| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196040 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111113000 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5111117030 | Doc | 80.0% | CN | US | 2025-05-12 |

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics (≥85% Wool Content)

📌 Product Overview

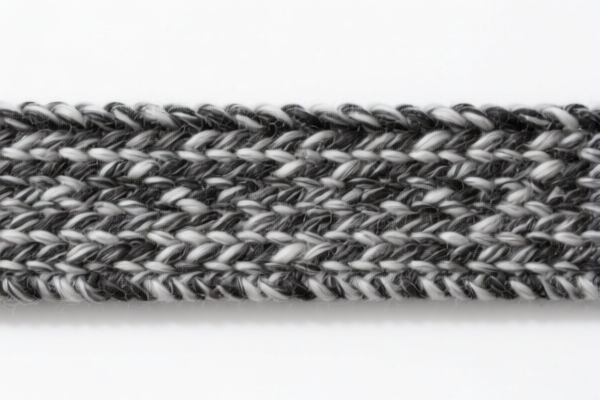

You are dealing with woven fabrics made from combed wool or combed fine animal hair, with the following key characteristics:

- Wool content ≥85% by weight

- Average fiber diameter ≤18.5 microns

- Weight ≤270 g/m²

- Dyed and finished fabric

📦 HS Code Classification

Based on the description, the most likely HS Code is:

✅ HS CODE: 5112196010

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or of fine animal hair, of wool yarns with an average fiber diameter of 18.5 microns or less, weighing not more than 270 g/m².

📊 Tariff Breakdown (As of Now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-dumping duties are currently applicable for this product category.

- No specific anti-dumping duties on iron/aluminum apply here, as this is a textile product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Check Weight: Confirm the fabric weighs ≤270 g/m² to qualify for this HS code.

- Certifications: Some countries may require certifications of origin, material composition, or compliance with textile regulations (e.g., REACH, CPSIA).

- Tariff Planning: If importing after April 11, 2025, be prepared for a 30% additional tariff, which could significantly increase your total cost.

- Consult a Customs Broker: For complex or high-value imports, it's advisable to work with a customs broker to ensure compliance and avoid delays.

📌 Alternative HS Codes (For Reference)

| HS Code | Description | Total Tariff |

|---|---|---|

| 5112196010 | Woven combed wool fabric, ≤18.5 microns, ≤270g/m² | 80.0% |

| 5112196040 | Woven combed wool fabric, ≤18.5 microns, other | 80.0% |

| 5111113000 | Woven carded wool fabric, hand-woven, <76cm loom | 65.0% |

| 5111117030 | Woven carded wool fabric, with fine animal hair | 80.0% |

📌 Conclusion

For your combed wool woven fabric (≥85% wool, ≤18.5 microns, ≤270g/m²), the most accurate HS code is 5112196010, with a total tariff of 80.0%, including a 30% additional tariff after April 11, 2025.

Make sure to verify all product specifications and plan for the upcoming tariff increase to avoid unexpected costs.

✅ Customs Classification and Tariff Analysis for Combed Wool Woven Fabrics (≥85% Wool Content)

📌 Product Overview

You are dealing with woven fabrics made from combed wool or combed fine animal hair, with the following key characteristics:

- Wool content ≥85% by weight

- Average fiber diameter ≤18.5 microns

- Weight ≤270 g/m²

- Dyed and finished fabric

📦 HS Code Classification

Based on the description, the most likely HS Code is:

✅ HS CODE: 5112196010

- Description: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or of fine animal hair, of wool yarns with an average fiber diameter of 18.5 microns or less, weighing not more than 270 g/m².

📊 Tariff Breakdown (As of Now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-dumping duties are currently applicable for this product category.

- No specific anti-dumping duties on iron/aluminum apply here, as this is a textile product.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair and that the average fiber diameter is ≤18.5 microns.

- Check Weight: Confirm the fabric weighs ≤270 g/m² to qualify for this HS code.

- Certifications: Some countries may require certifications of origin, material composition, or compliance with textile regulations (e.g., REACH, CPSIA).

- Tariff Planning: If importing after April 11, 2025, be prepared for a 30% additional tariff, which could significantly increase your total cost.

- Consult a Customs Broker: For complex or high-value imports, it's advisable to work with a customs broker to ensure compliance and avoid delays.

📌 Alternative HS Codes (For Reference)

| HS Code | Description | Total Tariff |

|---|---|---|

| 5112196010 | Woven combed wool fabric, ≤18.5 microns, ≤270g/m² | 80.0% |

| 5112196040 | Woven combed wool fabric, ≤18.5 microns, other | 80.0% |

| 5111113000 | Woven carded wool fabric, hand-woven, <76cm loom | 65.0% |

| 5111117030 | Woven carded wool fabric, with fine animal hair | 80.0% |

📌 Conclusion

For your combed wool woven fabric (≥85% wool, ≤18.5 microns, ≤270g/m²), the most accurate HS code is 5112196010, with a total tariff of 80.0%, including a 30% additional tariff after April 11, 2025.

Make sure to verify all product specifications and plan for the upcoming tariff increase to avoid unexpected costs.

Customer Reviews

No reviews yet.