| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

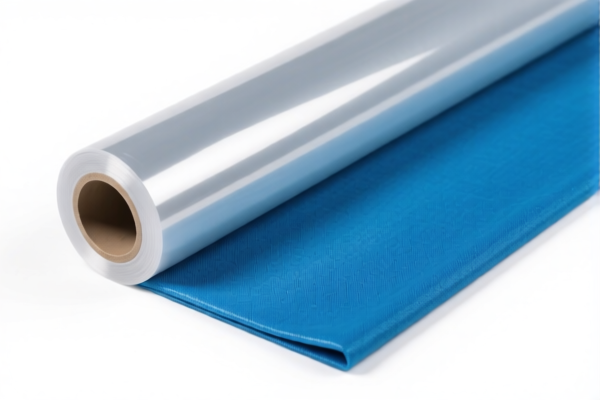

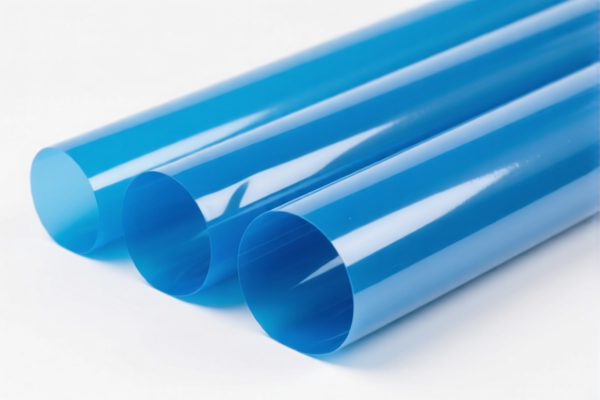

Product Classification: Commercial Textile Plastic Film

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921902900

- Description: Applicable to films combining plastic with textile materials.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for general textile-plastic composite films without specific weight or fiber composition restrictions.

-

HS CODE: 3921901950

- Description: Applicable to plastic films with textile backing, but requires further determination based on the weight percentage of plant fibers.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may require additional documentation to confirm the fiber composition.

-

HS CODE: 3921901100

- Description: Applicable to plastic sheets, plates, films, and foils combined with textile materials, with a total weight not exceeding 1.492 kg/m², and plastic weight exceeding 70%.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is strictly weight-dependent and may require technical specifications for accurate classification.

-

HS CODE: 3921905050

- Description: Applicable to other plastic sheets, plates, films, foils, and strips not covered by the above categories.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code has no additional tariffs but still applies the special tariff after April 11, 2025.

-

HS CODE: 3921901910

- Description: Applicable to plastic sheets, plates, films, foils, and strips combined with other textile materials, with a total weight not exceeding 1.492 kg/m².

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is similar to 3921901950, but with a weight limit and no fiber composition requirement.

✅ Proactive Advice:

- Verify the material composition (e.g., plastic vs. textile weight, fiber type) to ensure correct HS code selection.

- Check the unit price and total weight per square meter to meet the criteria for specific codes.

- Confirm if any certifications (e.g., textile fiber content, composite material testing) are required for customs compliance.

- Be aware of the April 11, 2025, special tariff—this applies to all the above codes and may significantly increase the total tax burden.

Let me know if you need help determining the most suitable HS code for your specific product.

Product Classification: Commercial Textile Plastic Film

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 3921902900

- Description: Applicable to films combining plastic with textile materials.

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is suitable for general textile-plastic composite films without specific weight or fiber composition restrictions.

-

HS CODE: 3921901950

- Description: Applicable to plastic films with textile backing, but requires further determination based on the weight percentage of plant fibers.

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may require additional documentation to confirm the fiber composition.

-

HS CODE: 3921901100

- Description: Applicable to plastic sheets, plates, films, and foils combined with textile materials, with a total weight not exceeding 1.492 kg/m², and plastic weight exceeding 70%.

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is strictly weight-dependent and may require technical specifications for accurate classification.

-

HS CODE: 3921905050

- Description: Applicable to other plastic sheets, plates, films, foils, and strips not covered by the above categories.

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code has no additional tariffs but still applies the special tariff after April 11, 2025.

-

HS CODE: 3921901910

- Description: Applicable to plastic sheets, plates, films, foils, and strips combined with other textile materials, with a total weight not exceeding 1.492 kg/m².

- Total Tax Rate: 60.3%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is similar to 3921901950, but with a weight limit and no fiber composition requirement.

✅ Proactive Advice:

- Verify the material composition (e.g., plastic vs. textile weight, fiber type) to ensure correct HS code selection.

- Check the unit price and total weight per square meter to meet the criteria for specific codes.

- Confirm if any certifications (e.g., textile fiber content, composite material testing) are required for customs compliance.

- Be aware of the April 11, 2025, special tariff—this applies to all the above codes and may significantly increase the total tax burden.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.