Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5407921020 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5515220520 | Doc | 75.1% | CN | US | 2025-05-12 |

| 5515990510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5408310520 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5407910520 | Doc | 80.0% | CN | US | 2025-05-12 |

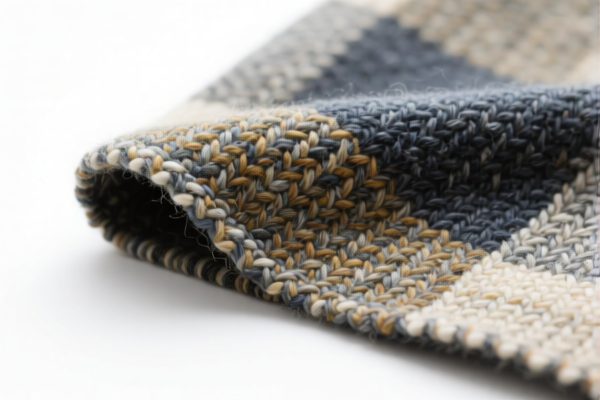

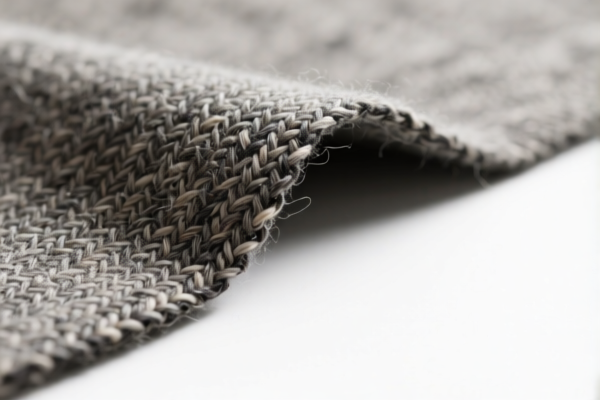

Product Name: Combed Wool Blended Woven Lining Fabric

Classification: Woven fabric made of synthetic fibers blended with wool or fine animal hair, combed, with wool content of 36% or more by weight.

✅ HS CODE Classification Summary:

- HS CODE: 5407910520

- Description: Woven fabrics of synthetic filament, including those made from materials of heading 5404, mainly or solely blended with wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes:

- Base Tariff: 25.0% (applies to all imports)

- Additional Tariff: 25.0% (general additional duty)

- Special Tariff after April 11, 2025: 30.0% (newly imposed, time-sensitive)

- No Anti-dumping duties are currently listed for this product category.

⚠️ Important Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm that the fabric is combed and contains 36% or more wool or fine animal hair by weight, as this is a critical classification criterion.

- Certifications Required: Check if any textile certifications (e.g., origin, composition, or environmental compliance) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric meets the 36% wool or fine animal hair requirement to qualify for this HS code.

- Check Unit Price: The final tax amount will depend on the import value per unit, so ensure accurate pricing documentation.

- Consult Customs Broker: For complex cases, especially if the fabric is blended with multiple synthetic fibers, consult a customs broker or classification expert to avoid misclassification penalties.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Combed Wool Blended Woven Lining Fabric

Classification: Woven fabric made of synthetic fibers blended with wool or fine animal hair, combed, with wool content of 36% or more by weight.

✅ HS CODE Classification Summary:

- HS CODE: 5407910520

- Description: Woven fabrics of synthetic filament, including those made from materials of heading 5404, mainly or solely blended with wool or fine animal hair, containing 36% or more by weight of wool or fine animal hair, and combed.

- Total Tax Rate: 80.0%

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes and Notes:

- Base Tariff: 25.0% (applies to all imports)

- Additional Tariff: 25.0% (general additional duty)

- Special Tariff after April 11, 2025: 30.0% (newly imposed, time-sensitive)

- No Anti-dumping duties are currently listed for this product category.

⚠️ Important Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm that the fabric is combed and contains 36% or more wool or fine animal hair by weight, as this is a critical classification criterion.

- Certifications Required: Check if any textile certifications (e.g., origin, composition, or environmental compliance) are required for import.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric meets the 36% wool or fine animal hair requirement to qualify for this HS code.

- Check Unit Price: The final tax amount will depend on the import value per unit, so ensure accurate pricing documentation.

- Consult Customs Broker: For complex cases, especially if the fabric is blended with multiple synthetic fibers, consult a customs broker or classification expert to avoid misclassification penalties.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.