| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196040 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111113000 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5111117030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5801100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5802300020 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5802300090 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5806103020 | Doc | 58.8% | CN | US | 2025-05-12 |

| 5806391000 | Doc | 61.6% | CN | US | 2025-05-12 |

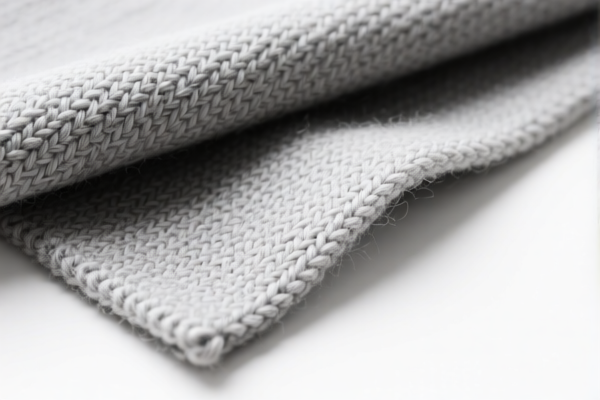

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics (≥85% Wool Content, ≤18.5 Microns, ≤270 g/m²)

🔍 Product Overview

You are dealing with woven fabrics made from combed wool or combed fine animal hair, with the following key characteristics: - Wool content ≥85% by weight - Average fiber diameter ≤18.5 microns - Weight ≤270 g/m²

These specifications align with HS Code 5112196010 and 5112196040, depending on the presence of fine animal hair.

📦 HS Code Classification

✅ HS Code 5112196010

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, of wool yarns with an average fiber diameter of 18.5 microns or less, containing fine animal hair, weighing not more than 270 g/m².

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

✅ HS Code 5112196040

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, of wool yarns with an average fiber diameter of 18.5 microns or less, other, weighing not more than 270 g/m².

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

📌 Key Tax Rate Changes (April 11, 2025)

- After April 11, 2025, an additional 30.0% tariff will be applied to these products.

- This is a time-sensitive policy and must be considered in your import planning.

⚠️ Important Notes and Recommendations

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Check Weight: Confirm the fabric weighs ≤270 g/m².

- Certifications: Some countries may require certifications (e.g., wool content verification, fiber diameter testing) for customs clearance.

- Unit Price: Be aware of tariff calculations based on unit price (e.g., per square meter or per kg).

- Documentation: Maintain accurate documentation (e.g., invoices, certificates of origin, fiber test reports) to avoid delays or penalties.

📌 Alternative HS Codes (For Reference Only)

| HS Code | Description | Total Tariff |

|---|---|---|

| 5111113000 | Woven fabrics of carded wool or carded fine animal hair, hand-woven, loom width <76 cm | 65.0% |

| 5111117030 | Woven fabrics of carded wool or carded fine animal hair, containing fine animal hair | 80.0% |

| 5801100000 | Woven pile fabrics and chenille fabrics of wool or fine animal hair | 55.0% |

| 5802300020 / 5802300090 | Tufted textile fabrics of wool or fine animal hair | 61.2% |

| 5806103020 / 5806391000 | Narrow woven fabrics of wool or fine animal hair | 58.8% to 61.6% |

📌 Proactive Advice

- Plan Ahead: If importing after April 11, 2025, be prepared for higher tariffs.

- Consult a Customs Broker: For complex or high-value imports, consider professional assistance to ensure compliance.

- Stay Updated: Monitor tariff changes and regulatory updates from customs authorities.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics (≥85% Wool Content, ≤18.5 Microns, ≤270 g/m²)

🔍 Product Overview

You are dealing with woven fabrics made from combed wool or combed fine animal hair, with the following key characteristics: - Wool content ≥85% by weight - Average fiber diameter ≤18.5 microns - Weight ≤270 g/m²

These specifications align with HS Code 5112196010 and 5112196040, depending on the presence of fine animal hair.

📦 HS Code Classification

✅ HS Code 5112196010

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, of wool yarns with an average fiber diameter of 18.5 microns or less, containing fine animal hair, weighing not more than 270 g/m².

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

✅ HS Code 5112196040

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, of wool yarns with an average fiber diameter of 18.5 microns or less, other, weighing not more than 270 g/m².

- Tariff Details:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 80.0%

📌 Key Tax Rate Changes (April 11, 2025)

- After April 11, 2025, an additional 30.0% tariff will be applied to these products.

- This is a time-sensitive policy and must be considered in your import planning.

⚠️ Important Notes and Recommendations

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Check Weight: Confirm the fabric weighs ≤270 g/m².

- Certifications: Some countries may require certifications (e.g., wool content verification, fiber diameter testing) for customs clearance.

- Unit Price: Be aware of tariff calculations based on unit price (e.g., per square meter or per kg).

- Documentation: Maintain accurate documentation (e.g., invoices, certificates of origin, fiber test reports) to avoid delays or penalties.

📌 Alternative HS Codes (For Reference Only)

| HS Code | Description | Total Tariff |

|---|---|---|

| 5111113000 | Woven fabrics of carded wool or carded fine animal hair, hand-woven, loom width <76 cm | 65.0% |

| 5111117030 | Woven fabrics of carded wool or carded fine animal hair, containing fine animal hair | 80.0% |

| 5801100000 | Woven pile fabrics and chenille fabrics of wool or fine animal hair | 55.0% |

| 5802300020 / 5802300090 | Tufted textile fabrics of wool or fine animal hair | 61.2% |

| 5806103020 / 5806391000 | Narrow woven fabrics of wool or fine animal hair | 58.8% to 61.6% |

📌 Proactive Advice

- Plan Ahead: If importing after April 11, 2025, be prepared for higher tariffs.

- Consult a Customs Broker: For complex or high-value imports, consider professional assistance to ensure compliance.

- Stay Updated: Monitor tariff changes and regulatory updates from customs authorities.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.