| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

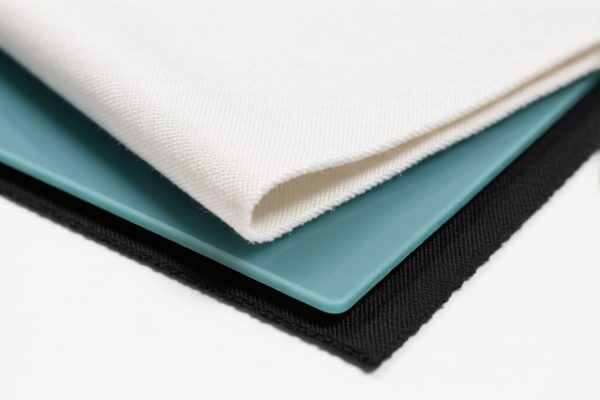

Product Classification: Cotton Fabric Composite Plastic Sheets

HS CODE: 3921902100 (Primary Code for Cotton Fabric Composite Plastic Sheets)

🔍 Classification Overview

- Product Name: Cotton Fabric Composite Plastic Sheets

- HS Code: 3921902100

- Tariff Summary: 61.5% total tax rate

- Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

📌 Key Tax Rate Changes

- Base Tariff: 6.5% (standard rate for composite plastic sheets with cotton fabric)

- Additional Tariff: 25.0% (applies to all imports under this category)

- April 11, 2025 Special Tariff: 30.0% (newly imposed after April 11, 2025, increasing the total tax rate to 61.5%)

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A new 30.0% tariff is imposed on this product category after April 11, 2025. This will significantly increase the total tax burden from 31.5% to 61.5%.

- Impact: This may affect cost structures and pricing strategies for importers. Ensure compliance with updated regulations.

📦 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed a composite of cotton fabric and plastic, as misclassification can lead to penalties.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., textile or plastic standards) for customs clearance.

- Monitor Tariff Updates: Stay informed about any changes in tariff rates, especially after April 11, 2025.

- Consult Customs Broker: For accurate classification and compliance, consider working with a licensed customs broker or compliance expert.

📋 Alternative HS Codes for Similar Products

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3921902900 | Textile Composite Plastic Sheets | 59.4% |

| 3921902510 | Plastic & Textile Composite Panels | 61.5% |

| 3921902550 | Plastic-Based Textile Composite Sheets | 61.5% |

Note: Some codes may overlap in description. Ensure the most accurate classification based on the exact product composition and use.

If you need further assistance with customs documentation or tariff calculation, feel free to provide more details about the product.

Product Classification: Cotton Fabric Composite Plastic Sheets

HS CODE: 3921902100 (Primary Code for Cotton Fabric Composite Plastic Sheets)

🔍 Classification Overview

- Product Name: Cotton Fabric Composite Plastic Sheets

- HS Code: 3921902100

- Tariff Summary: 61.5% total tax rate

- Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable for this product category.

📌 Key Tax Rate Changes

- Base Tariff: 6.5% (standard rate for composite plastic sheets with cotton fabric)

- Additional Tariff: 25.0% (applies to all imports under this category)

- April 11, 2025 Special Tariff: 30.0% (newly imposed after April 11, 2025, increasing the total tax rate to 61.5%)

⚠️ Time-Sensitive Policy Alert

- April 11, 2025 Special Tariff: A new 30.0% tariff is imposed on this product category after April 11, 2025. This will significantly increase the total tax burden from 31.5% to 61.5%.

- Impact: This may affect cost structures and pricing strategies for importers. Ensure compliance with updated regulations.

📦 Proactive Advice for Importers

- Verify Material Composition: Confirm that the product is indeed a composite of cotton fabric and plastic, as misclassification can lead to penalties.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., textile or plastic standards) for customs clearance.

- Monitor Tariff Updates: Stay informed about any changes in tariff rates, especially after April 11, 2025.

- Consult Customs Broker: For accurate classification and compliance, consider working with a licensed customs broker or compliance expert.

📋 Alternative HS Codes for Similar Products

| HS Code | Description | Total Tax Rate |

|---|---|---|

| 3921902900 | Textile Composite Plastic Sheets | 59.4% |

| 3921902510 | Plastic & Textile Composite Panels | 61.5% |

| 3921902550 | Plastic-Based Textile Composite Sheets | 61.5% |

Note: Some codes may overlap in description. Ensure the most accurate classification based on the exact product composition and use.

If you need further assistance with customs documentation or tariff calculation, feel free to provide more details about the product.

Customer Reviews

No reviews yet.