| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111196080 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111196020 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5601290020 | Doc | 59.0% | CN | US | 2025-05-12 |

| 5601290090 | Doc | 59.0% | CN | US | 2025-05-12 |

| 5603941090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5603949090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5602210000 | Doc | 49.5¢/kg + 7.5%+55.0% | CN | US | 2025-05-12 |

| 5602109010 | Doc | 65.6% | CN | US | 2025-05-12 |

| 6006100000 | Doc | 65.0% | CN | US | 2025-05-12 |

| 6006909000 | Doc | 55.0% | CN | US | 2025-05-12 |

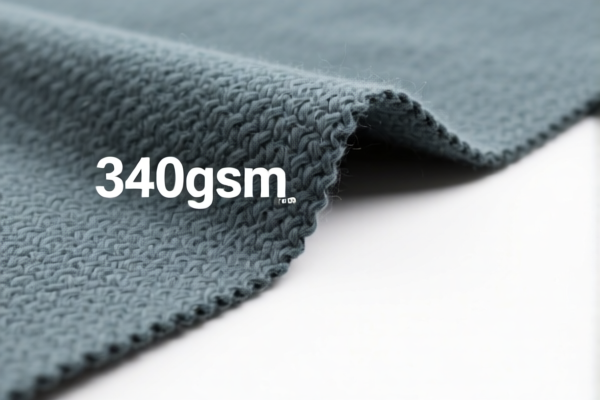

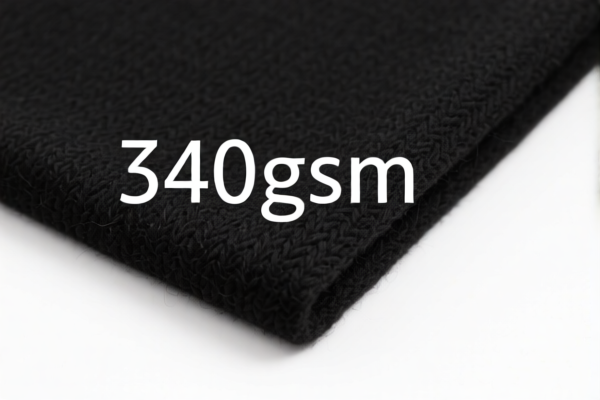

✅ Customs Classification and Tariff Analysis for Combed Wool/Fine Animal Hair Fabric (Over 340gsm for Filtration)

🔍 Product Description Matched to HS Code:

Product Name: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, other, other, of wool yarns with an average fiber diameter of 18.5 microns or less, weighing more than 340 g/m².

HS CODE: 5112196060

📊 Tariff Breakdown (As of Now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date for customs clearance planning.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the fabric is combed wool or combed fine animal hair, and that it contains 85% or more by weight of wool or fine animal hair.

- Weight Check: Ensure the fabric weighs more than 340 g/m². This is a critical classification factor.

- Yarn Fiber Diameter: Must be 18.5 microns or less to fall under this specific HS code.

- Certifications: Verify if any certifications (e.g., origin, composition, or environmental compliance) are required for import.

📌 Proactive Advice for Importers

- Double-check the fabric’s specifications (fiber type, weight, and composition) to ensure correct HS code classification.

- Review the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Consult with a customs broker or trade compliance expert for complex or high-value shipments.

📌 Alternative HS Codes for Similar Products (For Reference)

| Description | HS Code | Total Tariff Rate |

|---|---|---|

| Woven fabrics of carded wool or fine animal hair (over 400gsm) | 5111196080 | 80.0% |

| Wadding of wool or fine animal hair | 5601290020 | 59.0% |

| Nonwovens (over 150gsm) | 5603941090 / 5603949090 | 55.0% |

| Felt of wool or fine animal hair | 5602210000 | 49.5¢/kg + 7.5% + 55.0% |

| Knitted or crocheted fabrics of wool or fine animal hair | 6006100000 | 65.0% |

✅ Conclusion:

For your combed wool/fine animal hair fabric over 340gsm, the correct HS code is 5112196060, with a total tariff rate of 80.0%. Be mindful of the April 11, 2025 tariff increase and ensure all product specifications align with the classification criteria.

✅ Customs Classification and Tariff Analysis for Combed Wool/Fine Animal Hair Fabric (Over 340gsm for Filtration)

🔍 Product Description Matched to HS Code:

Product Name: Woven fabrics of combed wool or of combed fine animal hair, containing 85% or more by weight of wool or fine animal hair, other, other, of wool yarns with an average fiber diameter of 18.5 microns or less, weighing more than 340 g/m².

HS CODE: 5112196060

📊 Tariff Breakdown (As of Now)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date for customs clearance planning.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the fabric is combed wool or combed fine animal hair, and that it contains 85% or more by weight of wool or fine animal hair.

- Weight Check: Ensure the fabric weighs more than 340 g/m². This is a critical classification factor.

- Yarn Fiber Diameter: Must be 18.5 microns or less to fall under this specific HS code.

- Certifications: Verify if any certifications (e.g., origin, composition, or environmental compliance) are required for import.

📌 Proactive Advice for Importers

- Double-check the fabric’s specifications (fiber type, weight, and composition) to ensure correct HS code classification.

- Review the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Consult with a customs broker or trade compliance expert for complex or high-value shipments.

📌 Alternative HS Codes for Similar Products (For Reference)

| Description | HS Code | Total Tariff Rate |

|---|---|---|

| Woven fabrics of carded wool or fine animal hair (over 400gsm) | 5111196080 | 80.0% |

| Wadding of wool or fine animal hair | 5601290020 | 59.0% |

| Nonwovens (over 150gsm) | 5603941090 / 5603949090 | 55.0% |

| Felt of wool or fine animal hair | 5602210000 | 49.5¢/kg + 7.5% + 55.0% |

| Knitted or crocheted fabrics of wool or fine animal hair | 6006100000 | 65.0% |

✅ Conclusion:

For your combed wool/fine animal hair fabric over 340gsm, the correct HS code is 5112196060, with a total tariff rate of 80.0%. Be mindful of the April 11, 2025 tariff increase and ensure all product specifications align with the classification criteria.

Customer Reviews

No reviews yet.