| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

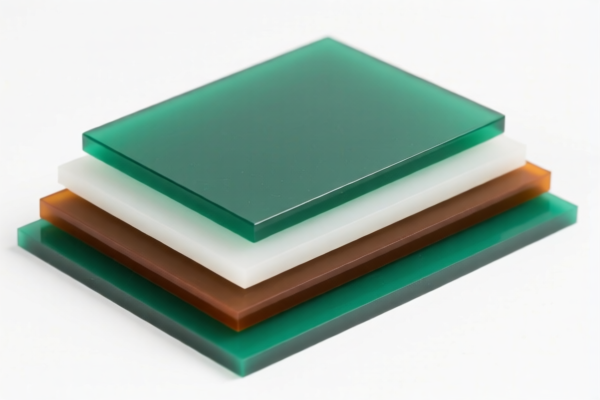

Product Classification: Combined Phenolic Resin Sheets

Based on the provided information, the classification of Combined Phenolic Resin Sheets depends on the form and use of the product. Here's a breakdown of the two possible HS codes and their associated tax implications:

✅ Option 1: 3920940000

Description:

- Applies to phenolic resin sheets used in construction, furniture, packaging, and chemical applications.

- Includes finished or semi-finished plastic sheets made from phenolic resin.

Tax Details:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

Key Notes: - This classification is suitable if the product is finished or semi-finished and used in industrial or commercial applications (e.g., furniture, construction, packaging). - Proactive Advice: Confirm the end-use and physical form of the product (e.g., whether it is a finished panel or raw sheet).

✅ Option 2: 3909390000

Description:

- Applies to primary forms of phenolic resin, such as adhesive sheets or raw resin-based sheets.

- Typically used in manufacturing processes rather than end-use applications.

Tax Details:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This classification is more appropriate if the product is in primary or raw form, such as adhesive sheets or resin sheets used in production. - Proactive Advice: Verify if the product is processed or unprocessed, and whether it is intended for direct use or further manufacturing.

📌 Critical Actions for Importers:

- Verify Material Composition: Confirm whether the product is made of phenolic resin and its exact form (e.g., adhesive, finished panel, raw sheet).

- Check Unit Price and Certification: Ensure compliance with customs documentation and any required certifications (e.g., safety, environmental).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs and plan accordingly.

- Consult with Customs Broker: For accurate classification and to avoid delays in customs clearance.

Let me know if you need help determining which HS code applies to your specific product.

Product Classification: Combined Phenolic Resin Sheets

Based on the provided information, the classification of Combined Phenolic Resin Sheets depends on the form and use of the product. Here's a breakdown of the two possible HS codes and their associated tax implications:

✅ Option 1: 3920940000

Description:

- Applies to phenolic resin sheets used in construction, furniture, packaging, and chemical applications.

- Includes finished or semi-finished plastic sheets made from phenolic resin.

Tax Details:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

Key Notes: - This classification is suitable if the product is finished or semi-finished and used in industrial or commercial applications (e.g., furniture, construction, packaging). - Proactive Advice: Confirm the end-use and physical form of the product (e.g., whether it is a finished panel or raw sheet).

✅ Option 2: 3909390000

Description:

- Applies to primary forms of phenolic resin, such as adhesive sheets or raw resin-based sheets.

- Typically used in manufacturing processes rather than end-use applications.

Tax Details:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes: - This classification is more appropriate if the product is in primary or raw form, such as adhesive sheets or resin sheets used in production. - Proactive Advice: Verify if the product is processed or unprocessed, and whether it is intended for direct use or further manufacturing.

📌 Critical Actions for Importers:

- Verify Material Composition: Confirm whether the product is made of phenolic resin and its exact form (e.g., adhesive, finished panel, raw sheet).

- Check Unit Price and Certification: Ensure compliance with customs documentation and any required certifications (e.g., safety, environmental).

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs and plan accordingly.

- Consult with Customs Broker: For accurate classification and to avoid delays in customs clearance.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.