| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926400090 | Doc | 35.3% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

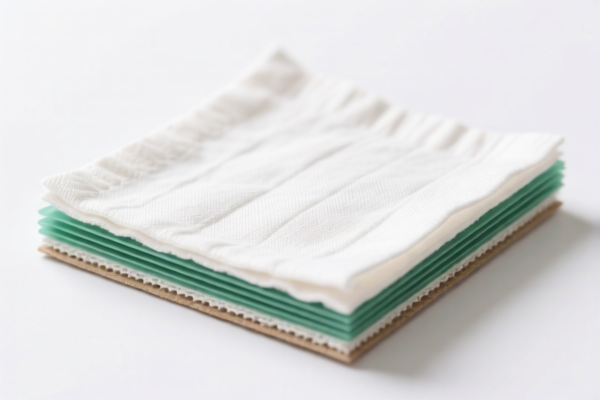

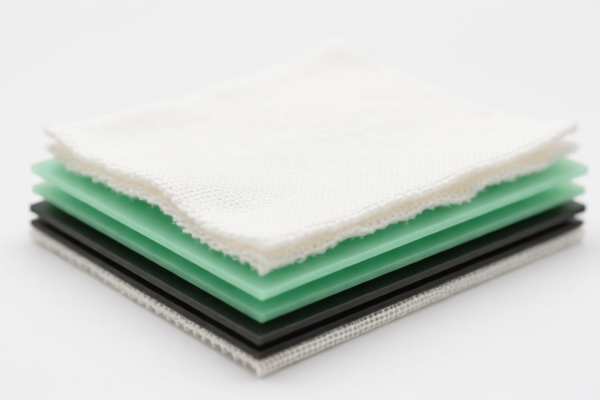

Product Name: Cotton Based Textile Composite Plastic Sheets (for Furniture)

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Options and Classification Analysis

Below are the HS codes and associated tariff details for your product, based on the provided data:

1. HS Code: 3926400090

Description: Plastic products for home decoration, such as ornaments, statues, etc.

Total Tax Rate: 35.3%

- Base Tariff: 5.3%

- Additional Tariff: 0.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is more suitable for decorative plastic items, not for composite plastic sheets used in furniture.

- Recommendation: Not the best fit for your product unless it is primarily decorative.

2. HS Code: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for plastic sheets, which may be a closer match for your product.

- Recommendation: Likely the best fit if your product is a sheet or panel made of plastic composite with cotton-based textile.

3. HS Code: 3920598000

Description: Other plastic products

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This is a catch-all category for other plastic products.

- Recommendation: Not ideal unless your product does not fit the more specific categories above.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All three codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- Anti-dumping duties: Not applicable for this product category (plastic composites).

- Material Verification: Confirm the exact composition of your product (e.g., percentage of cotton-based textile vs. plastic) to ensure correct classification.

- Certifications: Check if any import certifications or environmental compliance are required for plastic composites in your target market.

- Unit Price: Ensure the unit price is correctly declared, as this may affect the tariff calculation and customs valuation.

📌 Proactive Advice

- Verify the product composition (e.g., is it a composite of cotton and plastic? What is the dominant material?)

- Consult a customs broker or HS code expert for final classification, especially if the product is a composite or hybrid material.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Check for any local or regional trade agreements that may offer preferential rates.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Cotton Based Textile Composite Plastic Sheets (for Furniture)

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Options and Classification Analysis

Below are the HS codes and associated tariff details for your product, based on the provided data:

1. HS Code: 3926400090

Description: Plastic products for home decoration, such as ornaments, statues, etc.

Total Tax Rate: 35.3%

- Base Tariff: 5.3%

- Additional Tariff: 0.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is more suitable for decorative plastic items, not for composite plastic sheets used in furniture.

- Recommendation: Not the best fit for your product unless it is primarily decorative.

2. HS Code: 3921905050

Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This code is for plastic sheets, which may be a closer match for your product.

- Recommendation: Likely the best fit if your product is a sheet or panel made of plastic composite with cotton-based textile.

3. HS Code: 3920598000

Description: Other plastic products

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Note: This is a catch-all category for other plastic products.

- Recommendation: Not ideal unless your product does not fit the more specific categories above.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: All three codes are subject to an additional 30% tariff after April 11, 2025. This is a time-sensitive policy and should be considered in your cost planning.

- Anti-dumping duties: Not applicable for this product category (plastic composites).

- Material Verification: Confirm the exact composition of your product (e.g., percentage of cotton-based textile vs. plastic) to ensure correct classification.

- Certifications: Check if any import certifications or environmental compliance are required for plastic composites in your target market.

- Unit Price: Ensure the unit price is correctly declared, as this may affect the tariff calculation and customs valuation.

📌 Proactive Advice

- Verify the product composition (e.g., is it a composite of cotton and plastic? What is the dominant material?)

- Consult a customs broker or HS code expert for final classification, especially if the product is a composite or hybrid material.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Check for any local or regional trade agreements that may offer preferential rates.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.