| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

✅ Customs Classification & Tariff Information for Commercial PVC Floor Tiles

Based on the provided data, Commercial PVC Floor Tiles are classified under several HS Codes (Harmonized System Codes) that fall under Chapter 39 (Plastics and articles thereof). Below is a structured summary of the classification and tariff details:

📦 Product Classification Overview

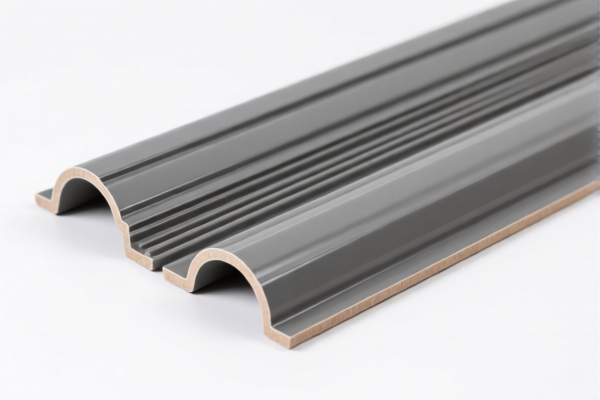

- Product: Commercial PVC Floor Tiles

- Material: Polyvinyl chloride (PVC) polymer

- Form: Tiles (not rolls)

- Usage: Floor covering

📌 Applicable HS Codes & Tax Rates

1. HS CODE: 3918101040

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings — Other vinyl tiles

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to this code)

- Note: This code is specifically for "other vinyl tiles" and is a common classification for commercial PVC tiles.

2. HS CODE: 3918101020

- Description: Floor coverings made of polyvinyl chloride polymer

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is also suitable for PVC tiles, especially if they are made of pure PVC polymer.

3. HS CODE: 3918901000

- Description: Other plastic floor coverings

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may apply if the product is not specifically classified under 39181010.

4. HS CODE: 3918101030

- Description: Vinyl tiles made of rigid foam polymer core (as per Chapter 39 statistical note 2)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to specific types of PVC tiles with a rigid foam core.

⚠️ Important Tariff Notes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase the total import cost.

-

Anti-dumping duties:

- Not applicable for PVC floor tiles (no specific anti-dumping duties listed for this product category).

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC polymer and not a composite or mixed material, as this may affect classification.

- Check Unit Price: The total tax rate is 60.3%, so the unit price will directly impact the final cost.

- Certifications Required: Confirm if any import certifications (e.g., CE, ISO, or specific customs documentation) are required for commercial use.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, especially regarding the April 11, 2025 policy.

📊 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Tariff after April 11, 2025 | Total Tax Rate |

|---|---|---|---|---|---|

| 3918101040 | Other vinyl tiles | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101020 | PVC polymer floor coverings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918901000 | Other plastic floor coverings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101030 | Vinyl tiles with rigid foam core | 5.3% | 25.0% | 30.0% | 60.3% |

If you need help selecting the most appropriate HS code based on your product's specifications, feel free to provide more details.

✅ Customs Classification & Tariff Information for Commercial PVC Floor Tiles

Based on the provided data, Commercial PVC Floor Tiles are classified under several HS Codes (Harmonized System Codes) that fall under Chapter 39 (Plastics and articles thereof). Below is a structured summary of the classification and tariff details:

📦 Product Classification Overview

- Product: Commercial PVC Floor Tiles

- Material: Polyvinyl chloride (PVC) polymer

- Form: Tiles (not rolls)

- Usage: Floor covering

📌 Applicable HS Codes & Tax Rates

1. HS CODE: 3918101040

- Description: Plastic floor coverings, whether self-adhesive or not, in sheets or tiles; plastic wall or ceiling coverings — Other vinyl tiles

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0% (applies to this code)

- Note: This code is specifically for "other vinyl tiles" and is a common classification for commercial PVC tiles.

2. HS CODE: 3918101020

- Description: Floor coverings made of polyvinyl chloride polymer

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is also suitable for PVC tiles, especially if they are made of pure PVC polymer.

3. HS CODE: 3918901000

- Description: Other plastic floor coverings

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may apply if the product is not specifically classified under 39181010.

4. HS CODE: 3918101030

- Description: Vinyl tiles made of rigid foam polymer core (as per Chapter 39 statistical note 2)

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to specific types of PVC tiles with a rigid foam core.

⚠️ Important Tariff Notes

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase the total import cost.

-

Anti-dumping duties:

- Not applicable for PVC floor tiles (no specific anti-dumping duties listed for this product category).

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of PVC polymer and not a composite or mixed material, as this may affect classification.

- Check Unit Price: The total tax rate is 60.3%, so the unit price will directly impact the final cost.

- Certifications Required: Confirm if any import certifications (e.g., CE, ISO, or specific customs documentation) are required for commercial use.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, especially regarding the April 11, 2025 policy.

📊 Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | Tariff after April 11, 2025 | Total Tax Rate |

|---|---|---|---|---|---|

| 3918101040 | Other vinyl tiles | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101020 | PVC polymer floor coverings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918901000 | Other plastic floor coverings | 5.3% | 25.0% | 30.0% | 60.3% |

| 3918101030 | Vinyl tiles with rigid foam core | 5.3% | 25.0% | 30.0% | 60.3% |

If you need help selecting the most appropriate HS code based on your product's specifications, feel free to provide more details.

Customer Reviews

No reviews yet.