| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112113030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111191000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5111112000 | Doc | 62.0% | CN | US | 2025-05-12 |

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics

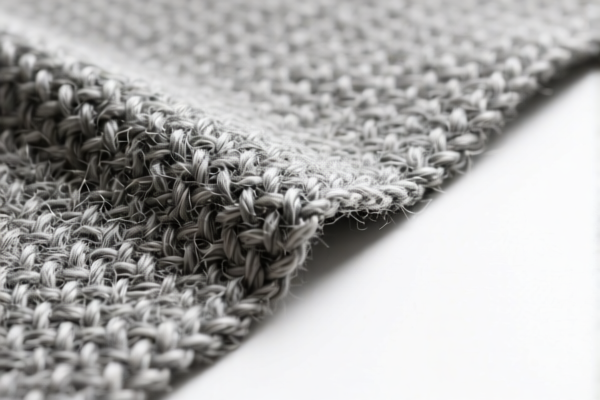

Based on your provided product descriptions and HS codes, here is a structured breakdown of the classification, tariff rates, and customs compliance considerations for the Combed Wool Woven Fabrics (≥85% Wool Content, ≤18.5 Microns, Interior Decoration Fabric).

📦 Product Classification Overview

1. HS Code: 5112113030

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing ≥85% by weight of wool or fine animal hair, ≤200g/m², of wool yarns with average fiber diameter ≤18.5 microns, containing fine animal hair.

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

- Key Notes:

- This code applies to lightweight (≤200g/m²) combed wool fabrics with fine animal hair, and ≤18.5 microns fiber diameter.

- Interior decoration fabric may fall under this category if it meets the weight and fiber specifications.

2. HS Code: 5112196010

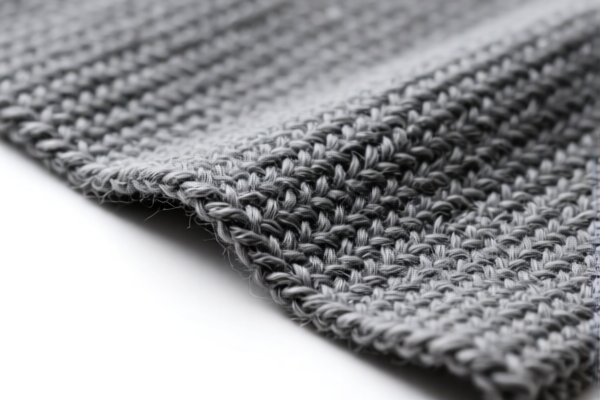

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing ≥85% by weight of wool or fine animal hair, ≤270g/m², of wool yarns with average fiber diameter ≤18.5 microns, containing fine animal hair.

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

- Key Notes:

- This code is for slightly heavier (≤270g/m²) combed wool fabrics with fine animal hair, and ≤18.5 microns fiber diameter.

- Also suitable for interior decoration if within the weight and fiber specs.

3. HS Code: 5111191000

- Description: Woven fabrics of carded wool or of carded fine animal hair, containing ≥85% by weight of wool or fine animal hair, other, tapestry and upholstery fabrics.

- Tariff Details:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 62.0%

- Key Notes:

- This code applies to carded (not combed) wool fabrics used for tapestry and upholstery.

- Not suitable for your product if it is combed wool.

4. HS Code: 5111112000

- Description: Woven fabrics of carded wool or of carded fine animal hair, containing ≥85% by weight of wool or fine animal hair, ≤300g/m², tapestry and upholstery fabrics ≤140g/m².

- Tariff Details:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 62.0%

- Key Notes:

- This code is for carded wool upholstery and tapestry fabrics with ≤140g/m².

- Not suitable for your product if it is combed wool.

📌 Critical Compliance Actions

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Check Fabric Weight: Confirm the weight per square meter (g/m²) to determine the correct HS code.

- Confirm Fabric Type: Ensure the fabric is combed wool, not carded wool, to avoid misclassification.

- Review Certification Requirements: Some countries may require textile certifications (e.g., origin, fiber content, etc.).

- Monitor Tariff Changes: The special tariff of 30% applies after April 11, 2025 — plan accordingly for cost estimation and compliance.

📅 Time-Sensitive Policy Alert

⚠️ Additional Tariff of 30% applies after April 11, 2025.

This is a critical date for customs clearance and cost estimation. Ensure your import timeline accounts for this increase.

📊 Summary of Tax Rates

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|

| 5112113030 | 25.0% | 25.0% | 30.0% | 80.0% |

| 5112196010 | 25.0% | 25.0% | 30.0% | 80.0% |

| 5111191000 | 7.0% | 25.0% | 30.0% | 62.0% |

| 5111112000 | 7.0% | 25.0% | 30.0% | 62.0% |

✅ Proactive Advice

- Double-check the fabric type (combed vs. carded) and fiber diameter to ensure correct HS code.

- Consult a customs broker or textile classification expert if the product is used for interior decoration or upholstery.

- Keep documentation on fiber content, weight, and fabric type for customs inspections.

Let me know if you need help with certification requirements or customs documentation templates.

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics

Based on your provided product descriptions and HS codes, here is a structured breakdown of the classification, tariff rates, and customs compliance considerations for the Combed Wool Woven Fabrics (≥85% Wool Content, ≤18.5 Microns, Interior Decoration Fabric).

📦 Product Classification Overview

1. HS Code: 5112113030

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing ≥85% by weight of wool or fine animal hair, ≤200g/m², of wool yarns with average fiber diameter ≤18.5 microns, containing fine animal hair.

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

- Key Notes:

- This code applies to lightweight (≤200g/m²) combed wool fabrics with fine animal hair, and ≤18.5 microns fiber diameter.

- Interior decoration fabric may fall under this category if it meets the weight and fiber specifications.

2. HS Code: 5112196010

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing ≥85% by weight of wool or fine animal hair, ≤270g/m², of wool yarns with average fiber diameter ≤18.5 microns, containing fine animal hair.

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

- Key Notes:

- This code is for slightly heavier (≤270g/m²) combed wool fabrics with fine animal hair, and ≤18.5 microns fiber diameter.

- Also suitable for interior decoration if within the weight and fiber specs.

3. HS Code: 5111191000

- Description: Woven fabrics of carded wool or of carded fine animal hair, containing ≥85% by weight of wool or fine animal hair, other, tapestry and upholstery fabrics.

- Tariff Details:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 62.0%

- Key Notes:

- This code applies to carded (not combed) wool fabrics used for tapestry and upholstery.

- Not suitable for your product if it is combed wool.

4. HS Code: 5111112000

- Description: Woven fabrics of carded wool or of carded fine animal hair, containing ≥85% by weight of wool or fine animal hair, ≤300g/m², tapestry and upholstery fabrics ≤140g/m².

- Tariff Details:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 62.0%

- Key Notes:

- This code is for carded wool upholstery and tapestry fabrics with ≤140g/m².

- Not suitable for your product if it is combed wool.

📌 Critical Compliance Actions

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Check Fabric Weight: Confirm the weight per square meter (g/m²) to determine the correct HS code.

- Confirm Fabric Type: Ensure the fabric is combed wool, not carded wool, to avoid misclassification.

- Review Certification Requirements: Some countries may require textile certifications (e.g., origin, fiber content, etc.).

- Monitor Tariff Changes: The special tariff of 30% applies after April 11, 2025 — plan accordingly for cost estimation and compliance.

📅 Time-Sensitive Policy Alert

⚠️ Additional Tariff of 30% applies after April 11, 2025.

This is a critical date for customs clearance and cost estimation. Ensure your import timeline accounts for this increase.

📊 Summary of Tax Rates

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|

| 5112113030 | 25.0% | 25.0% | 30.0% | 80.0% |

| 5112196010 | 25.0% | 25.0% | 30.0% | 80.0% |

| 5111191000 | 7.0% | 25.0% | 30.0% | 62.0% |

| 5111112000 | 7.0% | 25.0% | 30.0% | 62.0% |

✅ Proactive Advice

- Double-check the fabric type (combed vs. carded) and fiber diameter to ensure correct HS code.

- Consult a customs broker or textile classification expert if the product is used for interior decoration or upholstery.

- Keep documentation on fiber content, weight, and fabric type for customs inspections.

Let me know if you need help with certification requirements or customs documentation templates.

Customer Reviews

No reviews yet.