Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516320520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5515991020 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5407910520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516310520 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5407910520 | Doc | 80.0% | CN | US | 2025-05-12 |

Here is the structured analysis and classification for the Combed Wool Blended Waterproof Fabric based on the provided HS codes and tax details:

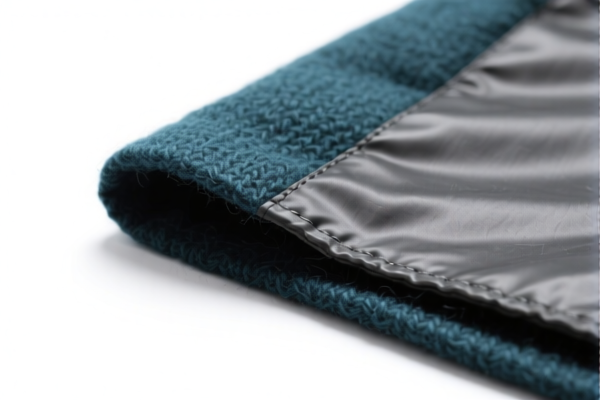

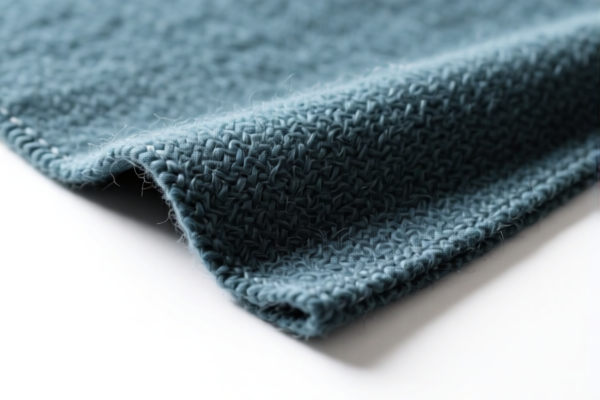

✅ Product Classification Overview: Combed Wool Blended Waterproof Fabric

🔍 HS CODE: 5516.32.05.20

- Description: Mixed wool combed fabric (waterproof)

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is one of the highest tax rates among the listed options.

🔍 HS CODE: 5515.99.10.20

- Description: Mixed combed wool waterproof fabric

- Total Tax Rate: 67.0%

- Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff compared to 5516.32.05.20, but still subject to the same additional and special tariffs.

🔍 HS CODE: 5407.91.05.20

- Description: Combed wool blended waterproof coated fabric

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to coated fabrics, which may be more specialized and thus subject to higher tariffs.

🔍 HS CODE: 5516.31.05.20

- Description: Combed wool blended fabric (for waterproof use)

- Total Tax Rate: 74.8%

- Breakdown:

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower total tax than 5516.32.05.20, but still high due to the special tariff.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase in total tax rate by 5% (from 25% to 30% in the special tariff).

- This is a time-sensitive policy, so importers must plan accordingly.

⚠️ Important Considerations:

- Material Verification: Confirm the exact composition of the fabric (e.g., wool percentage, type of coating, and whether it's woven or non-woven).

- Certifications: Check if any certifications (e.g., waterproofing standards, textile certifications) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or duty calculation.

- Customs Declaration: Ensure the HS code used matches the product description and technical specifications to avoid penalties.

📌 Proactive Advice:

- Double-check the fabric’s composition and finish (e.g., waterproof coating, blend ratio) to ensure correct HS code selection.

- Consult with customs brokers or tax consultants for the most up-to-date and accurate classification.

- Monitor the April 11, 2025 deadline to adjust import strategies and avoid unexpected cost increases.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured analysis and classification for the Combed Wool Blended Waterproof Fabric based on the provided HS codes and tax details:

✅ Product Classification Overview: Combed Wool Blended Waterproof Fabric

🔍 HS CODE: 5516.32.05.20

- Description: Mixed wool combed fabric (waterproof)

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is one of the highest tax rates among the listed options.

🔍 HS CODE: 5515.99.10.20

- Description: Mixed combed wool waterproof fabric

- Total Tax Rate: 67.0%

- Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff compared to 5516.32.05.20, but still subject to the same additional and special tariffs.

🔍 HS CODE: 5407.91.05.20

- Description: Combed wool blended waterproof coated fabric

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to coated fabrics, which may be more specialized and thus subject to higher tariffs.

🔍 HS CODE: 5516.31.05.20

- Description: Combed wool blended fabric (for waterproof use)

- Total Tax Rate: 74.8%

- Breakdown:

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower total tax than 5516.32.05.20, but still high due to the special tariff.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase in total tax rate by 5% (from 25% to 30% in the special tariff).

- This is a time-sensitive policy, so importers must plan accordingly.

⚠️ Important Considerations:

- Material Verification: Confirm the exact composition of the fabric (e.g., wool percentage, type of coating, and whether it's woven or non-woven).

- Certifications: Check if any certifications (e.g., waterproofing standards, textile certifications) are required for import.

- Unit Price: Verify the unit price and whether it affects the classification or duty calculation.

- Customs Declaration: Ensure the HS code used matches the product description and technical specifications to avoid penalties.

📌 Proactive Advice:

- Double-check the fabric’s composition and finish (e.g., waterproof coating, blend ratio) to ensure correct HS code selection.

- Consult with customs brokers or tax consultants for the most up-to-date and accurate classification.

- Monitor the April 11, 2025 deadline to adjust import strategies and avoid unexpected cost increases.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.