| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

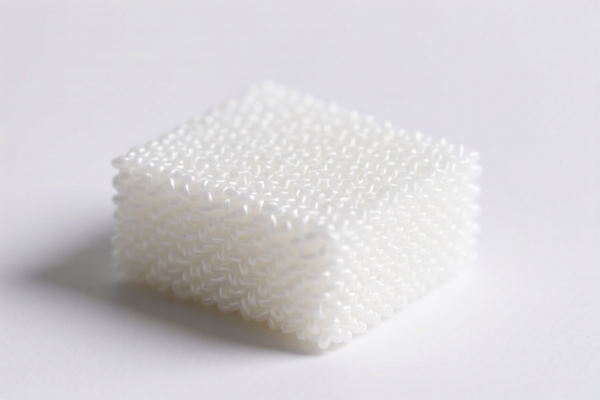

Product Name: Corrosion Resistant Grade Polyamide Raw Material

Classification: HS Code 3908902000

✅ HS CODE: 3908902000

Description: Other polyamide in primary form, suitable for engineering grade, high-performance, extrusion grade, injection molding grade, blow molding grade, etc.

🔍 Tariff Breakdown (as of current policy):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Specific Tariff on Iron/Aluminum: This product is a polyamide raw material, not related to iron or aluminum, so no additional duties apply in that context.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed classified under HS code 3908902000 and not misclassified (e.g., under 3907290000 for polyether resins).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For complex classifications or large-volume imports, consider engaging a customs broker or compliance expert.

📌 Alternative HS Code for Reference:

- HS Code 3907290000

- Description: Other polyether in primary form, suitable for wear-resistant grade raw materials.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Note: This code is for polyether resins, not polyamide. Ensure correct classification to avoid penalties.

Let me know if you need help with customs documentation or classification confirmation.

Product Name: Corrosion Resistant Grade Polyamide Raw Material

Classification: HS Code 3908902000

✅ HS CODE: 3908902000

Description: Other polyamide in primary form, suitable for engineering grade, high-performance, extrusion grade, injection molding grade, blow molding grade, etc.

🔍 Tariff Breakdown (as of current policy):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Specific Tariff on Iron/Aluminum: This product is a polyamide raw material, not related to iron or aluminum, so no additional duties apply in that context.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed classified under HS code 3908902000 and not misclassified (e.g., under 3907290000 for polyether resins).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For complex classifications or large-volume imports, consider engaging a customs broker or compliance expert.

📌 Alternative HS Code for Reference:

- HS Code 3907290000

- Description: Other polyether in primary form, suitable for wear-resistant grade raw materials.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Note: This code is for polyether resins, not polyamide. Ensure correct classification to avoid penalties.

Let me know if you need help with customs documentation or classification confirmation.

Customer Reviews

No reviews yet.