| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5513290090 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

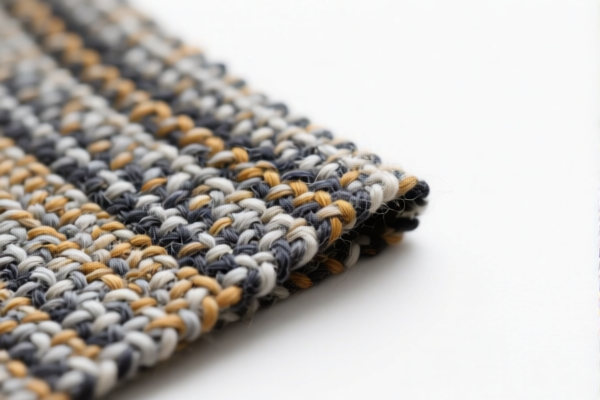

Product Name: Combed Wool Blended Woven Yarn Dyed Fabric

Classification HS Code: 5112203000 (multiple entries)

✅ HS CODE: 5112203000

Description:

- Combed wool blended woven fabric, with "combed wool" and "blended" components.

- Matches the HS code description: "Combed wool or combed fine animal hair fabrics: → mainly or only blended with man-made fibers: → Other."

📊 Tariff Summary (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes:

- Time-sensitive Policy:

- April 11, 2025 Special Tariff: An additional 30.0% tariff will be applied after this date.

-

Ensure compliance with customs regulations and plan for increased costs post-April 11, 2025.

-

No Anti-dumping duties on iron/aluminum:

- This product is not subject to anti-dumping duties on iron or aluminum.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact blend ratio of wool and man-made fibers (e.g., polyester, nylon) to ensure correct classification.

- Check Unit Price: Tariff calculations may depend on the declared value and unit price.

- Certifications Required: Ensure all necessary documentation (e.g., commercial invoice, packing list, certificate of origin) is prepared for customs clearance.

- Consider Alternative HS Codes: If the fabric is dyed and not just woven, double-check if other codes (e.g., 5513290090) might apply, depending on the fiber composition and weight.

🔄 Other Possible HS Codes (for reference):

- HS CODE: 5112303000

- For combed wool blended woven fabric with synthetic short fibers.

-

Total Tariff: 80.0% (same as 5112203000)

-

HS CODE: 5513290090

- For blended dyed woven fabric, mainly or only with cotton, weight ≤170g/m².

- Total Tariff: 69.9% (lower than wool-based fabrics)

📌 Conclusion:

The most likely HS code for your combed wool blended woven yarn dyed fabric is 5112203000, with a total tariff rate of 80.0%. Be mindful of the April 11, 2025 tariff increase and ensure all documentation is accurate and complete.

Product Name: Combed Wool Blended Woven Yarn Dyed Fabric

Classification HS Code: 5112203000 (multiple entries)

✅ HS CODE: 5112203000

Description:

- Combed wool blended woven fabric, with "combed wool" and "blended" components.

- Matches the HS code description: "Combed wool or combed fine animal hair fabrics: → mainly or only blended with man-made fibers: → Other."

📊 Tariff Summary (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes:

- Time-sensitive Policy:

- April 11, 2025 Special Tariff: An additional 30.0% tariff will be applied after this date.

-

Ensure compliance with customs regulations and plan for increased costs post-April 11, 2025.

-

No Anti-dumping duties on iron/aluminum:

- This product is not subject to anti-dumping duties on iron or aluminum.

📌 Proactive Advice:

- Verify Material Composition: Confirm the exact blend ratio of wool and man-made fibers (e.g., polyester, nylon) to ensure correct classification.

- Check Unit Price: Tariff calculations may depend on the declared value and unit price.

- Certifications Required: Ensure all necessary documentation (e.g., commercial invoice, packing list, certificate of origin) is prepared for customs clearance.

- Consider Alternative HS Codes: If the fabric is dyed and not just woven, double-check if other codes (e.g., 5513290090) might apply, depending on the fiber composition and weight.

🔄 Other Possible HS Codes (for reference):

- HS CODE: 5112303000

- For combed wool blended woven fabric with synthetic short fibers.

-

Total Tariff: 80.0% (same as 5112203000)

-

HS CODE: 5513290090

- For blended dyed woven fabric, mainly or only with cotton, weight ≤170g/m².

- Total Tariff: 69.9% (lower than wool-based fabrics)

📌 Conclusion:

The most likely HS code for your combed wool blended woven yarn dyed fabric is 5112203000, with a total tariff rate of 80.0%. Be mindful of the April 11, 2025 tariff increase and ensure all documentation is accurate and complete.

Customer Reviews

No reviews yet.