| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112199530 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111196080 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111196040 | Doc | 80.0% | CN | US | 2025-05-12 |

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs:

📌 Product Classification Overview

Your product is woven fabrics of combed wool or combed fine animal hair, with the following key characteristics:

- Wool content: ≥85% by weight

- Average fiber diameter: ≤18.5 microns

- Contains fine animal hair

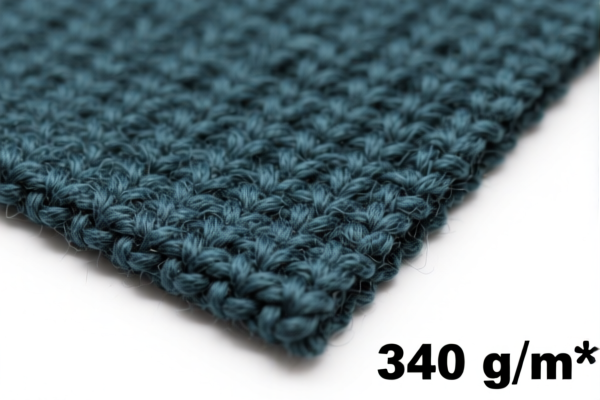

- Weight per square meter: >340 g/m²

- Type of yarn: Wool yarns (not carded)

This matches HS Code: 5112196030.

📦 HS Code: 5112196030

🔍 Description:

- Woven fabrics of combed wool or combed fine animal hair

- Containing 85% or more by weight of wool or fine animal hair

- Other (not elsewhere specified)

- Other (not elsewhere specified)

- Of wool yarns with an average fiber diameter of 18.5 microns or less

- Containing fine animal hair

- Weighing more than 340 g/m²

💰 Tariff Details (as of now)

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⏰ Time-Sensitive Policy Alert

⚠️ Additional Tariff of 30.0% will be imposed after April 11, 2025.

This is a special tariff and not an anti-dumping or countervailing duty.

Ensure your import timeline is aligned with this date to avoid unexpected costs.

📌 Other HS Codes for Reference

| HS Code | Description | Weight Range | Notes |

|---|---|---|---|

| 5112196030 | Combed wool, ≤18.5μm, fine hair, >340g/m² | >340g/m² | ✅ Match |

| 5112199530 | Combed wool/fine hair, >340g/m², not ≤18.5μm | >340g/m² | ❌ Fiber diameter >18.5μm |

| 5111196080 | Carded wool/fine hair, >400g/m², not fine hair | >400g/m² | ❌ Carded, not combed |

| 5111196040 | Carded wool/fine hair, >400g/m², with fine hair | >400g/m² | ❌ Carded, not combed |

🛑 Critical Actions for Importers

- Verify fiber diameter: Ensure it is ≤18.5 microns to qualify for HS Code 5112196030.

- Confirm weight per square meter: Must be >340 g/m².

- Check for fine animal hair content: Must be present.

- Review documentation: Include material composition certificates and weight specifications for customs compliance.

- Plan for 2025 tariff increase: If importing after April 11, 2025, budget for the 30% additional tariff.

📌 Proactive Advice

- If your fabric is not combed (i.e., carded), it would fall under HS Code 5111..., not 5112...

- If the fiber diameter is over 18.5 microns, it would fall under HS Code 5112199530

- Always double-check the exact composition and weight to avoid misclassification and penalties.

Let me know if you need help with certification requirements or tariff calculation tools.

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs:

📌 Product Classification Overview

Your product is woven fabrics of combed wool or combed fine animal hair, with the following key characteristics:

- Wool content: ≥85% by weight

- Average fiber diameter: ≤18.5 microns

- Contains fine animal hair

- Weight per square meter: >340 g/m²

- Type of yarn: Wool yarns (not carded)

This matches HS Code: 5112196030.

📦 HS Code: 5112196030

🔍 Description:

- Woven fabrics of combed wool or combed fine animal hair

- Containing 85% or more by weight of wool or fine animal hair

- Other (not elsewhere specified)

- Other (not elsewhere specified)

- Of wool yarns with an average fiber diameter of 18.5 microns or less

- Containing fine animal hair

- Weighing more than 340 g/m²

💰 Tariff Details (as of now)

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⏰ Time-Sensitive Policy Alert

⚠️ Additional Tariff of 30.0% will be imposed after April 11, 2025.

This is a special tariff and not an anti-dumping or countervailing duty.

Ensure your import timeline is aligned with this date to avoid unexpected costs.

📌 Other HS Codes for Reference

| HS Code | Description | Weight Range | Notes |

|---|---|---|---|

| 5112196030 | Combed wool, ≤18.5μm, fine hair, >340g/m² | >340g/m² | ✅ Match |

| 5112199530 | Combed wool/fine hair, >340g/m², not ≤18.5μm | >340g/m² | ❌ Fiber diameter >18.5μm |

| 5111196080 | Carded wool/fine hair, >400g/m², not fine hair | >400g/m² | ❌ Carded, not combed |

| 5111196040 | Carded wool/fine hair, >400g/m², with fine hair | >400g/m² | ❌ Carded, not combed |

🛑 Critical Actions for Importers

- Verify fiber diameter: Ensure it is ≤18.5 microns to qualify for HS Code 5112196030.

- Confirm weight per square meter: Must be >340 g/m².

- Check for fine animal hair content: Must be present.

- Review documentation: Include material composition certificates and weight specifications for customs compliance.

- Plan for 2025 tariff increase: If importing after April 11, 2025, budget for the 30% additional tariff.

📌 Proactive Advice

- If your fabric is not combed (i.e., carded), it would fall under HS Code 5111..., not 5112...

- If the fiber diameter is over 18.5 microns, it would fall under HS Code 5112199530

- Always double-check the exact composition and weight to avoid misclassification and penalties.

Let me know if you need help with certification requirements or tariff calculation tools.

Customer Reviews

No reviews yet.