| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

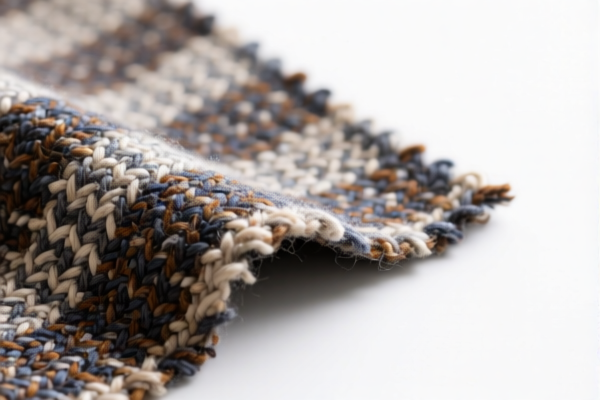

Product Name: Combed Wool Blended Woven Jacquard Fabric

HS CODE: 5112203000 (multiple entries confirm this as the most applicable code)

✅ HS Code Classification Summary:

- HS CODE: 5112203000

- Description: Mixed combed wool woven jacquard fabric (including elastic or plain jacquard), with a blend of wool and man-made fibers.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Note: The additional 30.0% tariff will apply after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance:

- Material Composition: Confirm the exact percentage of wool and man-made fibers in the fabric. This is critical for accurate classification and tariff calculation.

- Fabric Type: Ensure the fabric is indeed a "woven jacquard" and not a different type of weave (e.g., plain weave or twill), as this affects the HS code.

- Certifications: Check if any certifications (e.g., textile origin, environmental compliance) are required for import into the destination country.

- Unit Price: Verify the unit price for customs valuation purposes, as this may affect duty calculations under certain trade agreements or preferential schemes.

🛑 Proactive Advice:

- Double-check the fabric composition and weave type to ensure it falls under HS 5112203000 and not a different code (e.g., 5112909010 for cotton blends).

- Consult a customs broker or trade compliance expert if the product is being imported into a country with specific textile regulations (e.g., U.S. Textile Agreement, EU Tariff Preferences).

- Monitor the April 11, 2025 deadline for the special tariff increase and plan your import schedule accordingly.

Let me know if you need help with a specific import scenario or documentation.

Product Name: Combed Wool Blended Woven Jacquard Fabric

HS CODE: 5112203000 (multiple entries confirm this as the most applicable code)

✅ HS Code Classification Summary:

- HS CODE: 5112203000

- Description: Mixed combed wool woven jacquard fabric (including elastic or plain jacquard), with a blend of wool and man-made fibers.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Note: The additional 30.0% tariff will apply after April 11, 2025. Ensure your import timeline is aligned with this policy change.

📌 Key Considerations for Customs Compliance:

- Material Composition: Confirm the exact percentage of wool and man-made fibers in the fabric. This is critical for accurate classification and tariff calculation.

- Fabric Type: Ensure the fabric is indeed a "woven jacquard" and not a different type of weave (e.g., plain weave or twill), as this affects the HS code.

- Certifications: Check if any certifications (e.g., textile origin, environmental compliance) are required for import into the destination country.

- Unit Price: Verify the unit price for customs valuation purposes, as this may affect duty calculations under certain trade agreements or preferential schemes.

🛑 Proactive Advice:

- Double-check the fabric composition and weave type to ensure it falls under HS 5112203000 and not a different code (e.g., 5112909010 for cotton blends).

- Consult a customs broker or trade compliance expert if the product is being imported into a country with specific textile regulations (e.g., U.S. Textile Agreement, EU Tariff Preferences).

- Monitor the April 11, 2025 deadline for the special tariff increase and plan your import schedule accordingly.

Let me know if you need help with a specific import scenario or documentation.

Customer Reviews

No reviews yet.