| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917390010 | Doc | 33.1% | CN | US | 2025-05-12 |

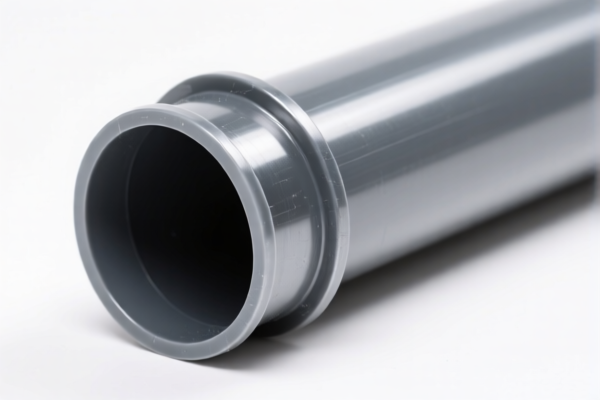

Here is the structured classification and tariff information for Construction Metal Reinforced Plastic Tubes, based on the provided HS codes and tax details:

🔍 HS CODE: 3917390010

Product Description:

- Metal reinforced plastic tubes (industrial, construction, high-strength variants)

- Plastic tubes with metal reinforcement

- Plastic tubes with fittings or soft tubes (various applications)

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.1%

Key Notes: - This code applies to multiple variants of metal-reinforced plastic tubes, including industrial and high-strength versions. - No anti-dumping duties are mentioned for this category. - Important: The 30% additional tariff applies only after April 11, 2025.

🔍 HS CODE: 3917310000

Product Description:

- Construction plastic tubes that meet the minimum burst pressure requirements

- Typically used in building and infrastructure applications

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

Key Notes: - This code is specific to construction-grade plastic tubes with pressure requirements. - Higher tax rate due to the additional 25% tariff. - Important: The 30% additional tariff applies only after April 11, 2025.

🔍 HS CODE: 3917320050

Product Description:

- Plastic construction tubes that are not reinforced or combined with other materials

- Do not include fittings

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

Key Notes: - This code applies to non-reinforced construction plastic tubes without fittings. - Similar to 3917310000, but with different product specifications. - Important: The 30% additional tariff applies only after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the product specification: Confirm whether the tubes are reinforced, include fittings, or are used in construction or industrial applications.

- Check the unit price and material composition: This will help determine the correct HS code and avoid misclassification.

- Review required certifications: Some products may require specific technical or safety certifications for import.

- Monitor the April 11, 2025, deadline: The additional 30% tariff will apply after this date, significantly increasing the total tax burden.

- Consider alternative HS codes: If your product doesn’t clearly fit one category, explore other HS codes to minimize tax liability.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured classification and tariff information for Construction Metal Reinforced Plastic Tubes, based on the provided HS codes and tax details:

🔍 HS CODE: 3917390010

Product Description:

- Metal reinforced plastic tubes (industrial, construction, high-strength variants)

- Plastic tubes with metal reinforcement

- Plastic tubes with fittings or soft tubes (various applications)

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 0.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 33.1%

Key Notes: - This code applies to multiple variants of metal-reinforced plastic tubes, including industrial and high-strength versions. - No anti-dumping duties are mentioned for this category. - Important: The 30% additional tariff applies only after April 11, 2025.

🔍 HS CODE: 3917310000

Product Description:

- Construction plastic tubes that meet the minimum burst pressure requirements

- Typically used in building and infrastructure applications

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

Key Notes: - This code is specific to construction-grade plastic tubes with pressure requirements. - Higher tax rate due to the additional 25% tariff. - Important: The 30% additional tariff applies only after April 11, 2025.

🔍 HS CODE: 3917320050

Product Description:

- Plastic construction tubes that are not reinforced or combined with other materials

- Do not include fittings

Tariff Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (before April 11, 2025): 25.0%

- Additional Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.1%

Key Notes: - This code applies to non-reinforced construction plastic tubes without fittings. - Similar to 3917310000, but with different product specifications. - Important: The 30% additional tariff applies only after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the product specification: Confirm whether the tubes are reinforced, include fittings, or are used in construction or industrial applications.

- Check the unit price and material composition: This will help determine the correct HS code and avoid misclassification.

- Review required certifications: Some products may require specific technical or safety certifications for import.

- Monitor the April 11, 2025, deadline: The additional 30% tariff will apply after this date, significantly increasing the total tax burden.

- Consider alternative HS codes: If your product doesn’t clearly fit one category, explore other HS codes to minimize tax liability.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.