| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5407910520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516330520 | Doc | 80.0% | CN | US | 2025-05-12 |

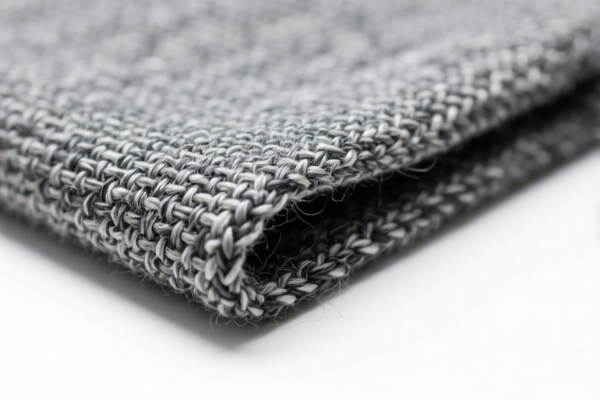

Product Name: Combed Wool Blended Woven Industrial Fabric

Classification: Based on the provided HS codes and summaries, the product falls under woven fabrics made from blended fibers, primarily or solely with combed wool or fine animal hair, with 36% or more by weight of wool or fine animal hair.

✅ HS CODES & TAX DETAILS

HS CODE: 5407910520

- Description: Woven fabrics made wholly or mainly of synthetic filament yarn, mainly or solely blended with combed wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 5516330520

- Description: Woven fabrics made mainly or solely of short man-made fibers, blended with combed wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Notes on Tax Rates

- Base Tariff: 25.0% applies to both HS codes.

- Additional Tariff: 25.0% is a general additional tariff.

- April 11 Special Tariff (2025.4.2): An extra 30.0% is imposed after April 11, 2025, which significantly increases the total tax burden.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are indicated for this product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric contains 36% or more by weight of combed wool or fine animal hair to qualify for these HS codes.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., wool content verification, origin documentation) are required for customs clearance.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff. If your import is scheduled after this date, the total tax rate will increase to 80.0%.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker to ensure compliance and avoid delays.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Combed Wool Blended Woven Industrial Fabric

Classification: Based on the provided HS codes and summaries, the product falls under woven fabrics made from blended fibers, primarily or solely with combed wool or fine animal hair, with 36% or more by weight of wool or fine animal hair.

✅ HS CODES & TAX DETAILS

HS CODE: 5407910520

- Description: Woven fabrics made wholly or mainly of synthetic filament yarn, mainly or solely blended with combed wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

HS CODE: 5516330520

- Description: Woven fabrics made mainly or solely of short man-made fibers, blended with combed wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Notes on Tax Rates

- Base Tariff: 25.0% applies to both HS codes.

- Additional Tariff: 25.0% is a general additional tariff.

- April 11 Special Tariff (2025.4.2): An extra 30.0% is imposed after April 11, 2025, which significantly increases the total tax burden.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are indicated for this product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric contains 36% or more by weight of combed wool or fine animal hair to qualify for these HS codes.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., wool content verification, origin documentation) are required for customs clearance.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for the special tariff. If your import is scheduled after this date, the total tax rate will increase to 80.0%.

- Consult Customs Broker: For complex classifications or large shipments, consider engaging a customs broker to ensure compliance and avoid delays.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.