| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112199550 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112301000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112199560 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111196040 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5509910000 | Doc | 67.0% | CN | US | 2025-05-12 |

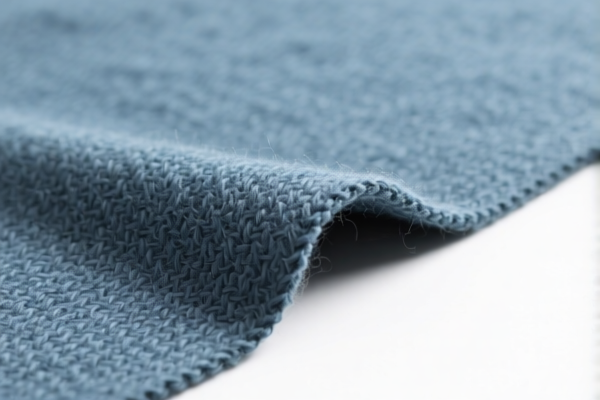

Product Name: Combed Wool/Fine Animal Hair Fabric Over 340gsm for Industrial Use

Classification: Based on the provided HS codes and descriptions, the product likely falls under HS Code 5112199550 or 5112199560, both of which are relevant to combed fine animal hair industrial fabric with a weight over 340gsm.

✅ HS CODE: 5112199550

Description: 270–340gsm fine animal hair industrial fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

(Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.)

📌 Key Considerations:

- Material Verification: Confirm that the fabric is made of combed fine animal hair (e.g., wool, cashmere, mohair) and not a blend with synthetic fibers. This will determine the correct HS code.

- Weight Specification: The fabric must be over 340gsm to qualify for this classification. If it's exactly 340gsm, it may fall under a different code (e.g., 5112199560).

- Industrial Use: This classification is for industrial applications, not for clothing or decorative purposes. If the fabric is used for other purposes, the classification may change.

- Certifications: Ensure that the product meets any required customs documentation or certifications (e.g., origin, material composition, weight).

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025: Additional tariffs of 30.0% will be imposed on this product. This is a significant increase from the current 25.0% additional tariff.

- Total tax rate after April 11, 2025: 80.0% (25% base + 25% additional + 30% special)

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and weight of the fabric to ensure correct classification.

- Check Required Certifications: Some countries may require import licenses or technical specifications for industrial textiles.

- Consult Customs Broker: For large shipments or complex classifications, it's advisable to work with a customs broker or trade compliance expert to avoid delays or penalties.

📌 Alternative HS Codes (for reference):

- 5112301000: For 300gsm+ combed fine animal hair blended decorative fabric (not industrial use).

- 5111196040: For combed animal hair high-strength industrial fabric (may be similar but with different specifications).

- 5509910000: For fine animal hair blended industrial yarn (if the product is in yarn form, not fabric).

Let me know if you need help with tariff calculation, customs documentation, or classification confirmation for your specific product.

Product Name: Combed Wool/Fine Animal Hair Fabric Over 340gsm for Industrial Use

Classification: Based on the provided HS codes and descriptions, the product likely falls under HS Code 5112199550 or 5112199560, both of which are relevant to combed fine animal hair industrial fabric with a weight over 340gsm.

✅ HS CODE: 5112199550

Description: 270–340gsm fine animal hair industrial fabric

Total Tax Rate: 80.0%

Tax Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

(Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.)

📌 Key Considerations:

- Material Verification: Confirm that the fabric is made of combed fine animal hair (e.g., wool, cashmere, mohair) and not a blend with synthetic fibers. This will determine the correct HS code.

- Weight Specification: The fabric must be over 340gsm to qualify for this classification. If it's exactly 340gsm, it may fall under a different code (e.g., 5112199560).

- Industrial Use: This classification is for industrial applications, not for clothing or decorative purposes. If the fabric is used for other purposes, the classification may change.

- Certifications: Ensure that the product meets any required customs documentation or certifications (e.g., origin, material composition, weight).

⚠️ Time-Sensitive Policy Alert:

- April 11, 2025: Additional tariffs of 30.0% will be imposed on this product. This is a significant increase from the current 25.0% additional tariff.

- Total tax rate after April 11, 2025: 80.0% (25% base + 25% additional + 30% special)

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and weight of the fabric to ensure correct classification.

- Check Required Certifications: Some countries may require import licenses or technical specifications for industrial textiles.

- Consult Customs Broker: For large shipments or complex classifications, it's advisable to work with a customs broker or trade compliance expert to avoid delays or penalties.

📌 Alternative HS Codes (for reference):

- 5112301000: For 300gsm+ combed fine animal hair blended decorative fabric (not industrial use).

- 5111196040: For combed animal hair high-strength industrial fabric (may be similar but with different specifications).

- 5509910000: For fine animal hair blended industrial yarn (if the product is in yarn form, not fabric).

Let me know if you need help with tariff calculation, customs documentation, or classification confirmation for your specific product.

Customer Reviews

No reviews yet.