| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

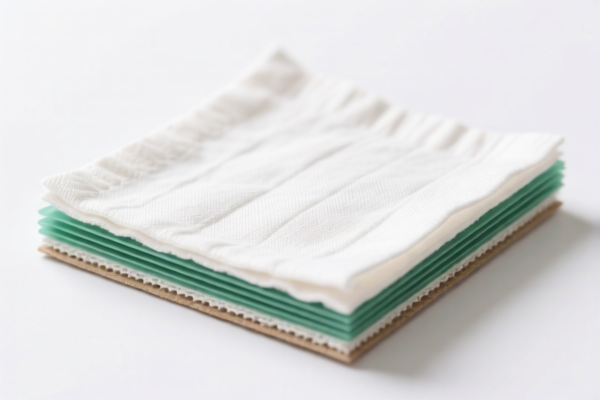

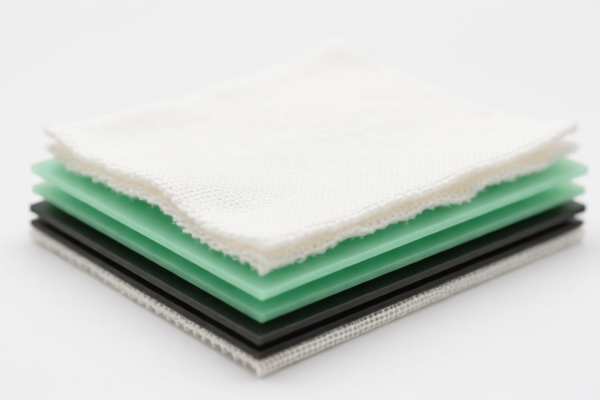

Product Classification: Cotton-Based Textile Composite Plastic Sheets

HS CODEs and Tax Details:

- HS CODE: 3921902100

- Description: Cotton-based composite plastic sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is specifically for cotton-based composite plastic sheets.

-

HS CODE: 3921902510

- Description 1: Plastic composite sheets combined with textile materials, where plastic weight exceeds 70%

- Description 2: Other plastic sheets combined with textile materials, where textile weight is the main component, and no single textile fiber exceeds synthetic fiber weight, with plastic weight over 70%

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Two different product descriptions under the same HS code. Ensure the correct description matches your product.

-

HS CODE: 3921902550

- Description: Other plastic sheets, films, foils, and strips combined with textile materials, with weight over 1.492 kg/m²

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Applies to composite materials with textile components and weight over 1.492 kg/m².

-

HS CODE: 3921902900

- Description: Plastic sheets, films, foils, and strips combined with other materials, with weight over 1.492 kg/m²

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Lower base tariff compared to others, but still subject to the same additional and special tariffs.

Key Tax Rate Changes (April 11, 2025 onwards):

- All HS codes listed above will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if possible.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition (e.g., cotton vs. other textile fibers, plastic weight percentage, and total weight per square meter).

- Check Unit Price and Certification: Some products may require specific certifications (e.g., textile or plastic content verification) for accurate classification.

- Consult with Customs Broker: For complex composite materials, a customs broker can help ensure correct HS code selection and avoid delays or penalties.

-

Monitor Tariff Updates: Be aware of any further changes in tariff rates or policy updates after April 11, 2025. Product Classification: Cotton-Based Textile Composite Plastic Sheets

HS CODEs and Tax Details: -

HS CODE: 3921902100

- Description: Cotton-based composite plastic sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code is specifically for cotton-based composite plastic sheets.

-

HS CODE: 3921902510

- Description 1: Plastic composite sheets combined with textile materials, where plastic weight exceeds 70%

- Description 2: Other plastic sheets combined with textile materials, where textile weight is the main component, and no single textile fiber exceeds synthetic fiber weight, with plastic weight over 70%

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Two different product descriptions under the same HS code. Ensure the correct description matches your product.

-

HS CODE: 3921902550

- Description: Other plastic sheets, films, foils, and strips combined with textile materials, with weight over 1.492 kg/m²

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: Applies to composite materials with textile components and weight over 1.492 kg/m².

-

HS CODE: 3921902900

- Description: Plastic sheets, films, foils, and strips combined with other materials, with weight over 1.492 kg/m²

- Total Tax Rate: 59.4%

- Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: Lower base tariff compared to others, but still subject to the same additional and special tariffs.

Key Tax Rate Changes (April 11, 2025 onwards):

- All HS codes listed above will have an additional 30.0% tariff applied after April 11, 2025.

- This is a time-sensitive policy, so ensure your customs clearance is completed before this date if possible.

Proactive Advice:

- Verify Material Composition: Confirm the exact composition (e.g., cotton vs. other textile fibers, plastic weight percentage, and total weight per square meter).

- Check Unit Price and Certification: Some products may require specific certifications (e.g., textile or plastic content verification) for accurate classification.

- Consult with Customs Broker: For complex composite materials, a customs broker can help ensure correct HS code selection and avoid delays or penalties.

- Monitor Tariff Updates: Be aware of any further changes in tariff rates or policy updates after April 11, 2025.

Customer Reviews

No reviews yet.