Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

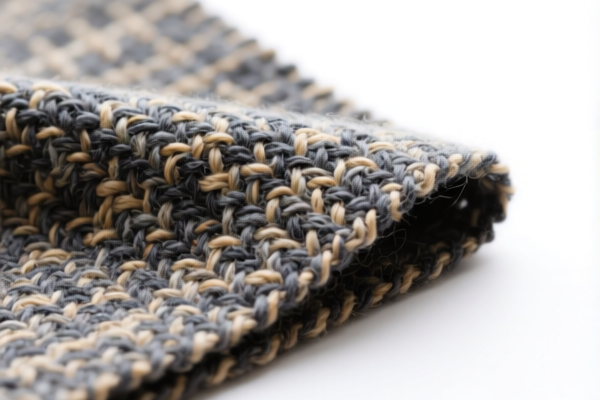

Product Name: Combed Wool Blended Woven Fabric for Apparel

HS CODE: 5112203000

🔍 Classification Summary:

- Product Type: Mixed combed wool woven fabric for apparel use

- HS Code: 5112203000 (10-digit code)

- Tariff Summary: 80.0% total tax rate

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This additional tariff applies after April 11, 2025, and may significantly increase the total import cost.

⚠️ Important Policy Alerts:

- April 11 Special Tariff:

- A 30.0% additional tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered in your import planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product (wool blended fabric).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fabric is indeed a blended wool (e.g., wool + synthetic fibers) and not 100% wool, as this would fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., origin, sustainability) are required for customs clearance.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly impact your import costs.

- Consult a Customs Broker: For complex cases, especially if the fabric is used in home textiles or industrial applications, a customs expert can help ensure correct classification.

🧾 Summary Table:

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff | 25.0% | Standard import duty |

| Additional Tariff | 25.0% | General additional duty |

| April 11 Special Tariff | 30.0% | Applies after April 11, 2025 |

| Total Tax Rate | 80.0% | Includes all applicable duties |

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Combed Wool Blended Woven Fabric for Apparel

HS CODE: 5112203000

🔍 Classification Summary:

- Product Type: Mixed combed wool woven fabric for apparel use

- HS Code: 5112203000 (10-digit code)

- Tariff Summary: 80.0% total tax rate

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This additional tariff applies after April 11, 2025, and may significantly increase the total import cost.

⚠️ Important Policy Alerts:

- April 11 Special Tariff:

- A 30.0% additional tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered in your import planning.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for this product (wool blended fabric).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fabric is indeed a blended wool (e.g., wool + synthetic fibers) and not 100% wool, as this would fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., origin, sustainability) are required for customs clearance.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly impact your import costs.

- Consult a Customs Broker: For complex cases, especially if the fabric is used in home textiles or industrial applications, a customs expert can help ensure correct classification.

🧾 Summary Table:

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff | 25.0% | Standard import duty |

| Additional Tariff | 25.0% | General additional duty |

| April 11 Special Tariff | 30.0% | Applies after April 11, 2025 |

| Total Tax Rate | 80.0% | Includes all applicable duties |

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.