| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4413000000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 4411924000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 4411129090 | Doc | 58.9% | CN | US | 2025-05-12 |

| 4411940020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940080 | Doc | 55.0% | CN | US | 2025-05-12 |

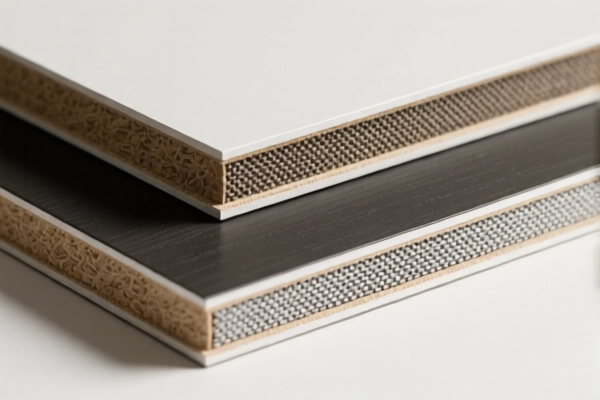

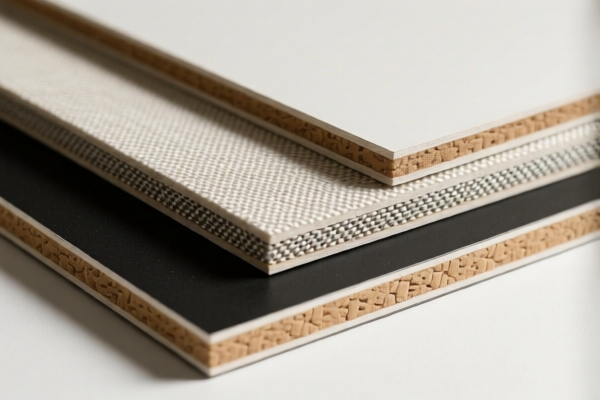

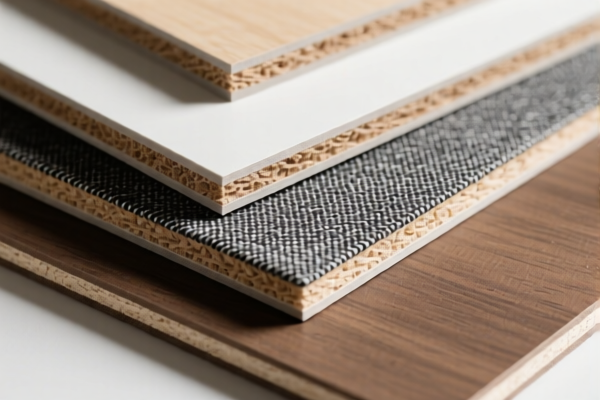

Product Classification: Construction Composite Boards

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 4413000000 – Wooden composite boards

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 58.7%

-

HS CODE: 4411924000 – Composite wood fiber board

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.0%

-

HS CODE: 4411129090 – Composite wooden fiber board

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 58.9%

-

HS CODE: 4411940020 – Wood fiber composite board

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 55.0%

-

HS CODE: 4411940080 – Wood fiber composite board

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in customs declarations and cost calculations. -

Base Tariff Variations:

The base tariff varies from 0.0% to 6.0%, depending on the specific type of composite board. This is important for accurate cost estimation. -

No Anti-Dumping Duties Mentioned:

As of now, no specific anti-dumping duties on iron or aluminum are listed for these products. However, always verify with the latest customs notices or consult a customs broker for confirmation.

✅ Proactive Advice:

-

Verify Material Composition:

Ensure the product is correctly classified based on its composition (e.g., wood fiber, composite, etc.) to avoid misclassification penalties. -

Check Unit Price and Certification Requirements:

Some products may require specific certifications (e.g., environmental, safety, or quality standards) for import. Confirm these with local customs or a compliance expert. -

Monitor Policy Updates:

Tariff rates and policies may change frequently. Stay updated with customs announcements, especially regarding the April 11, 2025, special tariff.

Let me know if you need help with HS code selection or customs documentation!

Product Classification: Construction Composite Boards

HS CODEs and Tax Details (April 2025 Update):

- HS CODE: 4413000000 – Wooden composite boards

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 58.7%

-

HS CODE: 4411924000 – Composite wood fiber board

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 61.0%

-

HS CODE: 4411129090 – Composite wooden fiber board

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 58.9%

-

HS CODE: 4411940020 – Wood fiber composite board

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Total Tax Rate: 55.0%

-

HS CODE: 4411940080 – Wood fiber composite board

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

📌 Key Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in customs declarations and cost calculations. -

Base Tariff Variations:

The base tariff varies from 0.0% to 6.0%, depending on the specific type of composite board. This is important for accurate cost estimation. -

No Anti-Dumping Duties Mentioned:

As of now, no specific anti-dumping duties on iron or aluminum are listed for these products. However, always verify with the latest customs notices or consult a customs broker for confirmation.

✅ Proactive Advice:

-

Verify Material Composition:

Ensure the product is correctly classified based on its composition (e.g., wood fiber, composite, etc.) to avoid misclassification penalties. -

Check Unit Price and Certification Requirements:

Some products may require specific certifications (e.g., environmental, safety, or quality standards) for import. Confirm these with local customs or a compliance expert. -

Monitor Policy Updates:

Tariff rates and policies may change frequently. Stay updated with customs announcements, especially regarding the April 11, 2025, special tariff.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.