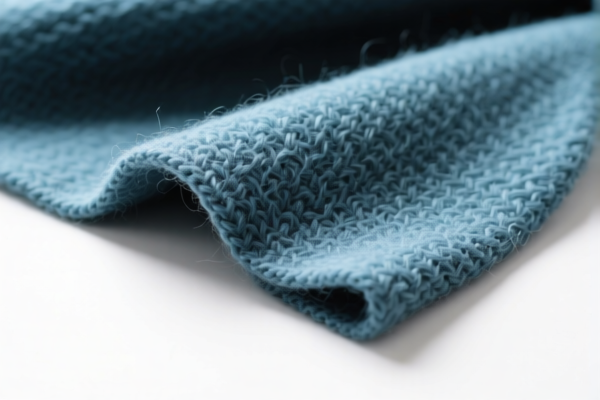

Product Name: Combed Wool Blended UV Protective Fabric

Classification Analysis:

Based on the product description and the provided HS codes, the most likely classification is:

✅ Recommended HS Code: 5407910520

Description:

Woven fabrics made of synthetic filament, mainly or solely blended with wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

🔍 Key Tax Rate Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Composition: The fabric must contain 36% or more wool or fine animal hair and be combed to qualify under this code.

- Certifications: Ensure the product meets any required textile certifications (e.g., UV protection standards, fiber content verification).

- Unit Price Verification: Confirm the material composition and unit price to ensure correct classification and avoid misdeclaration penalties.

📌 Alternative HS Codes Considered:

- 5516310520 – For synthetic short fiber woven fabrics with <85% synthetic fiber, but not combed.

- 5408310510 – For synthetic fiber woven fabrics blended with wool, not combed.

- 5408311000 – For woven fabrics blended with wool, not combed.

- 5407921020 – For dyed synthetic filament blended with wool, but not combed.

🛑 Proactive Advice:

- Verify the fabric’s composition (e.g., wool percentage, whether it is combed).

- Check the exact finishing process (e.g., dyed, bleached, or unbleached).

- Consult with a customs broker or textile classification expert if the product has multiple components or finishes.

- Update documentation before April 11, 2025, to avoid unexpected tariff increases.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Combed Wool Blended UV Protective Fabric

Classification Analysis:

Based on the product description and the provided HS codes, the most likely classification is:

✅ Recommended HS Code: 5407910520

Description:

Woven fabrics made of synthetic filament, mainly or solely blended with wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

🔍 Key Tax Rate Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Material Composition: The fabric must contain 36% or more wool or fine animal hair and be combed to qualify under this code.

- Certifications: Ensure the product meets any required textile certifications (e.g., UV protection standards, fiber content verification).

- Unit Price Verification: Confirm the material composition and unit price to ensure correct classification and avoid misdeclaration penalties.

📌 Alternative HS Codes Considered:

- 5516310520 – For synthetic short fiber woven fabrics with <85% synthetic fiber, but not combed.

- 5408310510 – For synthetic fiber woven fabrics blended with wool, not combed.

- 5408311000 – For woven fabrics blended with wool, not combed.

- 5407921020 – For dyed synthetic filament blended with wool, but not combed.

🛑 Proactive Advice:

- Verify the fabric’s composition (e.g., wool percentage, whether it is combed).

- Check the exact finishing process (e.g., dyed, bleached, or unbleached).

- Consult with a customs broker or textile classification expert if the product has multiple components or finishes.

- Update documentation before April 11, 2025, to avoid unexpected tariff increases.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.